PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892693

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892693

Europe Hot Water Cylinders Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

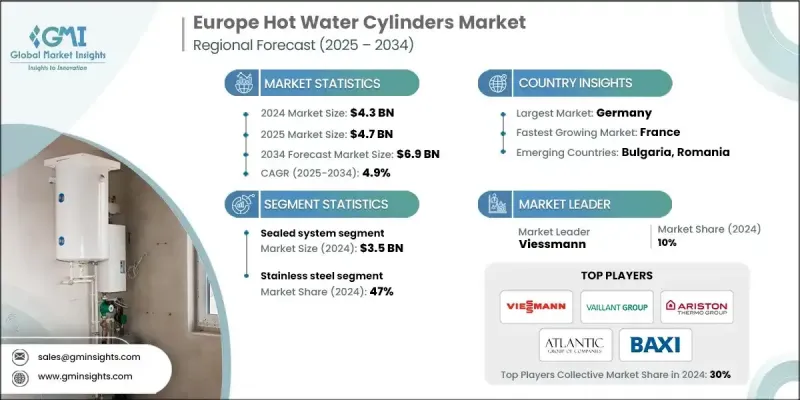

Europe Hot Water Cylinders Market was valued at USD 4.3 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 6.9 billion by 2034.

The market is evolving rapidly as consumers and businesses shift toward energy-efficient, sustainable heating solutions. Modern hot water cylinders are no longer just energy suppliers; they have become a reflection of sustainability and technological advancement. EU regulations and building codes focused on energy performance and carbon reduction are driving this transformation. Manufacturers are responding with innovations in insulation, smart controls, and integration with renewable energy sources such as solar and heat pumps. These features reduce energy consumption, improve system longevity, and support connected home ecosystems with remote monitoring and automatic scheduling. Renovation trends, durability, and lower life-cycle costs are influencing consumer choices, creating strong demand for modern, high-performance cylinders across both residential and commercial segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 4.9% |

The stainless steel segment held a 47% share in 2024. Stainless steel cylinders dominate due to their strength, resistance to corrosion, and ability to withstand high pressure and temperature variations. These cylinders are particularly suitable for modern heating systems, especially in regions with hard water. Their long life, low maintenance requirements, and compatibility with renewable energy systems make them a preferred choice for both residential and commercial applications, driving significant demand across Europe.

The indirect sales segment held a notable share in 2024. Distributors, wholesalers, and multi-brand retailers remain the primary route for cylinder sales due to the market's fragmented nature. Consumers often prefer to purchase from specialized plumbing suppliers and established retail networks, supporting the dominance of indirect distribution.

Germany Hot Water Cylinders Market held 21% share in 2024 and is expected to grow at a CAGR of 5.3% through 2034. The country's strong manufacturing base, advanced heating infrastructure, and strict energy efficiency standards drive demand for high-performance cylinders. German adoption of EU sustainability directives encourages integration with renewable systems like solar thermal and heat pumps. Consumers prioritize quality, reliability, and regulatory compliance, creating demand for premium solutions. Leading global players headquartered in Germany, such as Viessmann and Vaillant, strengthen the country's position as a center of innovation in heating technologies.

Key players in the Europe Hot Water Cylinders Market include Baxi Heating, Telford Copper & Stainless Cylinders, OSO Hotwater, Viessmann, Kingspan Group, Vaillant Group, Ariston Thermo Group, Atlantic Group, Galmet, Kospel, Fleck, Vulcano, and NIBE. Companies in the Europe Hot Water Cylinders Market are focusing on strategies to enhance their presence and market share. Many are investing heavily in R&D to develop energy-efficient, smart, and renewable-integrated cylinders. Strategic partnerships with distributors, retailers, and installers ensure wider reach across fragmented markets. Firms are also emphasizing sustainability certifications and energy labeling to meet regulatory requirements and appeal to eco-conscious consumers. Expanding manufacturing capabilities within Europe reduces lead times and supports local supply chains. In addition, marketing campaigns highlight product longevity, reliability, and cost-efficiency to strengthen brand loyalty.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Pressure System

- 2.2.3 Heating Source Configuration

- 2.2.4 Material

- 2.2.5 Capacity Range

- 2.2.6 End Use

- 2.2.7 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for energy-efficient heating solutions

- 3.2.1.2 Stringent European regulations on energy performance

- 3.2.1.3 Growth in residential construction and renovation activities

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial installation and material costs

- 3.2.2.2 Competition from alternative heating technologies

- 3.2.3 Opportunities

- 3.2.3.1 Integration with renewable energy systems

- 3.2.3.2 Smart and connected hot water cylinders

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Country

- 3.6.2 By Pressure System

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Pressure System, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Open system

- 5.3 Sealed system

Chapter 6 Market Estimates and Forecast, By Heat Source Configuration, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Direct (electric only)

- 6.3 Indirect single coil

- 6.4 Indirect twin coil

- 6.5 Multi-coil (3+ coils)

- 6.6 Heat pump optimized

Chapter 7 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Copper

- 7.3 Stainless Steel (Duplex)

- 7.4 Enamelled Steel

Chapter 8 Market Estimates and Forecast, By Capacity Range, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 60-120l (small)

- 8.3 150-210l (medium)

- 8.4 250-300l (large residential)

- 8.5 400-500l (xl residential/small commercial)

- 8.6 500-3000l (commercial/industrial)

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential new build

- 9.3 Residential retrofit/replacement

- 9.4 Commercial (small-medium)

- 9.5 Industrial/large commercial

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Country, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Germany

- 11.2 UK

- 11.3 Poland

- 11.4 Spain

- 11.5 Netherlands

- 11.6 Sweden

- 11.7 Portugal

- 11.8 Ireland

- 11.9 Rest of Europe

Chapter 12 Company Profiles

- 12.1 A.O. Smith Water Products

- 12.2 Ariston Thermo Group

- 12.3 Atlantic Group

- 12.4 Baxi Heating

- 12.5 Fleck

- 12.6 Galmet

- 12.7 Gledhill Water Storage

- 12.8 Kingspan Group

- 12.9 Kospel

- 12.10 NIBE

- 12.11 OSO Hotwater

- 12.12 Telford Copper & Stainless Cylinders

- 12.13 Vaillant Group

- 12.14 Viessmann

- 12.15 Vulcano