PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892687

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892687

Heterogeneous Integration Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

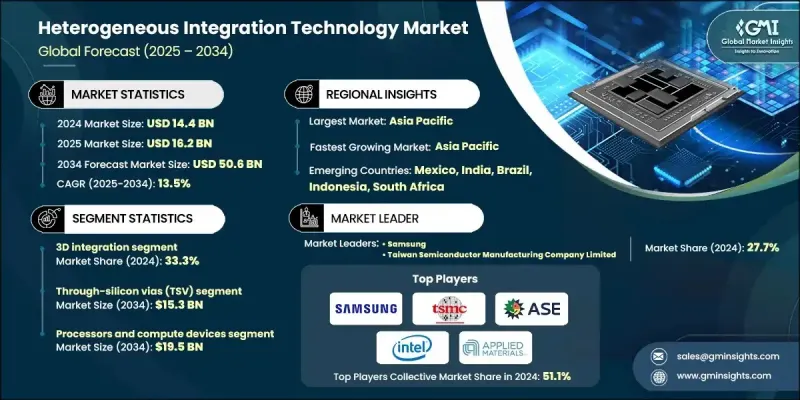

The Global Heterogeneous Integration Technology Market was valued at USD 14.4 billion in 2024 and is estimated to grow at a CAGR of 13.5% to reach USD 50.6 billion by 2034.

Market growth is accelerating as industries adopt advanced packaging solutions, AI-enabled systems, edge computing platforms, and next-generation wireless connectivity. Increasing reliance on high-performance compute architectures is pushing demand for compact, energy-efficient multi-die systems capable of delivering high bandwidth and low latency. As AI-driven workloads scale across connected devices, enterprise networks, and cloud infrastructure, heterogeneous integration is gaining strategic importance. The rapid spread of IoT applications across industrial automation, consumer ecosystems, and smart infrastructure is further elevating the need for dense, multifunctional integration within reduced footprints. The sector is also witnessing strong innovation in thermal management, interposer materials, and packaging architectures as chip designs grow more power-intensive. Efficient heat dissipation and power optimization have become essential for advanced accelerators and multi-chip modules to maintain peak reliability and performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.4 Billion |

| Forecast Value | $50.6 Billion |

| CAGR | 13.5% |

The 3D integration segment held a 33.3% share in 2024. Its momentum continues to grow alongside demand for higher bandwidth, reduced latency, and vertically integrated multi-die architectures. As memory, compute processors, and accelerators are increasingly stacked, developers are encouraged to advance chiplet standards, build broader design libraries, and expand cooperative development ecosystems.

The through-silicon vias segment is expected to reach USD 15.3 billion by 2034. TSV adoption is rising due to greater use of vertically integrated memory structures and high-density interconnects. The technology remains fundamental to vertical system architectures that require low-latency signal transmission. To maximize scalability, producers are working to reduce defect levels, enhance durability, and optimize via-middle and via-last fabrication techniques.

North America Heterogeneous Integration Technology Market held 17.9% share in 2024 and is forecasted to grow at a CAGR of 13.3% through 2034. Strong adoption of compact multi-die configurations is propelling regional growth as AI, IoT, and advanced connectivity drive system design requirements. The region's leadership in semiconductor design, packaging innovation, and chiplet-based integration research continues to encourage technological advancement.

Key companies participating in the Heterogeneous Integration Technology Market include Applied Materials, Inc., Samsung, Intel, EV Group (EVG), Atomica Corp, ASE Technology Holding, Amkor Technology, Indium Corporation, NHanced Semiconductors, and Taiwan Semiconductor Manufacturing Company Limited. Companies in the Heterogeneous Integration Technology Market are advancing their competitive positions through multiple strategic initiatives. Many are scaling R&D investments to enhance chiplet architectures, packaging density, and advanced thermal solutions. Firms are also adopting collaborative development models that align interface standards and accelerate ecosystem interoperability. Several players are expanding manufacturing capacity to support high-volume 3D integration and TSV processes, while others are investing in materials innovation to improve conductivity, reduce power loss, and strengthen structural reliability. Strategic alliances with semiconductor designers and system integrators help broaden product adoption across AI, edge computing, and data-centric applications.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Integration type trends

- 2.2.2 Interconnect Technology trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.2.5 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for advanced packaging to support high-performance computing

- 3.2.1.2 Growing adoption of AI, machine learning, and edge computing workloads

- 3.2.1.3 Expansion of 5G/6G infrastructure and related semiconductor requirements

- 3.2.1.4 Proliferation of IoT devices requiring efficient, compact integration

- 3.2.1.5 Rising investment in data centers and cloud infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing complexity and integration challenges

- 3.2.2.2 Elevated production costs for advanced multi-die packaging

- 3.2.3 Market opportunities

- 3.2.3.1 Development of standardized chiplet marketplaces enabling cross-vendor integration

- 3.2.3.2 Growth in advanced substrate and interposer manufacturing capacity

- 3.2.3.3 Expansion of 3D packaging tools, EDA platforms, and co-design software solutions

- 3.2.3.4 Adoption of heterogeneous integration for specialized, low-volume custom applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Patent and IP analysis

- 3.11 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Integration Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 2.5D integration

- 5.3 3D integration

- 5.4 Fan-out packaging

- 5.5 Chiplet-based integration

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Interconnect Technology, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Through-silicon vias (TSV)

- 6.3 Micro-bump interconnects

- 6.4 Redistribution layers (RDL)

- 6.5 Hybrid bonding (Cu-Cu Bonding)

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 3D Memory solutions

- 7.2.1 High bandwidth memory (HBM)

- 7.2.2 Wide I/O memory

- 7.2.3 3D NAND flash memory

- 7.3 Processors & compute devices

- 7.3.1 CPUs

- 7.3.2 GPUs

- 7.3.3 AI accelerators

- 7.3.4 FPGAs

- 7.4 CMOS image sensors

- 7.5 MEMS devices

- 7.5.1 Inertial sensors

- 7.5.2 Pressure sensors

- 7.5.3 Microphones

- 7.5.4 Others

- 7.6 RF & communication devices

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Integrated device manufacturers (IDMs)

- 8.3 Foundries

- 8.4 OSATs (outsourced semiconductor assembly & test)

- 8.5 Fabless semiconductor companies

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Samsung

- 10.1.2 Taiwan Semiconductor Manufacturing Company Limited

- 10.1.3 Intel

- 10.1.4 Applied Materials, Inc.

- 10.1.5 ASE Technology Holding

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Advanced Micro Devices (AMD)

- 10.2.1.2 Broadcom Inc

- 10.2.1.3 Lam Research Corporation

- 10.2.2 Europe

- 10.2.2.1 EV Group (EVG)

- 10.2.2.2 Indium Corporation

- 10.2.2.3 Micron Technology Inc.

- 10.2.3 APAC

- 10.2.3.1 Amkor Technology

- 10.2.3.2 JCET Group

- 10.2.3.3 United Microelectronics Corporation (UMC)

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 NHanced Semiconductors

- 10.3.2 Atomica Corp

- 10.3.3 Powertech Technology Inc.

- 10.3.4 Siliconware Precision Industries Co., Ltd.

- 10.3.5 Silicon Box Pte Ltd