PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892786

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892786

Open-Source Intelligence (OSINT) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

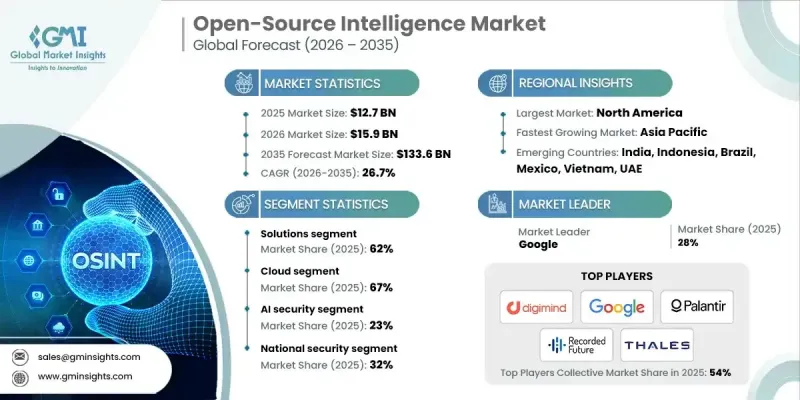

The Global Open-Source Intelligence (OSINT) Market was valued at USD 12.7 billion in 2025 and is estimated to grow at a CAGR of 26.7% to reach USD 133.6 billion by 2035.

The rising frequency and complexity of cyber threats, including ransomware, fraud, and data breaches, are driving organizations to adopt OSINT solutions for real-time threat detection and risk mitigation. The spike in cyber-attacks across enterprise networks in 2024 prompted significant adoption of OSINT platforms to enhance threat intelligence and provide early warning systems. Businesses are leveraging the increasing volume of publicly available data from social media, blogs, news portals, IoT devices, and web forums to gain actionable insights. Technological advancements in artificial intelligence, machine learning, natural language processing, and big data analytics have automated data collection, improved predictive threat detection, and strengthened analysis. Some OSINT platforms now integrate AI-driven business intelligence solutions, allowing both commercial organizations and government agencies to rapidly access accurate data, intelligence, and actionable insights for decision-making and security operations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $12.7 Billion |

| Forecast Value | $133.6 Billion |

| CAGR | 26.7% |

The solutions segment held a 62% share, generating USD 7.92 billion in 2025. This segment includes software platforms, data collection tools, analytical applications, and fully integrated intelligence suites that facilitate end-to-end OSINT operations, covering data acquisition, analysis, monitoring, and dissemination. Innovations such as cloud-based architectures and API-first integration for mobile access are expected to continue fueling growth.

The cloud deployment segment accounted for a 67% share in 2025 and is projected to grow at a CAGR of 27.3% through 2035. Cloud-based OSINT platforms offer subscription pricing, elastic scalability, rapid deployment, continuous updates, and multi-tenant efficiency. These advantages allow distributed teams worldwide to access advanced intelligence tools without maintaining on-premises infrastructure. Public cloud adoption also enables mid-sized organizations to implement OSINT solutions, promote collaboration, and integrate seamlessly with other cloud services within comprehensive security operations.

U.S. Open-Source Intelligence (OSINT) Market reached USD 3.06 billion in 2025. The market's maturity is supported by federal government spending, robust defense budgets, large corporations in the finance and technology sectors, and a well-established vendor ecosystem. Federal agencies and commercial security teams heavily rely on scalable threat intelligence platforms, link analysis, and dark web monitoring to strengthen security posture and operational efficiency.

Key players in the Global Open-Source Intelligence (OSINT) Market include Google, Palantir Technologies, Digimind (Onclusive), Cellebrite, Babelstreet, Maltego Technologies, Recorded Future, Thales, NICE, Sail Labs (Hensoldt), and CybelAngel. Companies in the Global Open-Source Intelligence (OSINT) Market are strengthening their foothold by investing in AI and ML-driven analytics, cloud-enabled deployment, and mobile-friendly solutions. Strategic partnerships with government agencies and enterprises help expand adoption and credibility. Firms are also focusing on API-first integrations to ensure interoperability with existing security infrastructures, while enhancing platform scalability and user experience. Regular updates, threat intelligence enrichment, and tailored industry solutions further differentiate offerings, allowing vendors to capture emerging opportunities in both commercial and public sector segments while maintaining long-term market leadership.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment mode

- 2.2.4 Security

- 2.2.5 Application

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising cyber threats & security concerns

