PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892785

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892785

Additive Manufacturing With Metal Powders Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

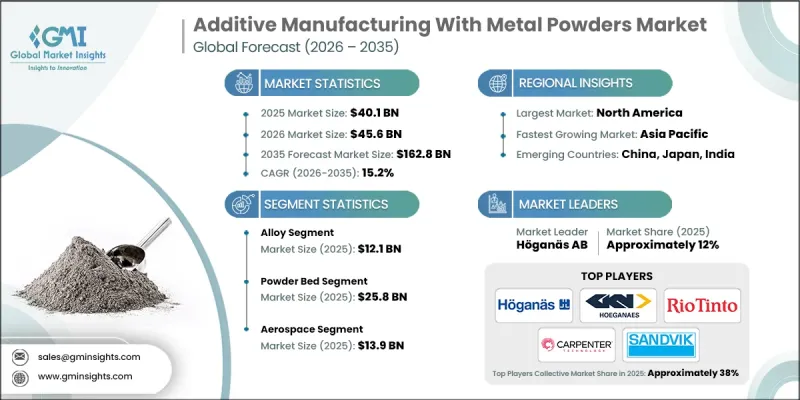

The Global Additive Manufacturing With Metal Powders Market was valued at USD 40.1 billion in 2025 and is estimated to grow at a CAGR of 15.2% to reach USD 162.8 billion by 2035.

The market is expanding rapidly as industries increasingly demand lightweight, high-strength components to enhance performance and fuel efficiency. Aerospace, automotive, and defense sectors are transitioning to metal additive manufacturing to achieve complex geometries and weight reduction without compromising durability. Advances in 3D printing technologies, including laser systems, electron-beam methods, and multi-laser setups, are accelerating build speed and improving precision. Wider adoption of powder-bed fusion processes has enhanced process reliability, shortened production cycles, and improved surface finishes, driving the commercialization of metal AM solutions. Additionally, the medical and dental sectors are fueling growth by adopting metal additive manufacturing for customized implants, prosthetics, and surgical instruments, creating a surge in demand for patient-specific and high-precision applications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $40.1 Billion |

| Forecast Value | $162.8 Billion |

| CAGR | 15.2% |

The alloy segment generated USD 12.1 billion in 2025 and is expected to grow at a CAGR of 15.5% through 2035. Alloys, including stainless steel, are widely used due to their corrosion resistance, mechanical strength, and suitability for complex geometries. Their broad adoption across aerospace, automotive, medical, and industrial equipment sectors is creating sustainable demand. Other types of steel provide cost-effective solutions for structural and tooling applications, allowing manufacturers to scale both prototyping and functional production efficiently.

The aerospace segment accounted for USD 13.9 billion in 2025, holding a 34.7% share, and is anticipated to grow at a CAGR of 14.9% during 2026-2035. Aerospace, automotive, and medical industries are driving demand for high-performance, lightweight, and precision components. Aerospace companies require advanced structural and engine parts, while automotive manufacturers use metal AM for tooling, prototyping, and limited-volume high-performance components. Medical applications are expanding rapidly as patient-specific implants and surgical tools gain traction. The convergence of these industries is reinforcing the trend toward high-precision metal additive manufacturing.

North America Additive Manufacturing With Metal Powders Market held USD 13.8 billion in 2025. Adoption of metal AM is rising across aerospace, defense, and medical sectors for lightweight, precise parts. Advanced digital manufacturing, well-established infrastructure, and ongoing R&D investments support commercialization. Growing use in prototyping, tooling, and specialty parts, along with hybrid and automated processes, is driving regional market expansion.

Key players in the Global Additive Manufacturing With Metal Powders Market include Hoganas AB, GKN Powder Metallurgy (Hoeganaes), Rio Tinto, Carpenter Technology Corporation, Sandvik Additive Manufacturing, and others. Companies in the Global Additive Manufacturing With Metal Powders Market are leveraging multiple strategies to strengthen their market presence. They are investing heavily in research and development to enhance printing speed, accuracy, and material compatibility. Strategic collaborations, joint ventures, and acquisitions are expanding product portfolios and geographic reach. Companies are introducing new alloy compositions and customizing solutions for aerospace, automotive, and medical applications. Adoption of digital and hybrid manufacturing systems, alongside automated post-processing and quality control solutions, helps streamline production and reduce costs. Additionally, firms are emphasizing customer training, technical support, and service networks to improve adoption rates, establish long-term partnerships, and maintain competitive advantage in a rapidly evolving industry.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material

- 2.2.3 Manufacturing Technique

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material, 2022- 2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Alloy

- 5.2.1 Titanium

- 5.2.1.1 Ti6Al4V

- 5.2.1.2 Ti6Al4V (ELI)

- 5.2.1.3 Others

- 5.2.2 Cobalt

- 5.2.2.1 CoCr

- 5.2.2.2 CoCrWC

- 5.2.2.3 CoCrMo

- 5.2.3 Copper

- 5.2.3.1 C18150

- 5.2.3.2 CuCr1Zr

- 5.2.3.3 CuNi2SiCr

- 5.2.4 Nickel

- 5.2.4.1 Inconel 625

- 5.2.4.2 Inconel 718

- 5.2.4.3 Hastelloy X

- 5.2.5 Aluminium

- 5.2.5.1 ALSi12

- 5.2.5.2 ALSi7Mg

- 5.2.5.3 ALSi10Mg

- 5.2.5.4 AL6061

- 5.2.5.5 Others

- 5.2.1 Titanium

- 5.3 Stainless Steel

- 5.3.1 Austenitic Steel

- 5.3.2 Martensitic Steel

- 5.3.3 Duplex steel

- 5.3.4 Ferritic Steel

- 5.4 Other Steel

- 5.4.1 High Speed Steel

- 5.4.2 Tool Steel

- 5.4.3 Low Alloy Steel

- 5.5 Precious Metal

- 5.5.1 Platinum

- 5.5.2 Other precious metal

- 5.6 Tungsten

- 5.7 Other materials

- 5.7.1 Silicon carbide

- 5.7.2 Aluminium oxide powder

- 5.7.3 Zirconium

- 5.7.4 Zirconium dioxide

- 5.7.5 Molybdenum

- 5.7.6 Magnesium

- 5.7.7 Aluminium nitride

- 5.7.8 Tungsten carbide

Chapter 6 Market Estimates and Forecast, By Manufacturing Technique, 2022 - 2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Powder Bed

- 6.2.1 Direct Metal Laser Sintering (DMLS)

- 6.2.2 Selective Laser Melting (SLM)

- 6.2.3 Electron Beam Melting (EBM)

- 6.3 Blown powder

- 6.3.1 Direct Metal Deposition (DMD)

- 6.3.2 Laser Engineering Net Shapes (LENS)

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Aerospace

- 7.3 Automotive

- 7.4 Medical

- 7.5 Oil & Gas

- 7.6 Energy

- 7.6.1 Nuclear

- 7.6.2 Renewable

- 7.7 Other

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Hoganas AB

- 9.2 GKN Powder Metallurgy (Hoeganaes)

- 9.3 Rio Tinto

- 9.4 Carpenter Technology Corporation

- 9.5 Sandvik Additive Manufacturing

- 9.6 LPW Technology

- 9.7 AP&C (Advanced Powders & Coatings)

- 9.8 Arcam AB

- 9.9 EOS GmbH

- 9.10 Bright Laser Technologies

- 9.11 Huake 3D

- 9.12 ReaLizer