PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892793

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892793

Automotive Micro Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

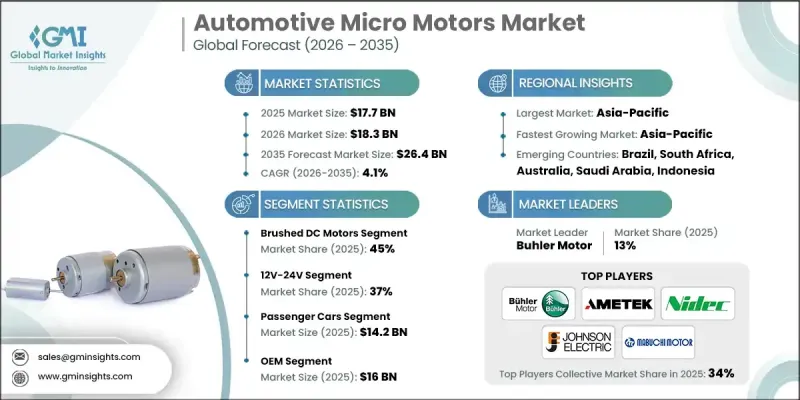

The Global Automotive Micro Motors Market was valued at USD 17.7 billion in 2025 and is estimated to grow at a CAGR of 4.1% to reach USD 26.4 billion by 2035.

Advancements in motor technology, changing production methods, and evolving industry requirements are reshaping the way micro motors are designed and manufactured. The shift from brushed DC motors to brushless DC (BLDC) motors represents a major technological transition, driven by the improved efficiency, longer lifespan, and reduced maintenance needs of BLDC systems. As semiconductor costs decline and large-scale production increases, BLDC motors are becoming more cost-effective for automotive applications. Expanding manufacturing capacity across global motor producers is further enhancing availability and lowering overall production expenses, supporting broader adoption of advanced motor technologies throughout the automotive sector.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $17.7 Billion |

| Forecast Value | $26.4 Billion |

| CAGR | 4.1% |

Multiple leading BLDC motor manufacturers, including NIDEC, Johnson Electric, and Buhler Motor, have increased their production capabilities to meet rising demand from automakers. This includes the establishment of additional facilities dedicated to supplying micro motors for automotive applications, reinforcing the industry's transition toward newer motor technologies.

The brushed DC motors segment accounted for a 45% share in 2025 and is forecasted to grow at a CAGR of 3.2% from 2026 to 2035. These motors remain widely used in various vehicle components, including window systems, mirror positioning, and seating mechanisms, especially within cost-sensitive vehicle categories. However, their mechanical commutation creates inherent performance limitations.

The 12V-24V motor category held a 37% share in 2025 and is projected to grow at a CAGR of 3.5% through 2035. This voltage range remains the most common for automotive micro motor applications, supporting functions such as power windows, seat adjustments, sunroofs, and basic blower systems. The standard operating voltages for these motors continue to be 12V and 24V.

China Automotive Micro Motors Market generated USD 4.6 billion in 2025. The region benefits from its position as the world's largest vehicle manufacturing hub, coupled with population growth, increasing vehicle ownership, and supportive policies designed to accelerate automotive electrification. These factors drive strong demand for micro motors across various vehicle systems.

Companies active in the Global Automotive Micro Motors Market include AMETEK, Mabuchi Motor, Johnson Electric, Maxon Motors, NIDEC, Buhler Motor, and Mitsuba. Companies in the Automotive Micro Motors Market are reinforcing their competitive position through strategic manufacturing expansion, technology enhancements, and diversified product offerings. Many manufacturers are scaling production facilities to meet rising demand from global automotive OEMs, while also investing in automation to improve quality and reduce cost. Emphasis on BLDC motor development allows companies to align with industry trends favoring higher efficiency and longer-lasting components. Firms are also leveraging partnerships with automotive suppliers to integrate their motors into a broader range of vehicle functions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast

- 1.4 Primary research and validation

- 1.5 Some of the primary sources

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

- 1.7 Inclusion & Exclusion

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Motor

- 2.2.3 Power Consumption

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component manufacturers

- 3.1.1.2 Motor manufacturers & integrators

- 3.1.1.3 OEMs & vehicle manufacturers

- 3.1.1.4 Aftermarket distribution channels

- 3.1.1.5 End use & service networks

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Vertical integration trends

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising vehicle electrification & powertrain shift

- 3.2.1.2 Proliferation of comfort & convenience features

- 3.2.1.3 Integration of advanced safety & ADAS

- 3.2.1.4 Stringent emission & fuel economy regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Shift from Brushed DC to Brushless DC (BLDC) Motors

- 3.2.2.2 Modularization & system integration

- 3.2.3 Market opportunities

- 3.2.3.1 AI & predictive navigation

- 3.2.3.2 Smartphone & app projection systems

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Brushed vs brushless DC motor technologies

