PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892780

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892780

Anti-Money Laundering Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

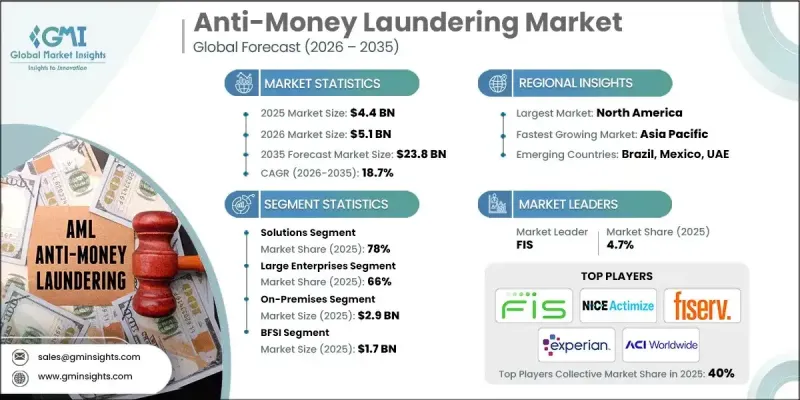

The Global Anti-Money Laundering Market was valued at USD 4.4 billion in 2025 and is estimated to grow at a CAGR of 18.7% to reach USD 23.8 billion by 2035.

This growth is fueled by stricter regulatory enforcement, increasing financial fraud incidents, and the rising complexity of transactions across banks, fintech platforms, and other financial sectors. As financial institutions prioritize faster transaction monitoring, improved customer due diligence, and robust compliance frameworks, advanced AML solutions are becoming indispensable for detecting and preventing illicit financial activities. Technological innovations such as AI- and ML-driven monitoring, real-time risk scoring, biometric authentication, blockchain-based KYC verification, and cloud-enabled compliance platforms are transforming traditional AML operations. These solutions provide end-to-end visibility into financial flows, reduce fraud risks, enhance regulatory reporting accuracy, and streamline compliance processes. The expansion of digital banking, mobile payment services, and cross-border transactions further accelerates demand for intelligent, scalable, and automated AML solutions. Activities such as sanction screening, risk assessment, real-time transaction monitoring, suspicious activity reporting, and customer onboarding have become critical for maintaining operational integrity in financial institutions worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.4 Billion |

| Forecast Value | $23.8 Billion |

| CAGR | 18.7% |

The solutions segment held a 78% share in 2025 and is expected to grow at a CAGR of 18.3% from 2026 to 2035. This dominance is driven by widespread adoption of technology-enabled platforms for transaction monitoring, fraud detection, automated KYC processes, and cloud-based compliance reporting. These solutions provide scalability, operational efficiency, and enhanced accuracy in preventing financial crimes, making them central to AML operations.

The large enterprises segment accounted for a 66% share in 2025 and is anticipated to grow at a CAGR of 17.9% between 2026 and 2035. The segment's growth is fueled by the complexity, high volume, and international regulatory obligations of major financial institutions. Large enterprises rely on comprehensive AML platforms to monitor high-frequency transactions, cross-border payments, and multiple accounts, ensuring adherence to global compliance standards and mitigating financial crime risks.

North America Anti-Money Laundering Market generated USD 1.5 billion in 2025. The dominance of North America stems from a mature financial ecosystem, robust banking and fintech infrastructure, advanced adoption of AI- and ML-based monitoring platforms, and stringent regulatory oversight. These factors position the region as a global leader in AML solutions and services.

Leading companies in the Anti-Money Laundering Market include Experian, Oracle, Fiserv, LexisNexis Risk Solutions, Actimize (NICE), ACI Worldwide, OpenText, FIS, Napier Technologies, and Nelito Systems. To strengthen Anti-Money Laundering Market presence, companies focus on continuous innovation in AI- and ML-powered platforms, cloud-based solutions, and blockchain-integrated KYC systems. Strategic partnerships with banks, fintech firms, and regulatory bodies help expand market reach. Firms also invest in upgrading compliance frameworks and providing training programs to enhance client adoption. Additionally, geographic expansion, real-time analytics integration, and development of scalable, modular AML platforms ensure operational efficiency, reduce fraud risks, and secure long-term competitiveness in a rapidly evolving regulatory environment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Model

- 2.2.4 Enterprise Size

- 2.2.5 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Regulatory Enforcement

- 3.2.1.2 Rising Financial Fraud & Money Laundering Activities

- 3.2.1.3 Technological Advancements

- 3.2.1.4 Digital Banking & Fintech Expansion

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Implementation Costs

- 3.2.2.2 False Positives & Operational Complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI & Automation

- 3.2.3.2 Expansion into Emerging Markets

- 3.2.3.3 Regulatory Compliance and Reporting

- 3.2.3.4 Digital Identity Verification and KYC Services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 FinCEN (U.S.)

- 3.4.1.2 SEC & OCC Regulations (U.S.)

- 3.4.1.3 OSFI & FINTRAC (Canada)

- 3.4.2 Europe

- 3.4.2.1 Germany BaFin AML Regulations

- 3.4.2.2 France ACPR AML Standards

- 3.4.2.3 United Kingdom FCA & PRA AML Rules

- 3.4.2.4 Bank of Italy AML Compliance

- 3.4.3 Asia Pacific

- 3.4.3.1 China PBOC & CBIRC AML Guidelines

- 3.4.3.2 Japan FSA AML Standards

- 3.4.3.3 South Korea FSC & FIU Compliance

- 3.4.3.4 India RBI & FIU-IND AML Regulations

- 3.4.4 Latin America

- 3.4.4.1 Brazil COAF & BACEN AML Guidelines

- 3.4.4.2 Mexico UIF AML Regulations

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE Central Bank AML Guidelines

- 3.4.5.2 Saudi Arabia SAMA AML Regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

- 3.13 Investment & Funding Analysis

- 3.13.1 Venture Capital Funding in AML Tech

- 3.13.2 M&A Activity & Strategic Investments

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Transaction Monitoring

- 5.2.2 Advanced Analytics & AI Solutions

- 5.2.3 Compliance Regulatory Reporting

- 5.2.4 Customer Screening & Watchlist Filtering

- 5.2.5 Case Management & Investigation

- 5.3 Services

- 5.3.1 Professional service

- 5.3.2 Managed service

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 On-Premises

- 6.3 Cloud / SaaS

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 Large Enterprises

- 7.3 SMEs

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 IT & Telecom

- 8.4 Government & Public Sector

- 8.5 Healthcare

- 8.6 Retail

- 8.7 Transportation & Logistics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 ACI Worldwide

- 10.1.2 BAE Systems

- 10.1.3 Fair Isaac

- 10.1.4 FIS

- 10.1.5 Fiserv

- 10.1.6 LSEG (Refinitiv World-Check)

- 10.1.7 NICE Actimize

- 10.1.8 Oracle

- 10.1.9 SAS Institute

- 10.1.10 Temenos

- 10.2 Regional Player

- 10.2.1 Accenture

- 10.2.2 Chainalysis

- 10.2.3 Cognizant Technology Solutions

- 10.2.4 ComplyAdvantage

- 10.2.5 Elliptic

- 10.2.6 Experian

- 10.2.7 LexisNexis Risk Solutions

- 10.2.8 OpenText

- 10.2.9 Tata Consultancy Services (TCS)

- 10.2.10 Wolters Kluwer

- 10.2.11 Nelito Systems

- 10.3 Emerging Players

- 10.3.1 Flagright

- 10.3.2 Hawk AI

- 10.3.3 Lucinity

- 10.3.4 Napier AI

- 10.3.5 Quantexa