PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892796

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892796

Truck Bedliners Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

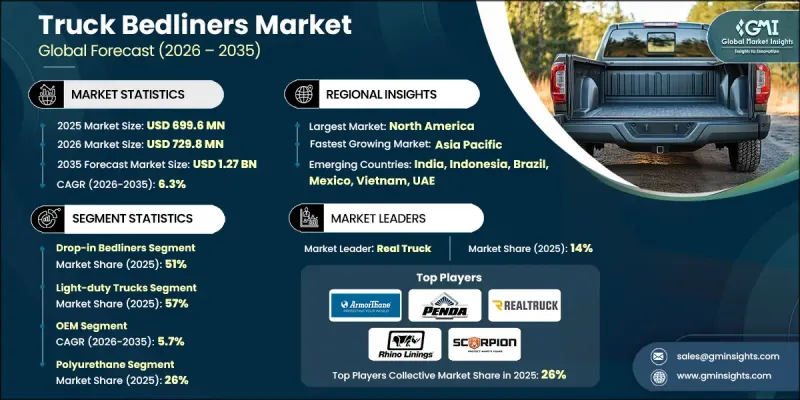

The Global Truck Bedliners Market was valued at USD 699.6 million in 2025 and is estimated to grow at a CAGR of 6.3% to reach USD 1.27 billion by 2035.

Market momentum is driven by the rising global adoption of pickup trucks across personal, commercial, and recreational use. Increasing vehicle ownership continues to strengthen pickup truck culture, which directly fuels demand for protective cargo bed solutions. Bedliners are widely viewed as essential accessories that help preserve vehicle condition while supporting long-term value retention. Both OEM and aftermarket participants benefit from longer replacement timelines and a steady shift toward customization across user segments. Consumers increasingly view pickup trucks as multifunctional assets, prompting higher spending on accessories that enhance durability, appearance, and usability. Bedliners remain among the most practical and affordable upgrades, supporting their widespread acceptance. Growth in accessory retail networks, expanding do-it-yourself adoption, and broader product availability further stimulate demand, particularly in developed markets and fast-growing urban regions. Commercial fleet operators also contribute significantly, as durable bed protection helps extend vehicle service life and reduce ongoing maintenance expenses, reinforcing bedliners as a cost-efficient investment.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $699.6 Million |

| Forecast Value | $1.27 Billion |

| CAGR | 6.3% |

Pickup owners continue to personalize their vehicles to improve both functionality and visual appeal. Bedliners are increasingly selected for their protective performance and value proposition. Easier installation options and growing consumer confidence in self-installation solutions support rising aftermarket penetration. Commercial operators prioritize durability to limit wear-related expenses, reinforcing steady demand across fleet applications.

The light-duty truck segment accounted for a 57% share in 2025 and is projected to grow at a CAGR of 7% between 2026 and 2035. This segment leads due to higher personal ownership rates, increased spending on accessories, strong customization trends, and the growing presence of electric pickup models. These factors are reinforced by large-scale production capabilities and consistently high bedliner attachment rates across a broad geographic footprint.

The OEM segment is expected to grow at a CAGR of 5.7% from 2026 to 2035. OEM-installed bedliners offer integrated fitment, warranty alignment, and added convenience for buyers. Segment growth is supported by rising light truck production volumes, premium factory-installed accessory offerings, and expanding collaboration with supplier partners to meet quality and regulatory standards.

US Truck Bedliners Market reached USD 261.9 million in 2025. Demand in the US continues to be shaped by preferences for durable coating solutions suited for intensive use. Growth is supported by high adoption of pickup trucks, increased fleet customization, and strong consumer focus on vehicle personalization. Manufacturers are responding with finishes designed to align visually with factory vehicle designs while maintaining performance durability.

Key companies active in the Global Truck Bedliners Market include LINE-X, WeatherTech, Rhino Linings, DualLiner, Truck Hero (BedRug), Rugged Liner, Penda Corporation (Pendaliner), Ultimate Linings, SPEEDLINER (Industrial Polymers), and Scorpion Protective Coatings. Companies in the Global Truck Bedliners Market strengthen their competitive position through product innovation, expanded distribution networks, and strategic partnerships. Manufacturers invest in advanced materials to improve durability, appearance, and environmental performance. Many players focus on expanding OEM relationships to secure factory-fitment opportunities while also enhancing aftermarket reach through specialized retailers and installer networks. Brand differentiation is reinforced through customization options, improved installation efficiency, and consistent product quality. Geographic expansion into high-growth regions supports volume gains, while marketing strategies emphasize durability, long-term cost savings, and vehicle value preservation. Continuous investment in manufacturing efficiency and customer support further helps companies defend market share and build long-term brand loyalty.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Vehicle

