PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892790

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892790

Separation Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

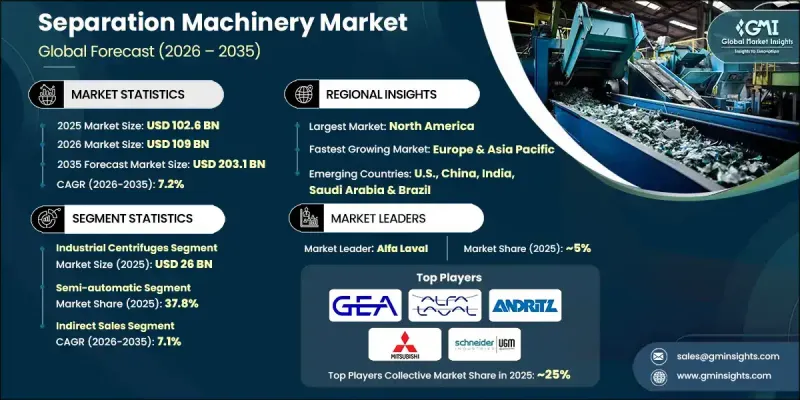

The Global Separation Machinery Market was valued at USD 102.6 billion in 2025 and is estimated to grow at a CAGR of 7.2% to reach USD 203.1 billion by 2035.

The market growth is driven by expanding industrial activity across sectors such as pharmaceuticals, chemicals, food and beverage, oil and gas, and mining. As industries scale up, there is an increasing demand for more efficient separation processes that improve product quality, enable resource recovery, and meet stringent environmental regulations. Rapid industrialization in the Asia Pacific, Latin America, and Africa is fueling investments in advanced machinery such as centrifuges, filters, and membranes. Technological innovations, including smart sensors, AI-driven process optimization, and next-generation membrane filtration, are enhancing operational efficiency, reducing energy consumption, and improving reliability. Modular equipment designs and digital monitoring systems supporting predictive maintenance are aligning with Industry 4.0 standards. Sustainability initiatives and rising urbanization are opening new opportunities for manufacturers in emerging markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $102.6 Billion |

| Forecast Value | $203.1 Billion |

| CAGR | 7.2% |

The industrial centrifuges segment accounted for USD 26 billion in 2025 and is expected to grow at a CAGR of 7.7% from 2026 to 2035. These systems are essential in separating solids from liquids across multiple industries due to their precision, high capacity, and superior performance. The rising demand for high-purity outputs in pharmaceuticals and biotechnology, along with stricter environmental regulations on wastewater management and recycling, is driving widespread adoption of advanced centrifuge technologies.

The indirect sales channel held a 61.9% share in 2025 and is projected to grow at a CAGR of 7.1% through 2035. Indirect channels provide bundled solutions, financing options, and robust regional networks, making it easier for small and medium-sized enterprises to acquire equipment. These distributors and channel partners act as strategic allies, offering integrated services and facilitating faster market penetration while ensuring responsiveness to customer requirements.

U.S. Separation Machinery Market generated USD 21.1 billion in 2025 and is forecasted to grow at a CAGR of 7.9% from 2026 to 2035. Rapid industrialization across pharmaceuticals, chemicals, food and beverage, oil and gas, and water treatment drives demand for advanced separation systems. Government initiatives focused on sustainability, decarbonization, and regulatory mandates on zero liquid discharge (ZLD), PFAS removal, and wastewater recycling have accelerated the adoption of energy-efficient and environmentally friendly separation technologies.

Key players in the Global Separation Machinery Market include Alfa Laval, Parkson Corporation, ANDRITZ, Rotex, CECO Environmental, Mitsubishi Kakoki Kaisha, SWECO, ACS Manufacturing, Gruppo Pieralisi, Hiller Separation & Process, Industriefabrik Schneider, Ferrum, Russell Finex, and Forsbergs. Companies are reinforcing their Separation Machinery Market presence by investing in R&D for energy-efficient, high-capacity, and technologically advanced equipment. Strategic partnerships with distributors and channel partners help expand reach in emerging markets. Firms are adopting modular designs and digital systems for faster deployment and predictive maintenance capabilities. Sustainability-focused production processes, compliance with environmental regulations, and product customization enhance competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Technology

- 2.2.4 Operation mode

- 2.2.5 Speed

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid industrialization across various sectors

- 3.2.1.2 Innovations in separation technologies

- 3.2.1.3 Growing demand in emerging markets

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Increasingly stringent environmental regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Industrial centrifuges

- 5.3 Magnetic separators

- 5.4 Membrane separators

- 5.5 Stage separators

- 5.6 Industrial strainers & sieves

- 5.7 Evaporators

- 5.8 Others (distillation columns, scrubbers)

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Mechanical separation

- 6.3 Membrane separation

- 6.4 Electrostatic separation

Chapter 7 Market Estimates & Forecast, By Operation Mode, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Semi-automatic

- 7.4 Manual

Chapter 8 Market Estimates & Forecast, By Speed, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low (Below 1000 RPM)

- 8.3 Medium (1000 - 5000 RPM)

- 8.4 High (5000 - 15000 RPM)

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Life sciences

- 9.3 Water & wastewater

- 9.4 Transportation

- 9.5 HVAC & environmental

- 9.6 Industrial processing

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 ACS Manufacturing

- 12.2 Alfa Laval

- 12.3 ANDRITZ

- 12.4 CECO Environmental

- 12.5 Ferrum

- 12.6 Forsbergs

- 12.7 GEA Group

- 12.8 Gruppo Pieralisi

- 12.9 Hiller Separation & Process

- 12.10 Industriefabrik Schneider

- 12.11 Mitsubishi Kakoki Kaisha

- 12.12 Parkson Corporation

- 12.13 Rotex

- 12.14 Russell Finex

- 12.15 SWECO