PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892744

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892744

Nutraceutical Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

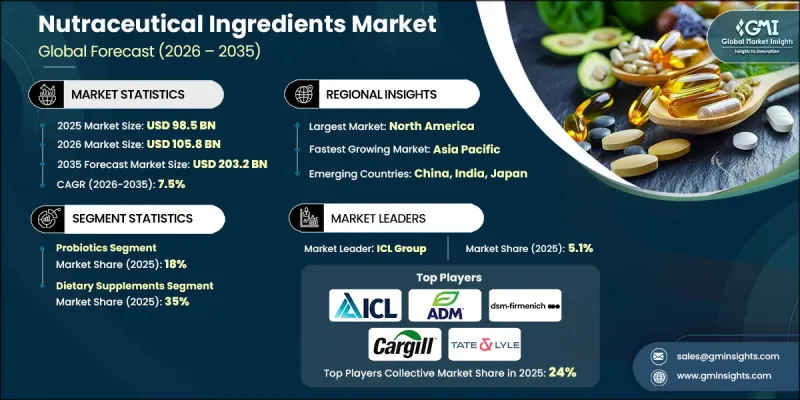

The Global Nutraceutical Ingredients Market was valued at USD 98.5 billion in 2025 and is estimated to grow at a CAGR of 7.5% to reach USD 203.2 billion by 2035.

The near-term growth is fueled by the rising adoption of functional foods and ready-to-drink formats, while medium-term expansion is driven by personalized nutrition and clinically substantiated health claims that are easy for consumers to understand. The nutraceutical ingredients market demonstrates resilience even when broader food sectors slow down, as its growth is diversified across multiple channels and applications. Consumers increasingly link diet to chronic disease prevention, which continues to propel demand for ingredients supporting digestive health, immune function, cardiovascular wellness, and overall vitality. Rising interest in plant-based, organic, and ethically sourced ingredients is further encouraging manufacturers to innovate formulations that appeal to health-conscious and environmentally aware buyers.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $98.5 Billion |

| Forecast Value | $203.2 Billion |

| CAGR | 7.5% |

The probiotics segment accounted for an 18% share in 2025, fueled by the growing mainstream adoption of digestive wellness solutions. Consumers are increasingly recognizing the importance of gut health, immunity support, and overall well-being, which has led to the integration of probiotics across functional foods, beverages, and over-the-counter supplements. The emphasis on scientifically validated strains and targeted formulations has strengthened consumer confidence, driving higher adoption rates.

The dietary supplements segment held a 35% share in 2025, underscoring the demand for precise dosing, multi-ingredient combinations, and clear efficacy claims. Consumers increasingly seek supplements that offer measurable benefits for immunity, energy, cognitive function, and overall wellness. The ability to deliver standardized bioactive compounds, including vitamins, minerals, amino acids, and plant extracts, in convenient dosage forms enhances product appeal.

North America Nutraceutical ingredients Market held 38% share in 2025, led by a mature supplement culture, strong retail and e-commerce infrastructure, and regulatory clarity under DSHEA. The U.S. benefits from premium brand positioning, clinical marketing, and professional recommendations, while Canada sees increasing demand for plant-based ingredients, probiotics, and beauty-from-within solutions.

Key players in the Global Nutraceutical Ingredients Market include Tate & Lyle, DSM NV, BASF SE, DuPont Nutrition & Biosciences, Cargill Incorporated, Arla Food Ingredients, Divis Laboratories, Ajinomoto, Ingredion, Prinova Group, Roquette Freres, Barentz, and BI Nutraceuticals. Companies in the Global Nutraceutical ingredients Market are focusing on strategies such as investing in research and development to create clinically substantiated and innovative ingredients. They are expanding product portfolios to cater to functional foods, beverages, and dietary supplements. Strategic partnerships and collaborations with food manufacturers, distributors, and healthcare professionals help enhance market penetration. Firms are emphasizing clean-label, plant-based, and sustainable formulations to appeal to evolving consumer preferences. Mergers and acquisitions are pursued to strengthen geographic presence and diversify product offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product

- 2.2.2 Application

- 2.2.3 Form

- 2.2.4 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Product, 2022-2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Probiotics

- 5.2.1 Lactobacilli

- 5.2.2 Bifidobacterium

- 5.2.3 Bacillus

- 5.2.4 Streptococcus

- 5.2.5 Saccharomyces (yeast)

- 5.2.6 Others

- 5.3 Prebiotics

- 5.3.1 FOS (fructooligosaccharides)

- 5.3.2 Inulin

- 5.3.3 GOS (galactooligosaccharides)

- 5.3.4 MOS (mannanoligosaccharides)

- 5.3.5 Others

- 5.4 Vitamins

- 5.4.1.1 Vitamin A

- 5.4.1.2 Vitamin C

- 5.4.1.3 Vitamin D

- 5.4.1.4 Vitamin E

- 5.4.1.5 Vitamin K

- 5.4.1.6 Vitamin B-complex (B1, B2, B6, B12, Biotin, Folic Acid, Niacin)

