PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892703

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892703

EMEA Bagging Machines for Mineral Industry Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

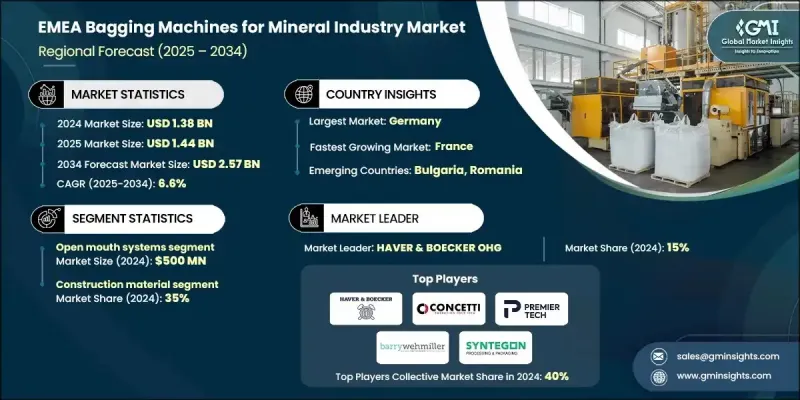

EMEA Bagging Machines for Mineral Industry Market was valued at USD 1.38 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 2.57 billion by 2034.

The market is reshaped as mining and mineral operations prioritize efficiency, accuracy, and safety in bulk material handling. Bagging machinery, once viewed as simple end-of-line equipment, is now integrated earlier in the production process to maintain high-speed output while minimizing dust and waste. Operators increasingly demand flexible systems capable of handling various bag types and sizes without compromising productivity. Automation has emerged as a key trend, with sensors and intelligent controls reducing labor dependency and enhancing process consistency. The rising focus on environmentally friendly packaging is also driving adoption, with recyclable systems and reduced material waste becoming important considerations across operations. Overall, modern bagging machinery is becoming a core part of process optimization, operational safety, and sustainable practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.38 billion |

| Forecast Value | $2.57 billion |

| CAGR | 6.6% |

The open-mouth bagging systems segment generated USD 500 million in 2024. These systems are preferred for their versatility and ability to handle multiple bag styles and sizes, making them suitable for diverse minerals and packaging needs. Open-mouth bags are especially beneficial when presentation and branding matter, as they allow for neat sealing and labeling.

The construction materials segment accounted for a 35% share in 2024, holding the largest share. High-volume demand for products like cement, lime, and sand drives the need for reliable, automated bagging machinery. Standardized bag sizes and continuous production schedules enable manufacturers to optimize machinery for speed, efficiency, and durability, making construction materials the most critical segment for bagging systems.

Germany Bagging Machines for Mineral Industry Market held a 27% share in 2024 and is expected to grow at a CAGR of 6.9% during 2025-2034. Europe's strong industrial base, investment in automation, and commitment to sustainability support the growth of bagging machines. Countries like Germany, France, and Italy leverage extensive engineering and manufacturing expertise to produce advanced systems, while regulations around worker safety, dust control, and energy efficiency further stimulate demand.

Major players operating in the EMEA Bagging Machines for Mineral Industry Market include HAVER & BOECKER OHG, Premier Tech Systems, Concetti S.p.A., PAYPER S.P.A., Wolf Verpackungsmaschinen GmbH, STATEC BINDER GmbH, Premier Tech Chronos, BW Flexible Systems, All-Fill International, Rennco LLC, Arodo, Pronova AB, Rovema GmbH, Dolzan Impianti, and Matrix Packaging Machinery. Key strategies adopted by companies in the EMEA Bagging Machines for Mineral Industry Market include expanding product portfolios with highly automated and flexible systems to cater to different bag types and mineral materials. Firms are investing in R&D to integrate sensors, smart controls, and IoT-enabled monitoring for real-time process optimization. Emphasis on environmentally sustainable packaging solutions, such as recyclable bags and dust-reducing machinery, is enhancing their market appeal. Companies are strengthening regional presence through partnerships, distributor networks, and after-sales service infrastructure. Additionally, manufacturers are offering custom solutions tailored to client needs, focusing on high durability, low maintenance, and energy efficiency, which improves customer retention and drives competitive advantage across the EMEA region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product type

- 2.2.3 End use industry

- 2.2.4 Automation

- 2.2.5 Capacity

- 2.2.6 Materials handled

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising mineral production across EMEA

- 3.2.1.2 Automation and efficiency in packaging operations

- 3.2.1.3 Stringent safety and dust control regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Maintenance and operational complexity

- 3.2.3 Opportunities

- 3.2.3.1 Integration of smart technologies

- 3.2.3.2 Growth in sustainable packaging solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 FFS systems

- 5.2.1 Vertical FFS systems

- 5.2.2 Horizontal FFS systems

- 5.2.3 Pre-made bag FFS systems

- 5.2.4 Integrated sealing systems

- 5.3 Open mouth systems

- 5.3.1 Net weighing systems

- 5.3.2 Gross weighing systems

- 5.3.3 Combination weighing systems

- 5.3.4 Manual/semi-auto/fully auto placement

- 5.4 Valve bagging systems

- 5.4.1 Rotary valve systems

- 5.4.2 Linear valve systems

- 5.4.3 Pneumatic valve systems

- 5.4.4 Electronic valve systems

- 5.5 Others (hybrid system, specialized mineral equipment)

Chapter 6 Market Estimates and Forecast, By Automation, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual bagging machines

- 6.3 Semi-automatic bagging machines

- 6.4 Fully automatic bagging machines

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low capacity (less than 300 bags/hr)

- 7.3 Medium capacity (300 to 800 bags/hr)

- 7.4 High capacity (more than 800 bags/hr)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Construction materials

- 8.3 Industrial minerals

- 8.4 Specialty chemicals

- 8.5 Mining & quarrying

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Materials Handled, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Fine powder

- 9.3 Granular materials

- 9.4 Coarse materials

- 9.5 Mixed materials

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Europe

- 11.1.1 Germany

- 11.1.2 UK

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Spain

- 11.1.6 Russia

- 11.2 Middle East and Africa

- 11.2.1 Saudi Arabia

- 11.2.2 UAE

- 11.2.3 South Africa

Chapter 12 Company Profiles

- 12.1 HAVER & BOECKER OHG

- 12.2 Premier Tech Systems

- 12.3 Concetti S.p.A.

- 12.4 PAYPER S.P.A.

- 12.5 Wolf Verpackungsmaschinen GmbH

- 12.6 STATEC BINDER GmbH

- 12.7 Premier Tech Chronos

- 12.8 BW Flexible Systems

- 12.9 All-Fill International

- 12.10 Rennco LLC

- 12.11 Arodo

- 12.12 Pronova AB

- 12.13 Rovema GmbH

- 12.14 Barry-Wehmiller

- 12.15 Syntegon Technology