PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892722

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892722

Micro-Mobility Integration Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

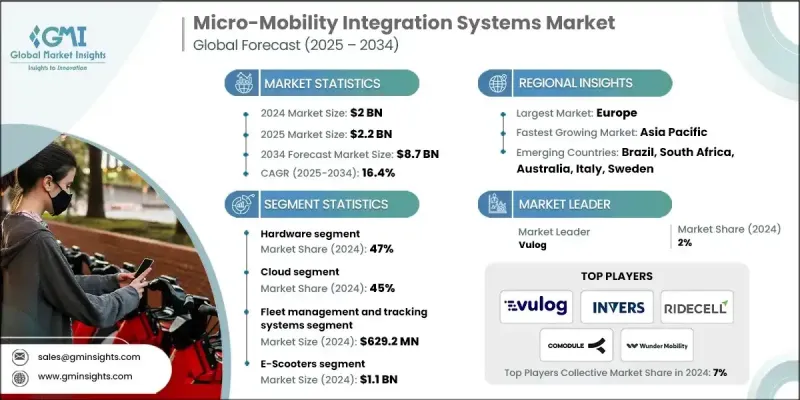

The Global Micro-Mobility Integration Systems Market was valued at USD 2 billion in 2024 and is estimated to grow at a CAGR of 16.4% to reach USD 8.7 billion by 2034.

The market is undergoing a transformation as micro-mobility becomes increasingly integrated into multimodal transportation networks, reshaping technology architecture, operational strategies, and business models across the industry. Platforms that combine various forms of urban mobility are driving efficiency, convenience, and accessibility, encouraging both public and private adoption. Fleet management is being revolutionized through the adoption of artificial intelligence and machine learning, allowing operators to leverage predictive analytics, automated decision-making, and dynamic resource allocation. These advancements are increasing operational efficiency, reducing downtime, and improving profitability for fleet managers. The growing demand for smart mobility solutions across Europe, particularly in urban centers, is further accelerating adoption, as governments and private operators invest heavily in integrated systems to optimize mobility, reduce congestion, and enhance user experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 16.4% |

The hardware segment held a 47% share in 2024 and is projected to grow at a CAGR of 16.1% from 2025 to 2034. Hardware in the ecosystem includes IoT devices, telematics units, and charging infrastructure, such as wired and wireless charging stations, battery swap stations, smart locks, GPS modules, and diagnostic sensors. Factory-installed connectivity is increasingly standard, with an estimated seventy percent of new fleets expected to feature some form of IoT integration.

The cloud segment accounted for a 45% share in 2024 and is anticipated to grow at a CAGR of 17% through 2034. Cloud platforms hosted by providers like AWS, Azure, and Google Cloud offer scalable application software, analytical engines, and operational tools. Cloud adoption reduces the need for physical server management, accelerates implementation, allows mobile access, and enables automatic updates.

Germany Micro-Mobility Integration Systems Market held a 28% share in 2024. Numerous companies operate dockless vehicles across multiple cities, providing widespread access to scooters and bike-sharing services. Regulatory frameworks, such as fleet caps in urban areas, are helping manage growth and ensure safety while supporting sustainable urban mobility expansion.

Major players in the Micro-Mobility Integration Systems Market include Atom Mobility, Comodule, INVERS, Joyride, Ridecell, Roam.ai, Urban Sharing, Vulog, Wunder Mobility, and Splyt. Companies in the Micro-Mobility Integration Systems Market are expanding their presence by investing in AI-driven fleet management and predictive analytics to improve vehicle uptime and operational efficiency. They are integrating IoT-enabled hardware and smart charging infrastructure to provide seamless connectivity and enhance the user experience. Strategic partnerships with local authorities, mobility operators, and technology providers allow companies to scale rapidly in urban markets. Cloud-based solutions and platform interoperability are prioritized to facilitate multimodal transportation integration and streamline operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast

- 1.4 Primary research and validation

- 1.5 Some of the primary sources

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

- 1.7 Inclusion & Exclusion

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Technology

- 2.2.4 Deployment mode

- 2.2.5 Vehicle

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component manufacturers

- 3.1.1.2 Platform providers

- 3.1.1.3 Connectivity & network providers

- 3.1.1.4 System integrators & consultants

- 3.1.1.5 End use

- 3.1.1.6 Supporting services

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Vertical integration trends

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & last-mile demand

- 3.2.1.2 Technology & connectivity

- 3.2.1.3 Sustainability & regulatory support

- 3.2.1.4 Charging & battery infrastructure

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High upfront integration & regulatory complexity

- 3.2.2.2 Safety risks & interoperability issues

- 3.2.3 Market opportunities

- 3.2.3.1 Advanced data monetization & analytics

- 3.2.3.2 Expansion to emerging cities

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 AI & machine learning integration

