PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892778

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892778

Automated Cell Counter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

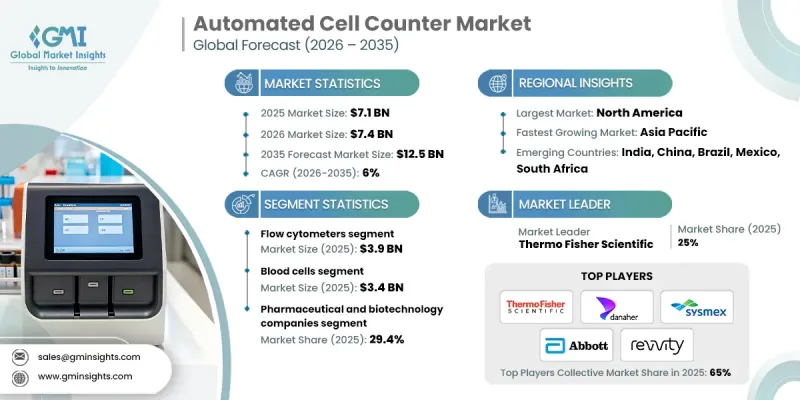

The Global Automated Cell Counter Market was valued at USD 7.1 billion in 2025 and is estimated to grow at a CAGR of 6% to reach USD 12.5 billion by 2035.

Market expansion is driven by the rising incidence of long-term and infectious health conditions, increasing global investment in research activities, and continuous technological progress within automated cell analysis solutions. As healthcare systems emphasize early diagnosis, precision medicine, and large-scale screening initiatives, demand for fast and accurate cell analysis continues to increase. Automated cell counters support high-throughput workflows while minimizing manual variability, which enhances reliability across diagnostic, clinical, and research environments. Growing emphasis on efficiency, reproducibility, and data accuracy is reinforcing their adoption across laboratories worldwide. These systems are becoming integral to modern healthcare and life science research due to their ability to deliver consistent results at scale, supporting both routine testing and advanced scientific studies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7.1 Billion |

| Forecast Value | $12.5 Billion |

| CAGR | 6% |

The flow cytometry segment generated USD 3.9 billion in 2025 and accounted for 55% share. Flow cytometry technology enables rapid analysis of large cell populations by evaluating multiple cellular characteristics simultaneously. Its high-speed processing and multi-parameter assessment capabilities make it a core tool in advanced cell measurement applications across clinical diagnostics and research laboratories.

The blood cell analysis segment was valued at USD 3.4 billion in 2025. Blood cell measurement remains one of the most frequently performed diagnostic procedures, supporting disease detection, treatment monitoring, and clinical research. Automated systems improve accuracy and turnaround time while reducing operational burden across healthcare facilities.

The pharmaceutical and biotechnology companies held a 29.4% share in 2024. These organizations rely on automated cell counters to support drug development, biologics manufacturing, and quality assurance processes. Increasing focus on biologics and individualized therapies continues to elevate demand for precise and scalable cell counting technologies.

North America Automated Cell Counter Market held a 38% share in 2024. Strong healthcare infrastructure, advanced laboratory capabilities, and growing demand for accurate diagnostic tools support sustained adoption across the region. Emphasis on efficiency and data-driven care continues to accelerate the use of automated solutions.

Key companies active in the Global Automated Cell Counter Market include Thermo Fisher Scientific, Sysmex Corporation, Abbott Laboratories, Bio-Rad Laboratories, Danaher, Merck KGaA, Agilent Technologies, PerkinElmer, F. Hoffmann-La Roche Ltd, NanoEnTek, ChemoMetec A/S, Logos Biosystems, Nexcelom Bioscience (Revvity), DeNovix, and Curiosis. Companies in the Global Automated Cell Counter Market implement strategic initiatives to strengthen their competitive position. Continuous investment in research and product innovation enables the development of faster, more accurate, and user-friendly systems. Firms expand their portfolios to address diverse application needs across diagnostics, research, and bioprocessing. Strategic partnerships and acquisitions help broaden geographic presence and technical capabilities. Companies also focus on automation, software integration, and data analytics to enhance system value.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic and infectious diseases

- 3.2.1.2 Increasing research and development expenditure worldwide

- 3.2.1.3 Technological advancements in automated cell counter industry

- 3.2.1.4 Expansion of stem cell and regenerative medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of automated cell counter devices

- 3.2.2.2 Lack of skilled workforce

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in cell therapy manufacturing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Flow cytometers

- 5.3 Fluorescence image-based cell counter

- 5.4 Coulter counter

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Blood cells

- 6.3 Cell lines

- 6.4 Microbial cells

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Pharmaceutical & biotechnology companies

- 7.3 Hospitals

- 7.4 Diagnostic laboratories

- 7.5 Research institutes

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Thermo Fisher Scientific

- 9.2 PerkinElmer

- 9.3 Bio-Rad Laboratories

- 9.4 Abbott Laboratories

- 9.5 Sysmex Corporation

- 9.6 NanoEnTek

- 9.7 F. Hoffmann-La Roche Ltd

- 9.8 Danaher (Beckman Coulter Inc. and Radiometer)

- 9.9 Agilent Technologies

- 9.10 Merck KGaA

- 9.11 ChemoMetec A/S

- 9.12 Logos Biosystems

- 9.13 Nexcelom Bioscience (Revvity)

- 9.14 DeNovix

- 9.15 Curiosis