PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892709

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892709

Fast-Charging EV Battery Chemistries Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

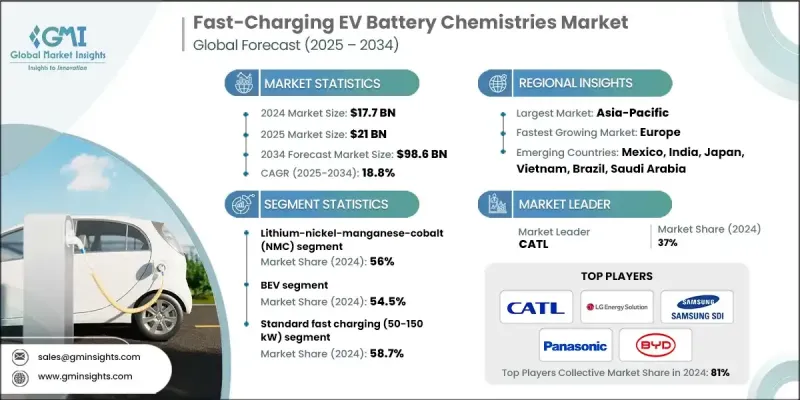

The Global Fast-Charging EV Battery Chemistries Market was valued at USD 17.7 billion in 2024 and is estimated to grow at a CAGR of 18.8% to reach USD 98.6 billion by 2034.

The rapid transition toward electric vehicles is a key driver, as governments and industries worldwide focus on reducing greenhouse gas emissions and supporting net-zero targets. The transportation sector alone accounts for over 25% of global emissions, making EV adoption a critical necessity rather than just a consumer preference. As EV ownership rises, range anxiety and limited charging infrastructure have pushed the demand for advanced battery chemistries capable of charging from 10% to 80% in 10-30 minutes. Innovations in ultra-fast charging technologies, including 350 kW+ systems and high-voltage architectures like 800V platforms, are enabling substantial range gains in just 10 to 15 minutes. This trend is propelling investments in battery chemistries such as lithium-nickel-manganese-cobalt (NMC), lithium iron phosphate (LFP), and lithium-nickel-cobalt-aluminum (NCA), which can deliver higher efficiency, longer life, and faster charge times.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.7 Billion |

| Forecast Value | $98.6 Billion |

| CAGR | 18.8% |

The lithium-nickel-manganese-cobalt (NMC) segment held a 56% share in 2024. Increasing EV adoption, combined with declining lithium costs, is accelerating demand for NMC batteries, which are widely preferred by automakers for their rapid charging capabilities.

The battery electric vehicle (BEV) segment held a 54.5% share in 2024. BEVs drive the need for fast-charging battery chemistries due to their larger battery packs and growing consumer expectations for reduced charging times. Advances in lithium-ion and LFP chemistries are enhancing charging speed, energy storage, and battery safety, while extending overall lifespan.

U.S. Fast-Charging EV Battery Chemistries Market reached USD 2.9 billion in 2024. Government policies, such as the Inflation Reduction Act (IRA), are accelerating domestic production by providing tax incentives and promoting the use of local materials. These initiatives are encouraging automakers to focus on NMC, LFP, and other advanced fast-charging battery chemistries within compliant supply chains to reduce costs and support sustainability.

Key players in the Global Fast-Charging EV Battery Chemistries Market include BYD, SK On, Factorial Energy, LG Energy Solution, CATL, Samsung SDI, BorgWarner, Panasonic, Farasis Energy, and EVE Energy. Companies in the Global Fast-Charging EV Battery Chemistries Market are strengthening their positions by investing heavily in R&D to improve energy density, safety, and charge speed. Strategic partnerships with automakers and technology firms help accelerate the commercialization of next-generation chemistries. Many are expanding production capacity in strategic regions to reduce logistics costs and meet local content requirements. Firms are also pursuing patents, licensing agreements, and joint ventures to secure supply chains for critical raw materials while focusing on sustainability and recycling initiatives to appeal to environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Battery Chemistry

