PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892771

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892771

Perfluoropolyether Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

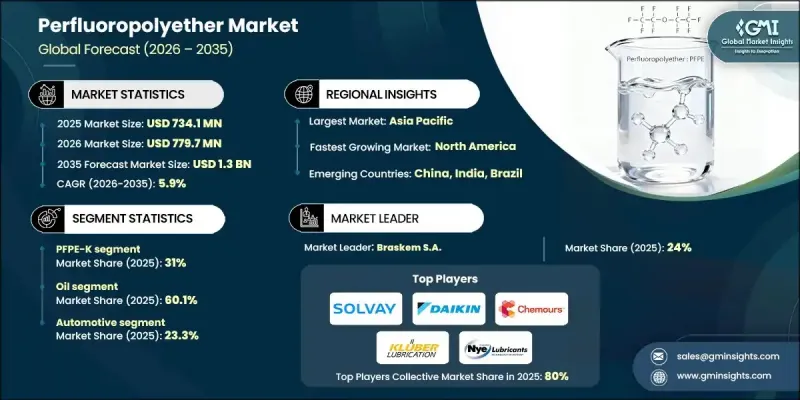

The Global Perfluoropolyether Market was valued at USD 734.1 million in 2025 and is estimated to grow at a CAGR of 5.9% to reach USD 1.3 billion by 2035.

PFPE lubricants are unique in their ability to perform under extreme conditions, including high temperatures, aggressive chemicals, vacuum environments, and ultra-clean manufacturing spaces. This makes them essential across industries such as aerospace, semiconductor fabrication, medical devices, and high-tech electronics, where reliability, low volatility, and long service life are critical. Between 2021 and 2024, PFPE demand closely aligns with advanced manufacturing trends, particularly in semiconductors, portable electronics, and aerospace recovery, reflecting the growing need for clean, high-performance lubricants in these sectors. Increasing automation, expansion of data centers, and investments in semiconductor fabs have further driven the adoption of PFPE in wafer processing tools, vacuum pumps, and precision micro-mechanisms. Additionally, stricter safety, environmental, and performance regulations in food, medical, pharmaceutical, and power-generation sectors are supporting sustained demand for high-purity PFPE formulations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $734.1 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 5.9% |

The PFPE-K segment held a 31% share in 2025 and is expected to grow at a CAGR of 5.1% through 2035. Manufacturers are customizing these grades based on viscosity, volatility, and thermal stability to meet the precise needs of semiconductors, aerospace, electric vehicles, and food-grade applications. Many clients opt to dual-source different PFPE grades from a single supplier to streamline approval processes and reduce qualification delays.

In terms of form, the PFPE oils segment held a 60.1% share in 2025 and is projected to grow at a CAGR of 5.8% from 2026 to 2035. Companies are increasingly offering integrated oil-grease systems designed to optimize temperature resistance, load-carrying capacity, and volatility across entire equipment systems, rather than providing standalone lubricants. These solutions are widely applied in semiconductor machinery, turbines, EV drivetrains, and cleanroom operations.

North America Perfluoropolyether Market accounted for USD 206 million in 2025 and is anticipated to reach USD 367.6 million by 2035, emerging as the fastest-growing regional market. Demand is driven by aerospace, semiconductor, and advanced automotive sectors, alongside stringent reliability standards and growing electric vehicle production, which increasingly favors PFPE over conventional lubricants. The U.S. remains the key PFPE consumer within the region due to its concentration of semiconductor fabs, aerospace OEMs, and advanced medical technology manufacturing, supporting robust demand for high-purity, long-life PFPE solutions.

Leading companies operating in the Global Perfluoropolyether Market include The Chemours Company, Daikin Industries, Inc., Solvay, M&I Materials Limited, LUBRILOG SAS, IKV Tribology, Fluorotech USA, Metalubgroup, Setral Chemie GmbH, Jet-Lube, Kluber Lubrication, Fomblin (Solvay brand), Nye Lubricants, Dow Specialty Fluids, and Halocarbon Products Corporation. Companies in the Global Perfluoropolyether Market are employing multiple strategies to strengthen their market presence and maintain a competitive edge. They are investing in R&D to develop customized PFPE grades that meet specific industrial requirements for viscosity, thermal stability, and low volatility. Strategic partnerships with semiconductor, aerospace, and medical equipment manufacturers help secure long-term supply agreements. Firms are expanding production facilities in high-demand regions to reduce lead times and improve supply chain efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Type

- 2.2.4 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing use in semiconductor and advanced electronics

- 3.2.1.2 Recovery in aerospace and high-performance mobility applications

- 3.2.1.3 Stricter safety, cleanliness and reliability regulations engineering

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and complex fluorochemical production

- 3.2.2.2 Dependence on limited, specialized global supplier base

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of EV, power electronics and renewables infrastructure

- 3.2.3.2 Rising advanced manufacturing investments in Asia Pacific n

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 PFPE-K

- 5.3 PFPE-M

- 5.4 PFPE-Z

- 5.5 PFPE-Y

- 5.6 PFPE-D

Chapter 6 Market Estimates and Forecast, By Type, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Oil

- 6.3 Grease

Chapter 7 Market Estimates and Forecast, By End Use, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.2.1 Engine and powertrain components

- 7.2.2 Electric vehicle drivetrains and e-motors

- 7.2.3 Bearings, seals, and joints

- 7.2.4 Brake systems and actuators

- 7.2.5 Interior mechanisms (switches, sunroof, seat tracks)

- 7.3 Aerospace

- 7.3.1 Airframe and control systems

- 7.3.2 Engine and turbine components

- 7.3.3 Landing gear and actuation systems

- 7.3.4 Avionics, connectors, and sensors

- 7.3.5 Spacecraft and satellite mechanisms

- 7.4 Electronics

- 7.4.1 Connectors and switches

- 7.4.2 Microelectronics and semiconductors

- 7.4.3 Hard disk drives and precision drives

- 7.4.4 Cooling and heat dissipation systems

- 7.4.5 Cleanroom and vacuum applications

- 7.5 Metal Processing

- 7.5.1 Hot and cold rolling equipment

- 7.5.2 Heat treatment furnaces

- 7.6 Power Generation

- 7.6.1 Gas and steam turbines

- 7.6.2 Wind turbine gearboxes and bearings

- 7.6.3 Hydropower equipment

- 7.6.4 Nuclear plant auxiliary equipment

- 7.7 Textile

- 7.7.1 Spinning and twisting equipment

- 7.7.2 Weaving and knitting machines

- 7.7.3 Dyeing and finishing lines

- 7.8 Pulp and Paper

- 7.8.1 Dryers and calendar stacks

- 7.8.2 Press sections and rollers

- 7.8.3 Conveyors and handling systems

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 The Chemours Company

- 9.2 Daikin Industries, Inc.

- 9.3 Solvay

- 9.4 M&I Materials Limited

- 9.5 LUBRILOG SAS

- 9.6 IKV Tribology

- 9.7 Fluorotech USA

- 9.8 Metalubgroup

- 9.9 Setral Chemie GmbH

- 9.10 Jet-Lube

- 9.11 Kluber Lubrication

- 9.12 Fomblin (Solvay brand)

- 9.13 Nye Lubricants

- 9.14 Dow (Specialty Fluids)

- 9.15 Halocarbon Products Corporation