PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892747

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892747

Laparoscopic Instruments Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

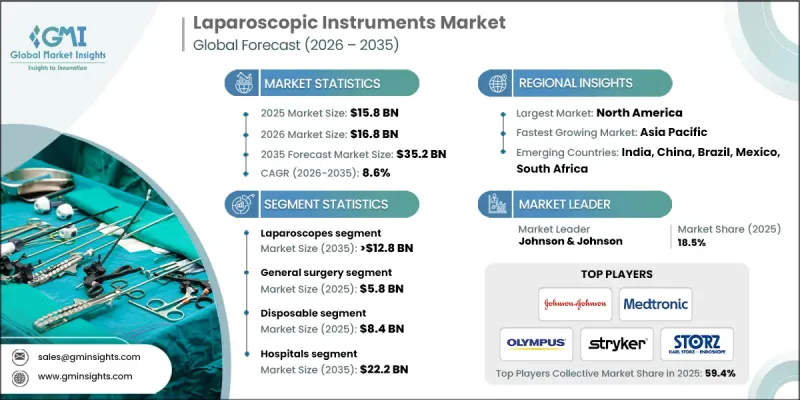

The Global Laparoscopic Instruments Market was valued at USD 15.8 billion in 2025 and is estimated to grow at a CAGR of 8.6% to reach USD 35.2 billion by 2035.

Market growth is fueled by the increasing adoption of minimally invasive surgeries, the rising prevalence of chronic conditions requiring surgical intervention, and ongoing technological advancements in laparoscopic equipment. Laparoscopic instruments are specialized surgical tools designed for procedures conducted through small abdominal incisions, including trocars, graspers, scissors, dissectors, and energy-based devices. These instruments enable precise internal manipulation, enhancing visualization and access while reducing patient trauma, recovery time, and complication risks. Rising cases of obesity, gastrointestinal, urological, and colorectal disorders are driving higher surgical volumes that rely on laparoscopy. Innovations such as articulating instruments, high-definition and 3D/4K visualization systems, energy-based technologies, and wireless cameras are improving surgical accuracy and ergonomics. Additionally, AI-assisted imaging and robotic-assisted laparoscopy are further supporting the adoption of advanced devices in operating rooms worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $15.8 Billion |

| Forecast Value | $35.2 Billion |

| CAGR | 8.6% |

The energy devices segment generated USD 3.4 billion in 2025 and is projected to grow at a CAGR of 8.8% from 2026 to 2035. These instruments are in high demand as surgeons increasingly rely on precise tissue sealing and cutting technologies to improve procedural efficiency. The segment benefits from the growing adoption of advanced ultrasonic and bipolar systems that reduce operation times while enhancing patient safety.

The general surgery segment accounted for USD 5.8 billion in 2025 and is expected to grow at a CAGR of 8.9% through 2035. High procedural volumes in areas such as hernia repair, appendectomy, and cholecystectomy continue to drive recurring demand for laparoscopic instruments. Advancements in visualization technologies, ergonomic designs, and articulating tools make laparoscopic procedures safer and more efficient, prompting hospitals to invest in upgraded equipment.

U.S. Laparoscopic Instruments Market was valued at USD 6.3 billion in 2025. The popularity of minimally invasive procedures in North America is driven by improved patient outcomes, shorter hospital stays, and reduced complications. Hospitals and ambulatory surgical centers with advanced operating rooms are adopting high-end laparoscopic systems, including energy devices, graspers, and visualization tools. Investments in robotic-assisted platforms, integrated operating rooms, and advanced imaging systems continue to propel market growth in the region.

Key players in the Laparoscopic Instruments Market include B. BRAUN, Boston Scientific, Medtronic, KARL STORZ, FUJIFILM, Johnson & Johnson, Intuitive Surgical, Smith & Nephew, CONMED, COOK Medical, OLYMPUS, Richard Wolf, Microline Surgical, Stryker, and VICTOR MEDICAL. Companies in the Laparoscopic Instruments Market are employing multiple strategies to strengthen their position and expand their market presence. They are investing heavily in research and development to create next-generation devices, including AI-enabled and robotic-assisted instruments, to improve surgical outcomes. Strategic partnerships, mergers, and acquisitions allow firms to broaden their product portfolios and expand geographically. Companies are also focusing on advanced visualization systems, energy-based technologies, and ergonomic instrument designs to enhance operational efficiency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 Usage trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of gastrointestinal and gynecological disorders

- 3.2.1.2 Growing preference for minimally invasive surgeries

- 3.2.1.3 Technological advancements in laparoscopic devices

- 3.2.1.4 Expansion of robotic-assisted laparoscopy

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced laparoscopic instruments

- 3.2.2.2 Risk of equipment failure or complications

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption in emerging markets

- 3.2.3.2 Increasing demand for reusable and sustainable instruments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Consumer insights

- 3.8 Future market trends

- 3.9 Value chain analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Laparoscopes

- 5.2.1 Video laparoscopes

- 5.2.2 Fiber laparoscopes

- 5.3 Energy devices

- 5.4 Closure devices

- 5.5 Insufflators

- 5.6 Hand instruments

- 5.7 Access devices

- 5.8 Suction systems

- 5.9 Laparoscopic accessories

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 General surgery

- 6.3 Gynecological surgery

- 6.4 Urological surgery

- 6.5 Bariatric surgery

- 6.6 Colorectal surgery

- 6.7 Pediatric surgery

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By Usage, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Disposable

- 7.3 Reusable

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 B. BRAUN

- 10.2 Boston Scientific

- 10.3 CONMED

- 10.4 COOK Medical

- 10.5 FUJIFILM

- 10.6 Intuitive Surgical

- 10.7 Johnson & Johnson

- 10.8 KARL STORZ

- 10.9 Medtronic

- 10.10 Microline Surgical

- 10.11 OLYMPUS

- 10.12 Richard Wolf

- 10.13 Smith & Nephew

- 10.14 Stryker

- 10.15 VICTOR MEDICAL