- 3.2.1.2 Growing digital footprint & data availability

- 3.2.1.3 Regulatory compliance & risk management

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy & regulatory restrictions

- 3.2.2.2 Complexity & skilled resource requirement

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets & SMEs

- 3.2.3.2 Expansion into non-traditional sectors

- 3.2.3.3 Advanced analytics services

- 3.2.3.4 Integration with security ecosystems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 CISA (Cybersecurity & Infrastructure Security Agency)

- 3.4.1.2 Personal Information Protection and Electronic Documents Act (PIPEDA)

- 3.4.2 Europe

- 3.4.2.1 BDSG (Federal Data Protection Act)

- 3.4.2.2 Privacy Code (Codice in materia di protezione dei dati personali)

- 3.4.2.3 National Cybersecurity Agency (ANSSI) directives

- 3.4.2.4 Data Protection Act 2018

- 3.4.3 Asia Pacific

- 3.4.3.1 PIPL (Personal Information Protection Law)

- 3.4.3.2 Digital Personal Data Protection Act 2023

- 3.4.3.3 PIPA (Personal Information Protection Act)

- 3.4.3.4 Telecommunications (Interception and Access) Act 1979

- 3.4.4 Latin America

- 3.4.4.1 LGPD (Lei Geral de Protecao de Dados)

- 3.4.4.2 National Directorate for Personal Data Protection regulations

- 3.4.4.3 Federal Law on the Protection of Personal Data Held by Private Parties

- 3.4.5 Middle East & Africa

- 3.4.5.1 PDPL (Personal Data Protection Law)

- 3.4.5.2 Anti-Cyber Crime Law

- 3.4.5.3 Electronic Communications and Transactions Act

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing analysis

- 3.8.1 By product

- 3.8.2 By region

- 3.9 Cost breakdown analysis

- 3.9.1 Vendor cost structure

- 3.9.2 Implementation of cost components

- 3.9.3 Ongoing operational costs

- 3.9.4 Indirect customer costs

- 3.10 Patent analysis

- 3.11 Case studies

- 3.11.1 Government cyber agency

- 3.11.2 Global bank fraud detection & compliance monitoring

- 3.11.3 Retail & consumer brand reputation and counterfeit product tracking

- 3.11.4 Telecom company geopolitical & infrastructure intelligence

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future outlook and opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Mn)

- 5.1 Key trends

- 5.2 Solutions/Platforms

- 5.2.1 OSINT analytics platforms

- 5.2.2 Social media intelligence tools

- 5.2.3 Geospatial tools

- 5.2.4 Text-mining engines

- 5.3 Services

- 5.3.1 Professional services

- 5.3.1.1 Consulting

- 5.3.1.2 Deployment & integration

- 5.3.1.3 Support & maintenance

- 5.3.2 Managed services

- 5.3.1 Professional services

Chapter 6 Market Estimates & Forecast, By Security, 2022 - 2035 ($Mn)

- 6.1 Key trends

- 6.2 Human intelligence

- 6.3 Content intelligence

- 6.4 Big data security

- 6.5 AI security

- 6.6 Data analytics

- 6.7 Dark web analysis

- 6.8 Link/network analysis

Chapter 7 Market Estimates & Forecast, By Deployment mode, 2022 - 2035 ($Mn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 On-premises

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Mn)

- 8.1 Key trends

- 8.2 National security

- 8.3 Military & defense

- 8.4 Private sector

- 8.5 Public sector

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.3.8 Poland

- 9.3.9 Romania

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Vietnam

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 Accenture

- 10.1.2 Babel Street

- 10.1.3 Cellebrite

- 10.1.4 Google

- 10.1.5 IBM

- 10.1.6 Maltego Technologies

- 10.1.7 Microsoft

- 10.1.8 NICE

- 10.1.9 Palantir Technologies

- 10.1.10 Recorded Future

- 10.1.11 SAIL Labs

- 10.1.12 Thales

- 10.2 Regional players

- 10.2.1 BAE Systems Applied Intelligence

- 10.2.2 Ciqurix Intelligence

- 10.2.3 CybelAngel

- 10.2.4 DarkOwl

- 10.2.5 Digimind (Onclusive)

- 10.2.6 OpenText

- 10.2.7 Social Links

- 10.2.8 ThreatQuotient

- 10.2.9 Verint Systems

- 10.2.10 ZeroFox

- 10.3 Emerging players

- 10.3.1 Dataminr

- 10.3.2 Fivecast

- 10.3.3 Hetz

- 10.3.4 Hypersight

- 10.3.5 Kharon

- 10.3.6 Skopenow