- 5.5 Amino acids

- 5.5.1.1 Lysine

- 5.5.1.2 Methionine

- 5.5.1.3 Threonine

- 5.5.1.4 Tryptophan

- 5.6 Carotenoids

- 5.6.1.1 Beta-carotene

- 5.6.1.2 Lutein

- 5.6.1.3 Astaxanthin

- 5.6.1.4 Canthaxanthin

- 5.6.1.5 Lycopene

- 5.6.1.6 Others

- 5.7 Phytochemicals & plant extracts

- 5.7.1.1 Phytosterols

- 5.7.1.2 Flavonoids

- 5.7.1.3 Polyphenols

- 5.7.1.4 Others

- 5.8 Protein

- 5.8.1 Plant proteins

- 5.8.1.1 Wheat protein

- 5.8.1.2 Soy protein concentrates (SPC)

- 5.8.1.3 Soy protein isolates (SPI)

- 5.8.1.4 Textured soy protein

- 5.8.1.5 Pea protein

- 5.8.1.6 Canola protein

- 5.8.1.7 Others

- 5.8.2 Animal proteins

- 5.8.2.1 Egg protein

- 5.8.2.2 Milk protein concentrates/isolates

- 5.8.2.3 Whey protein concentrates (WPC 80, WPC 35)

- 5.8.2.4 Whey protein hydrolysates (WPH)

- 5.8.2.5 Whey protein isolates (WPI)

- 5.8.2.6 Gelatin

- 5.8.2.7 Casein/caseinates

- 5.8.1 Plant proteins

- 5.9 EPA/DHA (omega-3 fatty acids)

- 5.9.1 Anchovy/sardine

- 5.9.2 Algae oil

- 5.9.3 Tuna oil

- 5.9.4 Cod liver oil

- 5.9.5 Salmon oil

- 5.9.6 Krill oil

- 5.9.7 Menhaden oil

- 5.10 Minerals

- 5.11 Fiber & carbohydrates

- 5.11.1 Cereals & grains

- 5.11.2 Fruits & vegetables

- 5.12 Others

Chapter 6 Market Size and Forecast, By Application, 2022-2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Functional food

- 6.2.1 Fortified dairy products

- 6.2.2 Fortified juices

- 6.2.3 Functional bakery

- 6.2.4 Fortified cereals

- 6.3 Functional beverages

- 6.3.1 Sports drinks

- 6.3.2 Energy drinks

- 6.3.3 Fortified water

- 6.3.4 Beauty drinks

- 6.4 Dietary supplements

- 6.4.1 Capsules

- 6.4.2 Tablets

- 6.4.3 Powders

- 6.4.4 Gummies

- 6.4.5 Softgels

- 6.4.6 Liquids

- 6.5 Personal care & cosmeceuticals

- 6.5.1 Nutricosmetics (oral beauty supplements)

- 6.5.2 Topical formulations

- 6.6 Animal nutrition

- 6.6.1 Companion animals

- 6.6.2 Livestock

- 6.6.3 Aquaculture

- 6.7 Clinical nutrition

- 6.7.1 Medical foods

- 6.7.2 Therapeutic nutrition

- 6.7.3 Infant formula

- 6.7.4 Geriatric nutrition

- 6.8 Others

Chapter 7 Market Size and Forecast, By Form, 2022-2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Dry form

- 7.2.1 Powders

- 7.2.2 Capsules

- 7.2.3 Tablets

- 7.2.4 Gummies & chewables

- 7.2.5 Beadlets & microbeads

- 7.2.6 Crystals

- 7.3 Liquid form

- 7.3.1 Solutions & syrups

- 7.3.2 Softgels

- 7.3.3 Emulsions & suspensions

- 7.3.4 Liposomal formulations

- 7.4 Semi-solid form

- 7.4.1 Lozenges

- 7.4.2 Oral pouches

Chapter 8 Market Size and Forecast, By End Use Industry, 2022-2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceutical industry

- 8.2.1 Clinical nutrition

- 8.2.2 Medical foods

- 8.2.3 Therapeutic supplements

- 8.3 Food & beverage industry

- 8.3.1 Functional food manufacturers

- 8.3.2 Beverage fortification

- 8.4 Sports & fitness industry

- 8.5 Cosmetics & personal care industry

- 8.6 Animal feed industry

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2022-2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 ADM

- 10.3 Ingredion

- 10.4 DSM NV

- 10.5 Cargill Incorporated

- 10.6 Tate & Lyle

- 10.7 Ajinomoto

- 10.8 Prinova Group

- 10.9 Roquette Freres

- 10.10 Arla Food Ingredients

- 10.11 Dupont Nutrition & Biosciences

- 10.12 Divis Laboratories

- 10.13 Barentz

- 10.14 BI Nutraceuticals

- 10.15 Cosucra Groupe Warcoing

- 10.16 Ambe Phytoextracts

- 10.17 Nutraland USA

- 10.18 Nutra Food Ingredients

- 10.19 Aurobindo Pharma

- 10.20 Associated British Foods Plc

- 10.21 Aurea Biolabs

- 10.22 Innophos

- 10.23 AVT Natural Products