PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892696

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892696

Photonic Computing Components for Consumer Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

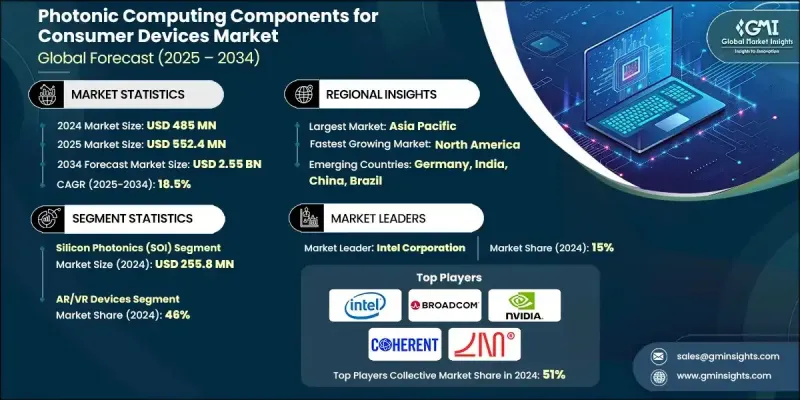

The Global Photonic Computing Components for Consumer Devices Market was valued at USD 485 million in 2024 and is estimated to grow at a CAGR of 18.5% to reach USD 2.55 billion by 2034.

Growth is driven by the increasing computational demands of artificial intelligence workloads on consumer electronics, which are fueling the adoption of photonic computing accelerators. Governments and research organizations are investing heavily in photonic systems to overcome the inherent limitations of traditional electronic AI processors. Rising data generation and processing requirements, particularly in devices requiring high bandwidth, are further propelling the market. The rollout of 5G and the development of 6G technologies are creating additional demand for photonic components to support faster connectivity. Moreover, leveraging established CMOS manufacturing processes has reduced production costs, allowing faster and broader adoption of photonic solutions across consumer electronics, enhancing the performance, efficiency, and compactness of devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $485 Million |

| Forecast Value | $2.55 Billion |

| CAGR | 18.5% |

The silicon photonics (SOI) segment generated USD 255.8 million in 2024. SOI platforms provide high integration density and superior performance, allowing thousands of components to be embedded on chips smaller than 10mm2. This compact design improves efficiency and performance in consumer devices, enabling faster data transfer and lower power consumption.

The AR/VR devices segment held a 46% share in 2024. These devices require high-speed data processing, minimal latency, and compact form factors, making them prime consumers of photonic computing components. Lightweight AR glasses and VR headsets benefit significantly from photonic solutions due to stringent size and weight constraints, enhancing the user experience while delivering high performance.

U.S. Photonic Computing Components for Consumer Devices Market held 74.9% share. The country's growth is supported by substantial investments in advanced computing technologies and the presence of key industry players. Government initiatives, including dedicated funding for research in quantum and photonic technologies, further strengthen the U.S. position, enabling innovation in consumer devices.

Key companies in the Global Photonic Computing Components for Consumer Devices Market for consumer devices include Broadcom Inc., Lightmatter Inc., Intel Corporation, Coherent Corp., Analog Photonics, Marvell Technology Inc., Cisco Systems Inc., LIGENTEC SA, Ayar Labs Inc., PsiQuantum, PICadvanced, NVIDIA Corporation, Q.ANT, Salience Labs, and Xanadu Quantum Technologies. Companies in the Photonic Computing Components for Consumer Devices Market are focusing on innovation, strategic partnerships, and ecosystem development to strengthen their position. They invest heavily in R&D to enhance the efficiency, speed, and integration density of photonic components. Collaborations with consumer electronics and semiconductor manufacturers help secure long-term adoption in high-demand devices. Leveraging scalable CMOS manufacturing reduces costs and accelerates production. Firms are expanding geographically and building robust supply chains while emphasizing energy efficiency and compactness in their products.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology platform

- 2.2.3 Component function

- 2.2.4 Consumer device application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Demand for high-speed data processing

- 3.2.1.2 Energy efficiency and thermal management

- 3.2.1.3 Advancements in integrated photonics and miniaturization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost and manufacturing complexity

- 3.2.2.2 Compatibility with existing electronic architectures

- 3.2.3 Opportunities

- 3.2.3.1 AI and edge computing acceleration

- 3.2.3.2 Emerging AR/VR and metaverse applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Regulatory landscape

- 3.6.1 Standards and compliance requirements

- 3.6.2 Regional regulatory frameworks

- 3.6.3 Certification standards

- 3.7 Gap analysis

- 3.8 Risk assessment and mitigation

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Technology Platform, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Silicon photonics (SOI)

- 5.3 Thin-film lithium niobate (TFLN/LNOI)

- 5.4 Silicon nitride (SiN/Si3N4)

- 5.5 Indium phosphide (InP)

- 5.6 Others emerging platform technologies

Chapter 6 Market Estimates & Forecast, By Component Function, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Optical waveguides

- 6.3 Optical modulators

- 6.4 photodetectors

- 6.5 Light sources

- 6.6 Optical switches & routing components

- 6.7 Coupling & interface components

Chapter 7 Market Estimates & Forecast, By Consumer Device Application, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 AR/VR devices

- 7.3 Smartphones & tablets

- 7.4 Automotive systems

- 7.5 Wearable devices

- 7.6 Gaming systems

- 7.7 IoT & edge devices

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Analog Photonics

- 9.2 Ayar Labs Inc.

- 9.3 Broadcom Inc.

- 9.4 Cisco Systems Inc.

- 9.5 Coherent Corp.

- 9.6 Intel Corporation

- 9.7 Lightmatter Inc.

- 9.8 LIGENTEC SA

- 9.9 Marvell Technology Inc.

- 9.10 NVIDIA Corporation

- 9.11 PICadvanced

- 9.12 PsiQuantum

- 9.13 Q.ANT

- 9.14 Salience Labs

- 9.15 Xanadu Quantum Technologies