PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892682

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892682

Reciprocating Plunger Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

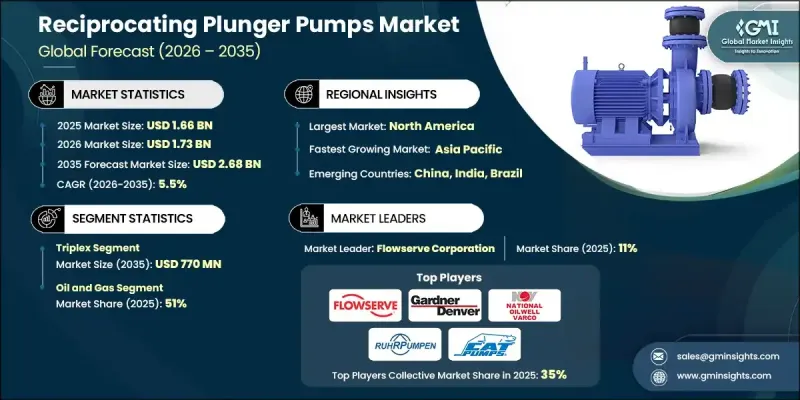

The Global Reciprocating Plunger Pumps Market was valued at USD 1.66 billion in 2025 and is estimated to grow at a CAGR of 5.5% to reach USD 2.68 billion by 2035.

Growth is shaped by the need for equipment capable of operating in demanding environments where fluids must be moved with precision, consistency, and resilience. Reciprocating pumps continue to be trusted solutions because they maintain constant pressure and can work with thick, abrasive, or challenging fluids. Their performance reliability makes them essential in sectors such as water treatment, chemical processing, and the oil and gas industry. Businesses depend on this pump category when operational stability and repeatable accuracy are mandatory over extended periods. The market has increasingly shifted toward designs engineered to reduce operational downtime and lower maintenance requirements, prompting manufacturers to consider energy-efficient configurations and digital enhancements. New developments centered on real-time monitoring and predictive maintenance are gaining momentum as companies seek higher productivity and cost savings throughout the pump lifecycle.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.66 Billion |

| Forecast Value | $2.68 Billion |

| CAGR | 5.5% |

The triplex pump segment is projected to attain USD 770 million by 2035. This configuration maintains a leading position because it offers a dependable balance of output, mechanical stability, and operating efficiency. Featuring three plungers, these pumps generate a uniform flow with limited pulsation, which is crucial in various high-demand industrial operations. Their simplified layout compared to multi-plunger alternatives helps minimize maintenance needs and reduce ownership costs, making them appealing for industries prioritizing reliability and streamlined operation.

The oil & gas market held 51% share in 2025. This sector depends heavily on reciprocating plunger pumps due to their ability to manage extremely high-pressure conditions required in drilling, fracturing, and other essential upstream and midstream activities. Projects in this field typically operate in environments that demand durable, accurate, and long-lasting equipment, reinforcing the importance of pumps engineered for demanding workloads.

United States Reciprocating Plunger Pumps Market captured 82% share and generated USD 410 million in 2025. North America maintains a prominent position in the global industry due to its advanced industrial base and strong oil and gas sector. The region's ongoing requirement for high-pressure systems used in hydraulic fracturing, drilling operations, and water injection applications continues to support market stability and long-term uptake.

Leading companies in the Global Reciprocating Plunger Pumps Market include Ariel Corporation, Cat Pumps (Interpump Group), Flowserve Corporation, Gardner Denver (Ingersoll Rand), Halliburton, Hammelmann GmbH (Paul Hammelmann Maschinenfabrik), KAMAT GmbH & Co. KG, Kerr Pumps (Weir SPM), National Oilwell Varco (NOV), Pratissoli Pumps (Interpump Group), Ruhrpumpen, Schlumberger (Cameron), URACA GmbH & Co. KG, Wanner Engineering (Hydra-Cell), and Weir Group (Weir Oil & Gas). Companies active in the Reciprocating Plunger Pumps Market are enhancing their market position by investing in advanced pump engineering, incorporating digital monitoring features, and introducing designs aimed at reducing energy consumption. Many manufacturers are expanding their product lines to address higher-pressure demands while improving material durability to extend pump service life. Collaboration with end-use industries is becoming more common as firms work to tailor pump configurations to specific operating conditions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Pump configuration

- 2.2.3 Application

- 2.2.4 Pressure range

- 2.2.5 Flow rate capacity

- 2.2.6 Drive type

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 High demand from oil & gas and industrial sectors

- 3.2.1.2 Growing focus on water and wastewater management

- 3.2.1.3 Technological advancements and automation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High maintenance and operational costs

- 3.2.2.2 Competition from centrifugal pumps

- 3.2.3 Opportunities

- 3.2.3.1 Expansion in Asia-Pacific and Middle East regions

- 3.2.3.2 Adoption in renewable energy and specialty applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Gap Analysis

- 3.7 Risk and mitigation Analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By pump configuration

- 3.10 Regulatory landscape

- 3.10.1 North America

- 3.10.2 Europe

- 3.10.3 Asia-Pacific

- 3.10.4 Middle East and Africa

- 3.10.5 Latin America

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Pump Configuration, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Triplex pumps

- 5.3 Quintuplex pumps

- 5.4 Septuplex pumps

- 5.5 Other configurations

Chapter 6 Market Estimates & Forecast, By Pressure Range, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low pressure (<500 bar / <7,250 psi)

- 6.3 Medium pressure (500-800 bar / 7,250-11,600 psi)

- 6.4 High pressure (>800 bar / >11,600 psi)

Chapter 7 Market Estimates & Forecast, By Flow Rate Capacity, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low flow (<100 gpm / <380 lpm)

- 7.3 Medium flow (100-500 gpm / 380-1,900 lpm)

- 7.4 High flow (>500 gpm / >1,900 lpm)

Chapter 8 Market Estimates & Forecast, By Drive Type, 2022-2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Electric motor driven

- 8.3 Diesel engine driven

- 8.4 Gas engine driven

- 8.5 Hydraulic driven

- 8.6 Other drive systems

Chapter 9 Market Estimates & Forecast, By Application, 2022-2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Oil & gas

- 9.3 Chemical processing

- 9.4 Water & wastewater

- 9.5 Power generation

- 9.6 Mining & minerals

- 9.7 Industrial manufacturing

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Turkey

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Flowserve Corporation

- 12.2 Gardner Denver (Ingersoll Rand)

- 12.3 National Oilwell Varco (NOV)

- 12.4 Ruhrpumpen

- 12.5 Cat Pumps (Interpump Group)

- 12.6 Weir Group (Weir Oil & Gas)

- 12.7 Halliburton

- 12.8 Schlumberger (Cameron)

- 12.9 Hammelmann GmbH (Paul Hammelmann Maschinenfabrik)

- 12.10 KAMAT GmbH & Co. KG

- 12.11 URACA GmbH & Co. KG

- 12.12 Kerr Pumps (Weir SPM)

- 12.13 Ariel Corporation

- 12.14 Pratissoli Pumps (Interpump Group)

- 12.15 Wanner Engineering (Hydra-Cell)