PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892756

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892756

Polypropylene Random Copolymer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

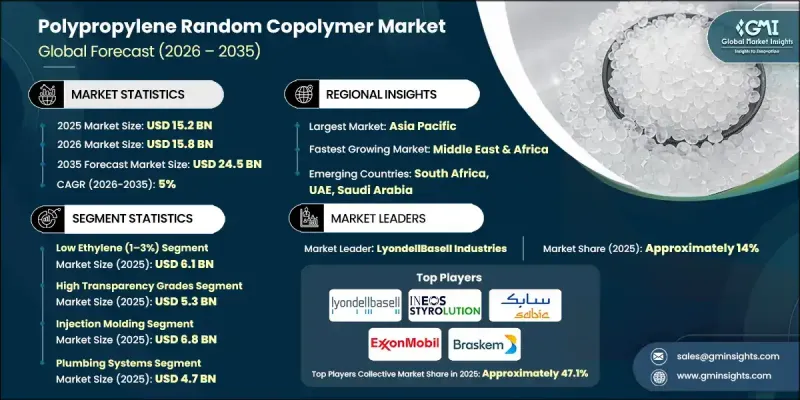

The Global Polypropylene Random Copolymer Market was valued at USD 15.2 billion in 2025 and is estimated to grow at a CAGR of 5% to reach USD 24.5 billion by 2035.

Market expansion is supported by strong growth in global construction activity, driven by accelerating urban development and large-scale infrastructure projects, particularly across Asia-Pacific and Latin America. Polypropylene random copolymer continues to gain preference due to its durability, corrosion resistance, and long service life, making it well-suited for modern building requirements. Its low-maintenance profile further strengthens adoption across long-term construction applications. At the same time, rising demand from the food and consumer packaging sector is supporting market momentum, as the material offers improved clarity, impact strength, and thermal stability. Growing emphasis on product safety and quality has encouraged manufacturers to shift toward versatile polymer solutions. The medical and pharmaceutical industries are also contributing to growth, as polypropylene random copolymer is valued for its chemical resistance, compatibility with sterilization processes, and suitability for precision applications. Together, these end-use industries are creating a stable and diversified demand base that continues to support steady market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $15.2 Billion |

| Forecast Value | $24.5 Billion |

| CAGR | 5% |

The high-transparency grades segment generated USD 5.3 billion in 2025 and is projected to grow at a CAGR of 5.3% from 2026 to 2035. These grades are increasingly adopted in applications where visual clarity and aesthetic quality are critical, while impact-modified variants are expanding their presence in uses requiring enhanced toughness and durability.

The plumbing systems segment accounted for USD 4.7 billion in 2025, representing a 30.7% market share, and is expected to grow at a CAGR of 4.8% through 2035. Sustained demand for long-lasting, corrosion-resistant piping in residential and commercial construction continues to drive adoption, alongside steady usage in medical components that require chemical stability and sterilization compatibility.

North America Polypropylene Random Copolymer Market was valued at USD 2.7 billion in 2025 and is expected to witness attractive growth during the forecast period. Demand in the region is supported by ongoing infrastructure upgrades, increasing adoption in industrial piping, rising use in medical and food-grade applications, and growing focus on recyclable and environmentally responsible materials.

Key companies operating in the Polypropylene Random Copolymer Market include SABIC, LyondellBasell Industries, Braskem S.A., ExxonMobil Chemical, INEOS Styrolution, and other established global producers. Companies in the Polypropylene Random Copolymer Market are strengthening their market position through capacity expansions, product grade differentiation, and investments in advanced polymer technologies. Many players are focusing on developing high-performance and specialty grades to meet evolving requirements in construction, packaging, and medical applications. Strategic partnerships with downstream manufacturers help secure long-term demand and application-specific innovation. Geographic expansion into high-growth regions supports volume growth, while sustainability initiatives, including recyclable and low-impact polymer solutions, enhance brand value.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Ethylene Content

- 2.2.3 Grade

- 2.2.4 Processing Form

- 2.2.5 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Ethylene Content, 2022- 2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Low Ethylene (1-3%)

- 5.3 Medium Ethylene (4-5%)

- 5.4 High Ethylene (6-7%)

Chapter 6 Market Estimates and Forecast, By Grade, 2022 - 2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 High Transparency Grades

- 6.2.1 Food packaging

- 6.2.2 Medical devices

- 6.3 Impact-Modified Grades

- 6.3.1 Plumbing pipes

- 6.3.2 Automotive parts

- 6.4 UV-Stabilized Grades

- 6.4.1 Outdoor piping

- 6.4.2 Agricultural applications

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Processing Form, 2022 - 2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Injection Molding

- 7.3 Extrusion

- 7.4 Blow Molding

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Plumbing Systems

- 8.2.1 Hot water pipes

- 8.2.2 Cold water pipes

- 8.3 Medical Applications

- 8.3.1 Syringes

- 8.3.2 Sterile containers

- 8.4 Food Packaging

- 8.4.1 Transparent containers

- 8.4.2 Caps & closures

- 8.5 Industrial Components

- 8.5.1 Chemical tanks

- 8.5.2 Fittings

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 LyondellBasell Industries

- 10.2 INEOS Styrolution

- 10.3 SABIC

- 10.4 ExxonMobil Chemical

- 10.5 Braskem S.A.

- 10.6 Formosa Plastics Corporation

- 10.7 TotalEnergies

- 10.8 Repsol

- 10.9 Chevron Phillips Chemical

- 10.10 Reliance Industries Limited

- 10.11 Aquatherm GmbH

- 10.12 Wefatherm GmbH

- 10.13 Georg Fischer Piping Systems

- 10.14 Uponor

- 10.15 Astral Poly Technik Ltd.