PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892705

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892705

Sustainable Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

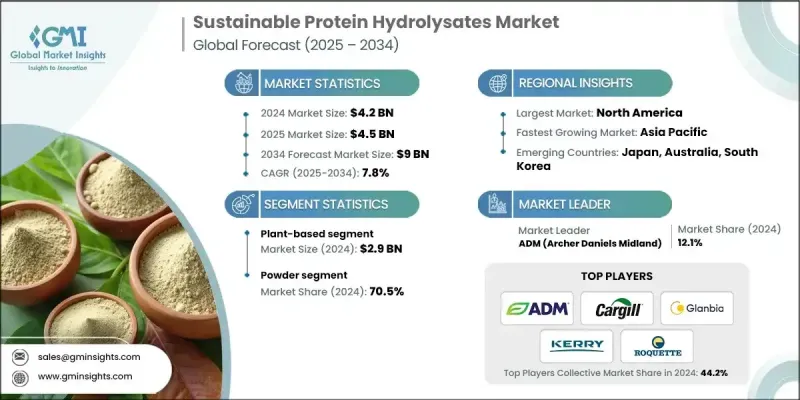

The Global Sustainable Protein Hydrolysates Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 9 billion by 2034.

Protein hydrolysates are bioactive peptides obtained through the enzymatic breakdown of sustainable protein sources. Industries are increasingly focusing on extracting proteins from plants, insects, and by-products to address the rising demand for environmentally conscious protein ingredients. These hydrolysates are gaining traction due to their superior bioavailability, functional properties, and health benefits, which align with the growing global emphasis on sustainability. Government initiatives promoting circular economy practices, such as the U.S. Department of Agriculture's Sustainable Agriculture Programs and the European Green Deal, are driving adoption across food, pharmaceuticals, and cosmetics. North America leads the market due to its advanced production infrastructure and supportive regulations, while Asia Pacific is emerging as the fastest-growing region, driven by large-scale investments in innovative processing technologies and strict sustainability policies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $9 Billion |

| CAGR | 7.8% |

The plant-based protein sources segment generated USD 2.9 billion in 2024 and dominated the market, reflecting a strong consumer shift toward plant-based nutrition and the availability of diverse protein sources suitable for hydrolysis. Legumes, grains, seeds, and other agricultural inputs provide a range of amino acid profiles and functional benefits, making them ideal for various applications.

The powdered protein hydrolysates segment held 70.5% share in 2024 owing to advantages in storage, transport, and flexibility for manufacturing. Long shelf-life powders with low moisture content simplify handling and dosing in food, nutraceutical, and animal feed formulations. Advances in spray drying, lyophilization, and other dehydration techniques ensure the preservation of bioactive compounds and functional properties during conversion from liquid to powder.

North America Sustainable Protein Hydrolysates Market will grow at a CAGR of 7.8% between 2025 and 2034, supported by rising consumer awareness of plant-based and clean-label products emphasizing naturalness, transparency, and health benefits. The food and beverage sector increasingly incorporates protein hydrolysates due to their digestibility, allergen-free nature, and alignment with sustainability preferences. Innovations in enzymatic hydrolysis and extraction technologies enhance product quality, bioavailability, and functional performance, enabling the development of personalized nutrition and wellness solutions.

Major players operating in the Global Sustainable Protein Hydrolysates Market include Actus Nutrition, ADM, Arla Foods Ingredients, Cargill, DSM-Firmenich, Fonterra Co-operative Group, FrieslandCampina Ingredients, Glanbia Nutritionals, Kemin Industries, Kerry Group plc, Roquette Freres, and Spryng. Companies in the Sustainable Protein Hydrolysates Market are focusing on strategies such as expanding production capacity, investing in R&D for new protein sources and improved hydrolysis processes, and forming strategic partnerships to enhance distribution networks. They are also emphasizing clean-label and allergen-free product development, entering emerging markets with high growth potential, adopting sustainable and circular economy practices in sourcing and manufacturing, and leveraging digital platforms for consumer engagement and product traceability. Additionally, product innovation aimed at personalized nutrition, functional foods, and nutraceutical applications is helping firms differentiate themselves and strengthen their market presence globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Source trends

- 2.2.2 Form trends

- 2.2.3 Processing method trends

- 2.2.4 Application trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing consumer demand for sustainable protein solutions

- 3.2.1.2 Regulatory push for circular economy practices

- 3.2.1.3 Technological advances in green processing methods

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment in sustainable processing technologies

- 3.2.2.2 Complex regulatory approval processes

- 3.2.3 Market opportunities

- 3.2.3.1 Untapped potential in insect-based protein hydrolysates

- 3.2.3.2 Waste valorization in food processing industry

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By source

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant-based

- 5.2.1 Soy protein hydrolysates

- 5.2.2 Pea protein hydrolysates

- 5.2.3 Wheat protein hydrolysates

- 5.2.4 Rice protein hydrolysates

- 5.2.5 Hemp protein hydrolysates

- 5.2.6 Other plant sources

- 5.3 Animal-based

- 5.3.1 Milk protein hydrolysates (whey, casein)

- 5.3.2 Meat protein hydrolysates

- 5.3.3 Marine protein hydrolysates (fish, collagen)

- 5.3.4 Egg protein hydrolysates

- 5.4 Insect-based protein hydrolysates

- 5.4.1 Cricket protein hydrolysates

- 5.4.2 Mealworm protein hydrolysates

- 5.4.3 Black soldier fly protein hydrolysates

- 5.4.4 Other insect sources

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Liquid

Chapter 7 Market Estimates and Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Enzymatic hydrolysis

- 7.3 Alkaline hydrolysis

- 7.4 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.2.1 Functional foods

- 8.2.2 Protein bars & snacks

- 8.2.3 Beverages & smoothies

- 8.2.4 Infant & baby nutrition

- 8.2.5 Bakery & confectionery

- 8.3 Nutraceuticals & dietary supplements

- 8.3.1 Sports nutrition products

- 8.3.2 Health supplements

- 8.3.3 Medical foods

- 8.3.4 Weight management products

- 8.4 Animal feed & pet food

- 8.4.1 Livestock feed applications

- 8.4.2 Aquaculture feed

- 8.4.3 Companion animal nutrition

- 8.4.4 Specialty pet foods

- 8.5 Cosmetics & personal care

- 8.5.1 Anti-aging products

- 8.5.2 Hair care formulations

- 8.5.3 Skin care applications

- 8.5.4 Sun care products

- 8.6 Pharmaceutical

- 8.6.1 Drug delivery systems

- 8.6.2 Therapeutic proteins

- 8.6.3 Wound healing products

- 8.6.4 Bioactive peptides

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Actus Nutrition

- 10.2 ADM

- 10.3 Arla Foods Ingredients

- 10.4 Cargill

- 10.5 DSM-Firmenich

- 10.6 Fonterra Co-operative Group

- 10.7 FrieslandCampina Ingredients

- 10.8 Glanbia Nutritionals

- 10.9 Kemin Industries

- 10.10 Kerry Group plc

- 10.11 Roquette Freres

- 10.12 Spryng