PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892713

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892713

Battery Recycling Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

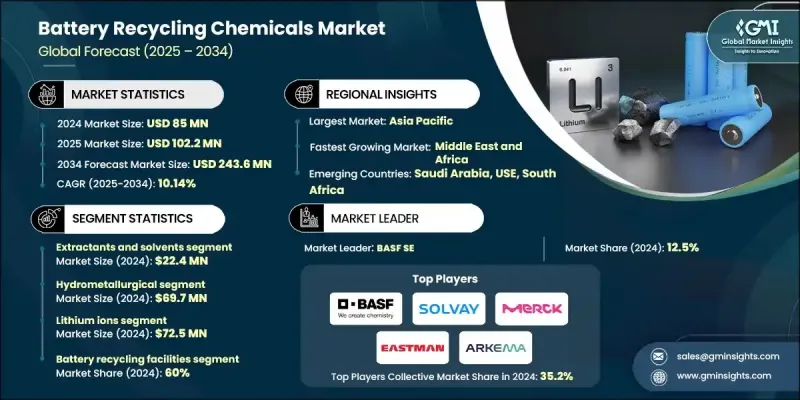

The Global Battery Recycling Chemicals Market was valued at USD 85 million in 2024 and is estimated to grow at a CAGR of 10.14% to reach USD 243.6 million by 2034.

Chemical recycling catalysts play a crucial role in converting waste polymers and plastics into their original monomers or other high-value compounds by triggering molecular-level transformations rather than relying on physical processing. These catalysts support advanced circular-economy approaches by improving reaction performance, optimizing selectivity, and enabling more sustainable processing. Interest in battery recycling chemicals is rising as waste-management strategies shift toward solutions that can restore material quality instead of producing downgraded outputs. Increasing environmental pressures, more aggressive regulatory requirements, and stronger demand for sustainable materials within the plastics and battery industries are accelerating adoption. Catalysts help reduce the energy needed to break polymer structures, enabling processes such as pyrolysis, hydrolysis, and depolymerization, depending on catalyst composition. This broader shift underscores how chemical recycling technologies are becoming essential in modern material recovery and in supporting the global transition toward cleaner, closed-loop resource systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $85 Million |

| Forecast Value | $243.6 Million |

| CAGR | 10.14% |

The hydrometallurgical processes segment generated USD 69.7 million in 2024. This approach is widely used to extract metals from spent batteries because it allows precise control over separation and recovery, yielding consistent results for valuable elements. Pyrometallurgical methods rely on high heat to simplify battery material mixtures, although these processes typically require more energy compared with aqueous-based treatments.

The battery recycling facilities segment held a 60% share in 2024. With countries prioritizing resource efficiency and low-impact production, sectors such as metal refining, chemical processing, automotive manufacturing, and electronics recycling continue to grow. Rising usage of electric vehicles, energy storage technologies, and electronic devices is increasing the need to reclaim essential materials from end-of-life products. Recycling and refining methods help maintain access to critical resources such as lithium, cobalt, and nickel while reducing overall environmental burden.

U.S. Battery Recycling Chemicals Market reached USD 18.1 million in 2024. In North America, which includes both the U.S. and Canada, the industry is expanding as companies work to recover key metals through advanced hydrometallurgical and chemical solutions. Strong growth in electric mobility and grid storage systems is driving the need for scalable, efficient treatments, and ongoing regulatory support for sustainable recycling continues to attract investment in chemical recovery technologies.

Major companies involved in the Global Battery Recycling Chemicals Market include BASF SE, Solvay SA, Merck KGaA, Eastman Chemical Company, Arkema SA, Umicore NV, Redwood Materials Inc, Ascend Elements Inc, Fortum Corporation, Guangdong Brunp Recycling Technology Co Ltd (GEM), Contemporary Amperex Technology Co Limited (CATL), Hydrovolt AS, RecycLiCo Battery Materials Inc, Cylib GmbH, Glencore PLC, Sibanye-Stillwater Limited, Terrafame Oy, American Battery Technology Company, Aqua Metals Inc, Neometals Ltd, EnviroLeach Technologies Inc, and Battery Resourcers Inc. Companies competing in the battery recycling chemicals sector are reinforcing their market presence by scaling hydrometallurgical capabilities, improving catalyst formulations, and expanding integrated recycling partnerships with battery manufacturers. Many firms are optimizing process efficiency by reducing reaction temperatures, improving metal-recovery yields, and adopting selective leaching and purification methods that deliver higher-quality outputs. Organizations are also forming regional alliances to secure feedstock, enhance supply-chain resilience, and ensure reliable access to end-of-life batteries. Increased investment in environmentally compliant technologies and low-emission processing systems remains a priority as regulatory expectations rise.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Chemicals type

- 2.2.2 Process type

- 2.2.3 Battery chemistry

- 2.2.4 End use industry

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in EVs & energy-storage drives supply surge

- 3.2.1.2 Adoption of advanced recovery technologies

- 3.2.1.3 Rising demand from emerging battery chemistries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital and operational costs

- 3.2.2.2 Complex and diverse battery chemistries

- 3.2.3 Market opportunities

- 3.2.3.1 Innovation in specialized chemicals

- 3.2.3.2 Integration with circular economy initiatives

- 3.2.3.3 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By chemicals type

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Chemicals Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Leaching agents

- 5.3 Reductants/Oxidants

- 5.4 Extractants & solvents

- 5.5 Precipitating agents

- 5.6 Ion-exchange materials

- 5.7 Pyromet additives

- 5.8 Direct recycling

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Process Type, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Hydrometallurgical

- 6.3 Pyrometallurgical

- 6.4 Direct & physical

- 6.5 Bioleaching

- 6.6 Hybrid process

Chapter 7 Market Estimates and Forecast, By Battery Chemistry, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Lithium-Ion

- 7.3 Lead-Acid

- 7.4 Nickel-Based

- 7.5 Alkaline & Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Battery recycling facilities

- 8.3 Metal refineries & smelters

- 8.4 Chemical processing plants

- 8.5 Automotive OEMs

- 8.6 Electronics recyclers

- 8.7 Industrial battery recyclers

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 Solvay SA

- 10.3 Merck KGaA

- 10.4 Eastman Chemical Company

- 10.5 Arkema SA

- 10.6 Umicore NV

- 10.7 Redwood Materials Inc

- 10.8 Ascend Elements Inc

- 10.9 Fortum Corporation

- 10.10 Guangdong Brunp Recycling Technology Co Ltd (GEM)

- 10.11 Contemporary Amperex Technology Co Limited (CATL)

- 10.12 Hydrovolt AS

- 10.13 RecycLiCo Battery Materials Inc

- 10.14 Cylib GmbH

- 10.15 Glencore PLC

- 10.16 Sibanye-Stillwater Limited

- 10.17 Terrafame Oy

- 10.18 American Battery Technology Company

- 10.19 Aqua Metals Inc

- 10.20 Neometals Ltd

- 10.21 EnviroLeach Technologies Inc

- 10.22 Battery Resourcers Inc