- 2.2.3 Powertrain

- 2.2.4 Vehicle

- 2.2.5 Charging Technology

- 2.2.6 Sales Channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing consumer demand for reduced charging times

- 3.2.1.2 Government mandates for zero-emission vehicles

- 3.2.1.3 Expansion of high-power charging infrastructure networks

- 3.2.1.4 Declining battery costs enabling fast-charging adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Battery degradation & cycle life concerns with fast charging

- 3.2.2.2 Raw material supply constraints

- 3.2.3 Market opportunities

- 3.2.3.1 Heavy-duty & commercial vehicle electrification

- 3.2.3.2 Extreme fast-charging technology development

- 3.2.3.3 Solid-state battery commercialization

- 3.2.3.4 Vehicle-to-grid (V2G) integration with fast-charging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology roadmaps & evolution

- 3.7.4 Technology adoption lifecycle analysis

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Consumer perception & adoption barriers

- 3.11.1 Consumer charging time expectations & acceptance thresholds

- 3.11.2 Range anxiety vs fast-charging availability trade-off

- 3.11.3 Price premium willingness for fast-charging capability

- 3.11.4 Battery degradation concerns & warranty expectations

- 3.11.5 Charging infrastructure accessibility perception

- 3.12 Thermal degradation & safety analysis

- 3.12.1 Global charging standards landscape

- 3.12.2 Power level standardization

- 3.12.3 Communication protocols

- 3.12.4 Megawatt charging system

- 3.12.5 Standardization gaps & interoperability challenges

- 3.13 Life cycle cost & total cost of ownership (TCO) analysis

- 3.13.1 TCO methodology & assumptions

- 3.13.2 Fast-charging premium cost analysis

- 3.13.3 Energy costs & charging efficiency

- 3.13.4 Maintenance & replacement costs

- 3.14 Case studies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Vendor selection criteria

Chapter 5 Market Estimates & Forecast, By Battery Chemistry, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Lithium Iron Phosphate (LFP)

- 5.3 Lithium-Nickel-Manganese-Cobalt (NMC)

- 5.4 Nickel-Cobalt-Aluminum (NCA)

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Powertrain, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 BEV

- 6.3 PHEV

- 6.4 HEV

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger Vehicles

- 7.2.1 SUVs

- 7.2.2 Sedans

- 7.2.3 Hatchbacks

- 7.3 Commercial Vehicles

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

- 7.4 Two-wheelers

Chapter 8 Market Estimates & Forecast, By Charging Technology, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Standard Fast Charging (50-150 kW)

- 8.3 Ultra-Fast Charging (Above 150 kW)

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Singapore

- 10.4.7 Malaysia

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.4.10 Thailand

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 CATL

- 11.1.2 LG Energy Solution

- 11.1.3 Samsung SDI

- 11.1.4 Panasonic Energy

- 11.1.5 SK On

- 11.1.6 BYD Company

- 11.1.7 Tesla

- 11.1.8 Farasis Energy

- 11.1.9 BorgWarner

- 11.2 Regional companies

- 11.2.1 Northvolt

- 11.2.2 CALB

- 11.2.3 Gotion High-Tech

- 11.2.4 Envision AESC

- 11.2.5 EVE Energy

- 11.2.6 Automotive Cells Company

- 11.3 Emerging companies

- 11.3.1 QuantumScape

- 11.3.2 StoreDot

- 11.3.3 Solid Power

- 11.3.4 Sila Nanotechnologies

- 11.3.5 Factorial Energy

- 11.3.6 Enevate

- 11.3.7 Amprius Technologies

- 11.3.8 ProLogium Technology

- 11.3.9 ONE

- 11.3.10 Freyr Battery

- 11.3.11 Cuberg

- 11.3.12 Sunwoda Electronic