- 3.3.1.2 Servo & Stepper motor advancements

- 3.3.1.3 Linear Actuator integration trends

- 3.3.1.4 Magnet-free & rare-earth-free motor development

- 3.3.2 Emerging technologies

- 3.3.2.1 Digital twin architecture & implementation

- 3.3.2.2 Cloud vs Edge processing trade-offs

- 3.3.2.3 Over-the-Air (OTA) updates

- 3.3.2.4 Firmware update capabilities

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 SAE international standards

- 3.5.2 UNECE WP.29 regulations

- 3.5.3 Regulatory compliance cost analysis

- 3.5.4 Regulatory roadmap & future requirements

- 3.5.5 Regional regulatory comparison

- 3.5.5.1 North America

- 3.5.5.2 Europe

- 3.5.5.3 Asia-Pacific

- 3.5.5.4 Latin America

- 3.5.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Cost breakdown analysis

- 3.9 Price trends

- 3.9.1 Price arbitrage opportunities

- 3.9.2 Price erosion trends & commoditization

- 3.9.3 Impact of raw material price trends

- 3.9.4 Average Selling Price (ASP) Trends

- 3.10 Risk assessment & mitigation strategies

- 3.10.1 Risk identification & classification

- 3.10.2 Compliance & regulatory risks

- 3.10.3 Technology & innovation risks

- 3.10.4 Risk mitigation strategies

- 3.11 Patent analysis

- 3.11.1 Patent filings by region

- 3.11.2 Patent grant rates & timelines

- 3.11.3 Technology-specific patent analysis

- 3.11.4 Patent landscape mapping

- 3.12 Product Pipeline & R&D Roadmap

- 3.12.1 Product development pipeline analysis

- 3.12.2 Technology roadmap by key players

- 3.12.3 R&D focus areas & investment priorities

- 3.12.4 Collaborative R&D initiatives

- 3.13 Sustainability and environmental aspects

- 3.13.1 Carbon footprint of navigation systems

- 3.13.2 Circular economic strategies

- 3.13.3 Sustainable navigation features

- 3.13.4 Corporate sustainability initiatives

- 3.13.5 Climate change impact on navigation

- 3.14 Market adoption & penetration analysis

- 3.14.1 Technology adoption curve analysis

- 3.14.2 Penetration rates by region

- 3.14.3 Penetration rates by vehicle segment

- 3.14.4 Feature adoption analysis

- 3.14.5 Adoption acceleration strategies

- 3.15 Customer & End use insights

- 3.15.1 Qualification & certification requirements

- 3.15.2 OEM customer segmentation

- 3.15.3 OEM pain points & unmet needs

- 3.15.4 Tier-1 supplier customer analysis

- 3.16 Scenario planning & sensitivity analysis

- 3.16.1 Scenario planning framework

- 3.16.2 Base case scenario

- 3.16.3 Regulatory impact sensitivity

- 3.16.4 New entrants & business models

- 3.16.5 Regulatory impact sensitivity

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

- 4.6 Premium positioning strategies

- 4.7 Competitive analysis and USPs

Chapter 5 Market Estimates & Forecast, By Motor, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Brushed DC Motors

- 5.3 Brushless DC Motors

- 5.4 Stepper Motors

Chapter 6 Market Estimates & Forecast, By Power Consumption, 2022 - 2035 ($Bn, units)

- 6.1 Key trends

- 6.2 3V-12V

- 6.3 12V-24V

- 6.4 25V-48V

- 6.5 More than 48V

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 SUV

- 7.2.2 Sedan

- 7.2.3 Hatchback

- 7.3 Commercial Vehicles

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Power Windows

- 8.3 Windshield Wipers

- 8.4 Electric Power Steering (EPS)

- 8.5 Seat Adjustments

- 8.6 Mirror Adjustments

- 8.7 Sunroof Actuators

- 8.8 HVAC Systems

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Continental

- 11.1.2 Denso

- 11.1.3 Garmin

- 11.1.4 HARMAN International

- 11.1.5 Hyundai Mobis

- 11.1.6 Mitsubishi Electric

- 11.1.7 Panasonic

- 11.1.8 Robert Bosch

- 11.2 Region players

- 11.2.1 Alpine Electronics

- 11.2.2 Clarion

- 11.2.3 Desay SV Automotive

- 11.2.4 JVCKENWOOD

- 11.2.5 LG Electronics

- 11.2.6 Marelli

- 11.2.7 Pioneer

- 11.2.8 Valeo

- 11.2.9 Visteon

- 11.3 Emerging players

- 11.3.1 Aisin Corporation

- 11.3.2 Dynavin

- 11.3.3 Luxoft

- 11.3.4 NNG Software

- 11.3.5 Preh Car Connect

- 11.3.6 Vinland