- 3.3.1.2 Predictive maintenance technologies

- 3.3.1.3 Autonomous rebalancing systems

- 3.3.1.4 Battery swapping infrastructure

- 3.3.2 Emerging technologies

- 3.3.2.1 5G & edge computing applications

- 3.3.2.2 Blockchain for payments & identity

- 3.3.2.3 Autonomous fleet optimization

- 3.3.2.4 Digital twins in smart battery swapping and charging infrastructure

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Federal regulations

- 3.5.2 State & municipal permitting requirements

- 3.5.3 Data sharing mandates

- 3.5.4 Safety standards

- 3.5.5 Privacy & data protection

- 3.5.6 Regional regulatory comparison

- 3.5.6.1 North America

- 3.5.6.2 Europe

- 3.5.6.3 Asia-Pacific

- 3.5.6.4 Latin America

- 3.5.6.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Price trends

- 3.10.1 Competitive pricing strategies

- 3.10.2 Software licensing price ranges

- 3.10.3 Professional services rates

- 3.10.4 Vendor revenue models & strategies

- 3.11 Investment & Funding Analysis

- 3.11.1 Venture capital & private equity trends

- 3.11.2 Geographic investment distribution

- 3.11.3 Stage-wise funding analysis

- 3.11.4 Major deals & transactions

- 3.11.5 Shift from growth to profitability focus

- 3.12 Patent analysis

- 3.12.1 Battery swapping technology patents

- 3.12.2 Fleet management system patents

- 3.12.3 IoT & connectivity patents

- 3.12.4 Charging infrastructure patents

- 3.12.5 Key patent holders & assignees

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Market adoption & penetration analysis

- 3.14.1 Technology adoption lifecycle

- 3.14.2 Adoption barriers & enablers

- 3.14.3 Market penetration analysis

- 3.14.4 Customer decision journey

- 3.15 Use case analysis & application scenarios

- 3.15.1 Use case framework & selection criteria

- 3.15.2 System requirements & integration points

- 3.15.3 Payment system integration

- 3.15.4 Use case comparison matrix

- 3.16 Customer Journey & Experience Mapping

- 3.16.1 Fleet operator

- 3.16.2 Municipality/city

- 3.16.3 Transit agency

- 3.16.4 MaaS provider

- 3.16.5 Journey comparison matrix

- 3.17 Risk assessment & risk matrix

- 3.17.1 Risk identification methodology

- 3.17.2 Risk scoring methodology

- 3.17.3 Heat map visualization

- 3.17.4 Risk monitoring & early warning indicators

- 3.18 Adoption & diffusion curve analysis

- 3.18.1 Diffusion of innovation framework

- 3.18.2 Fleet management platform adoption

- 3.18.3 Battery swapping infrastructure adoption

- 3.18.4 Geographic diffusion patterns

- 3.18.5 Technology substitution curves

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

- 4.6 Premium positioning strategies

- 4.7 Competitive analysis and USPs

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, units)

- 5.1 Key trends

- 5.1.1 Software Platforms

- 5.1.1.1 Fleet management

- 5.1.1.2 Booking systems

- 5.1.1.3 Payment & billing systems

- 5.1.1.4 Analytics & reporting

- 5.1.1.5 Rider apps / user interface

- 5.1.1.6 Operator dashboards

- 5.1.2 Hardware

- 5.1.2.1 IoT devices / sensors

- 5.1.2.2 GPS trackers / navigation modules

- 5.1.2.3 Smart locks

- 5.1.2.4 Battery management systems

- 5.1.2.5 Vehicle-mounted controllers

- 5.1.2.6 Charging docks / stations

- 5.1.3 Services

- 5.1.3.1 Consulting & advisory

- 5.1.3.2 System integration

- 5.1.3.3 Installation & deployment

- 5.1.3.4 Maintenance & repair

- 5.1.3.5 Customer support / helpdesk

- 5.1.3.6 Training & onboarding

- 5.1.1 Software Platforms

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, units)

- 6.1 Key trends

- 6.2 Fleet management & tracking systems

- 6.3 Payment & billing integration

- 6.4 IoT connectivity & telematics

- 6.5 Charging & battery management

- 6.6 Data analytics & reporting

- 6.7 Geofencing & compliance tools

Chapter 7 Market Estimates & Forecast, By Deployment mode, 2021 - 2034 ($Bn, units)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 Hybrid

- 7.4 On-premises

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, units)

- 8.1 Key trends

- 8.2 E-scooters

- 8.3 E-bikes

- 8.4 Pedal bikes

- 8.5 E-mopeds

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, units)

- 9.1 Key trends

- 9.2 Fleet operators

- 9.3 Municipalities

- 9.4 Universities & corporate campuses

- 9.5 Delivery companies

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Software / platform providers

- 11.1.1 ATOM Mobility

- 11.1.2 Fifteen

- 11.1.3 INVERS

- 11.1.4 Joyride

- 11.1.5 Movatic

- 11.1.6 Passport

- 11.1.7 Remix (Via)

- 11.1.8 Ridecell

- 11.1.9 Roam.ai

- 11.1.10 Splyt

- 11.1.11 Urban Sharing

- 11.1.12 Vulog

- 11.1.13 Wunder Mobility

- 11.1.14 ZOBA

- 11.2 Data & analytics platforms

- 11.2.1 Fluctuo

- 11.2.2 Populus

- 11.2.3 Ride Report

- 11.2.4 Vianova

- 11.3 IoT & connectivity providers

- 11.3.1. IoT

- 11.3.2 Comodule

- 11.3.3 KNOT

- 11.3.4 Omni

- 11.3.5 Onomondo

- 11.3.6 Teltonika

- 11.4 Computer Vision & AI

- 11.4.1 Drover AI

- 11.4.2 Luna Systems

- 11.5 Battery & charging infrastructure

- 11.5.1 Ample

- 11.5.2 Gogoro

- 11.5.3 Swiftmile