- 2.2.5 Sales channel

- 2.2.6 End use

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pickup truck sales

- 3.2.1.2 Growth in aftermarket customization

- 3.2.1.3 Increasing demand for vehicle protection

- 3.2.1.4 Advancements in spray-on coating materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatile raw material costs

- 3.2.2.2 Competition from low-cost alternatives

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging pickup markets

- 3.2.3.2 OEM partnership integration

- 3.2.3.3 Development of eco-friendly coatings

- 3.2.3.4 Growth in commercial fleet upfitting

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global

- 3.4.1.1 Environmental regulations

- 3.4.1.2 Emissions control requirements

- 3.4.1.3 Waste disposal regulations

- 3.4.1.4 Occupational health & safety standards

- 3.4.1.5 International labor organization standards

- 3.4.1.6 Automotive OEM standards

- 3.4.2 North America

- 3.4.3 Europe

- 3.4.4 Asia Pacific

- 3.4.5 Latin America

- 3.4.6 Middle East & Africa

- 3.4.1 Global

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Polyurethane chemistry & formulations

- 3.7.1.2 Polyurea chemistry & formulations

- 3.7.1.3 Hybrid system technologies

- 3.7.1.4 Application equipment technology

- 3.7.2 Emerging technologies

- 3.7.2.1 Self-healing coating technologies

- 3.7.2.2 Nano-technology enhanced coatings

- 3.7.2.3 Antimicrobial & antibacterial solutions

- 3.7.2.4 Color-changing & thermochromic finishes

- 3.7.1 Current technological trends

- 3.8 Pricing analysis

- 3.8.1.1 Professional installation pricing

- 3.8.1.2 Premium service pricing

- 3.8.1.3 DIY product pricing

- 3.8.1.4 Roll-on kit pricing analysis

- 3.8.1.5 Bed mat & rug pricing

- 3.8.1.6 Drop-in liner pricing

- 3.8.1.7 E-commerce vs retail pricing

- 3.8.1.8 OEM factory-install pricing

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.10.1 Manufacturing cost structure

- 3.10.2 Application & installation costs

- 3.10.3 Distribution & channel costs

- 3.10.4 Marketing & sales costs

- 3.10.5 Profitability analysis by segment

- 3.10.6 Cost optimization strategies

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Consumer behavior and customization trends

- 3.13.1 Customization market overview

- 3.13.2 Color & finish preferences

- 3.13.3 Texture & surface customization

- 3.13.4 Functional customization

- 3.13.5 Personalization trends by demographics

- 3.13.6 Emerging customization technologies

- 3.14 Regional purchasing preferences & usage patterns

- 3.14.1 Commercial vs personal segment mix

- 3.14.2 Usage pattern analysis by region

- 3.14.3 Application frequency & maintenance

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Drop-in bedliners

- 5.3 Spray-on bedliners

- 5.4 Bed mats & rugs

- 5.5 Roll-on/brush-on bedliners

- 5.6 Hybrid/custom-fitted bedliners

Chapter 6 Market Estimates & Forecast, By Material, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Polyurethane

- 6.3 Polyurea

- 6.4 Rubber

- 6.5 Composite/polyethylene

- 6.6 Epoxy-based formulations

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Light-duty trucks

- 7.3 Medium-duty trucks

- 7.4 Heavy-duty trucks

Chapter 8 Market Estimates & Forecast, By Sales channel, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

- 8.4 Online Retail

- 8.5 Dealerships

Chapter 9 Market Estimates & Forecast, By End use, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Military & defense

- 9.4 Energy (Oil, Gas, & Mining)

- 9.5 Construction

- 9.6 Agriculture

- 9.7 Retail & e-commerce

- 9.8 Others

- 9.9 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Poland

- 10.3.9 Romania

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Vietnam

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 ArmorThane

- 11.1.2 BASF

- 11.1.3 Dee Zee

- 11.1.4 DualLiner

- 11.1.5 Husky Liners

- 11.1.6 LINE-X

- 11.1.7 PPG Industries

- 11.1.8 Rhino Linings

- 11.1.9 Rugged Liner

- 11.1.10 Ultimate Linings

- 11.1.11 U-POL (RAPTOR)

- 11.1.12 WeatherTech

- 11.2 Regional players

- 11.2.1 Aeroklas

- 11.2.2 Armadillo Liners

- 11.2.3 BedRug

- 11.2.4 Bullet Liner

- 11.2.5 Lund International

- 11.2.6 OKULEN

- 11.2.7 Penda Corporation

- 11.2.8 Scorpion Protective Coatings

- 11.2.9 SPEEDLINER

- 11.2.10 Tuff Liner

- 11.2.11 Vortex Liners

- 11.3 Emerging players

- 11.3.1 AL’s Liner

- 11.3.2 Durabak

- 11.3.3 Herculiner

- 11.3.4 Iron Armor

- 11.3.5 POR-15