PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892770

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892770

Cardiac Arrhythmia Monitoring Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

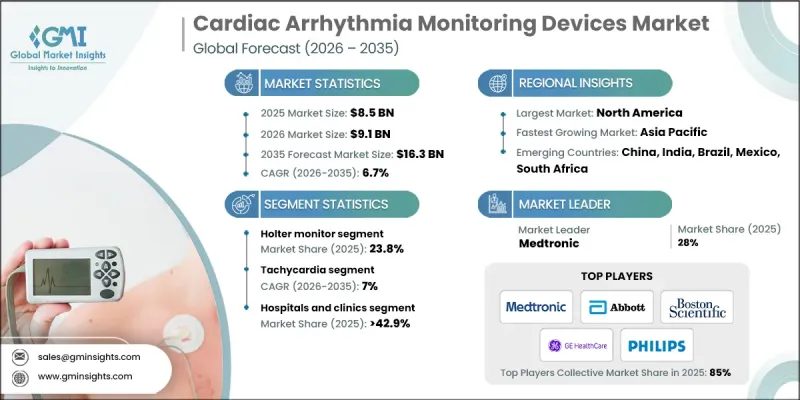

The Global Cardiac Arrhythmia Monitoring Devices Market was valued at USD 8.5 billion in 2025 and is estimated to grow at a CAGR of 6.7% to reach USD 16.3 billion by 2035.

The market is driven by the rising prevalence of cardiovascular disorders and a growing emphasis on early detection and continuous heart rhythm monitoring. With aging populations and the increasing burden of chronic cardiac conditions, these devices have become essential tools for improving patient outcomes and preventing hospitalizations. Cardiac arrhythmia monitoring solutions are reshaping cardiac care by enabling real-time monitoring, timely interventions, and personalized treatment strategies. Integration with mobile apps, cloud platforms, and telehealth systems allows clinicians to manage chronic conditions more effectively. These devices are especially important for patients at higher risk of arrhythmias, providing accurate diagnosis and aiding in treatment decisions, ultimately reducing mortality rates associated with cardiac disorders.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.5 Billion |

| Forecast Value | $16.3 Billion |

| CAGR | 6.7% |

The Holter monitor segment held a 23.8% share in 2025. Holter monitors have long been used for continuous ECG tracking during daily activities, helping clinicians detect arrhythmias that might not appear in standard ECG tests. Innovations such as wireless connectivity, compact designs, and cloud-based data sharing have improved patient convenience and accessibility, driving growth in this segment.

The tachycardia segment is expected to grow at a CAGR of 7% during 2025-2035. This segment includes atrial tachycardia and ventricular tachycardia monitoring devices. Rising adoption of advanced disease monitoring solutions is fueling demand, particularly due to increasing cases of atrial fibrillation and ventricular tachycardia among elderly populations and individuals with lifestyle-related risk factors. Continuous monitoring is critical for preventing complications such as stroke or sudden cardiac arrest.

U.S. Cardiac Arrhythmia Monitoring Devices Market was valued at USD 3 billion in 2025. The country remains one of the most advanced and mature markets, driven by strong healthcare infrastructure, extensive insurance coverage, and a focus on cardiovascular disease management. Leadership in digital health adoption, including telehealth, remote patient monitoring, and integrated care models, has accelerated the use of arrhythmia monitoring devices in clinical and home-care settings.

Key players in the Global Cardiac Arrhythmia Monitoring Devices Market include AliveCor, Biotricity, FUKUDA DENSHI, Boston Scientific, Medtronic, Applied Cardiac Systems, Nihon Kohden, Spacelabs Healthcare, Abbott Laboratories, GE Healthcare, Biotronik, Koninklijke Philips, Baxter International, iRhythm Technologies, and Mindray. Companies are strengthening their Cardiac Arrhythmia Monitoring Devices Market presence by investing in advanced technology integration, such as wireless connectivity, AI-assisted analytics, and cloud-based monitoring solutions. Strategic collaborations with healthcare providers and telehealth platforms expand market reach and ensure device adoption in both hospital and home settings. Continuous R&D for compact, user-friendly, and highly accurate devices enhances competitiveness. Firms are also focusing on regulatory compliance and certification to facilitate global market entry, while digital marketing and patient education campaigns help drive awareness and adoption of arrhythmia monitoring solutions worldwide.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Device trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of cardiovascular diseases and expenditure on cardiac health globally

- 3.2.1.2 Technological advancements and introduction of innovative devices for cardiac rhythm monitoring

- 3.2.1.3 Increasing adoption of mobile and telemetry cardiac monitors

- 3.2.1.4 Expanding geriatric population base coupled with growing prevalence of obesity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled professionals

- 3.2.2.2 High cost of implantable and advanced monitoring devices

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of cardiac monitoring devices with digital health ecosystems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Holter monitor

- 5.3 Event recorder

- 5.4 Mobile cardiac telemetry

- 5.5 Implantable cardiac monitor

- 5.6 Electrocardiogram (ECG) monitor

- 5.7 Other devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tachycardia

- 6.2.1 Atrial tachycardia

- 6.2.2 Ventricular tachycardia

- 6.3 Bradycardia

- 6.4 Premature contraction

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Diagnostic centers

- 7.4 Ambulatory surgical centers

- 7.5 Homecare settings

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AliveCor

- 9.3 Applied Cardiac Systems

- 9.4 Baxter International

- 9.5 Biotronik

- 9.6 Biotricity

- 9.7 Boston Scientific

- 9.8 FUKUDA DENSHI

- 9.9 GE Healthcare

- 9.10 iRhythm Technologies

- 9.11 Koninklijke Philips

- 9.12 Medtronic

- 9.13 Mindray

- 9.14 Nihon Kohden

- 9.15 Spacelabs Healthcare