PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892799

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892799

Ethoxylates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

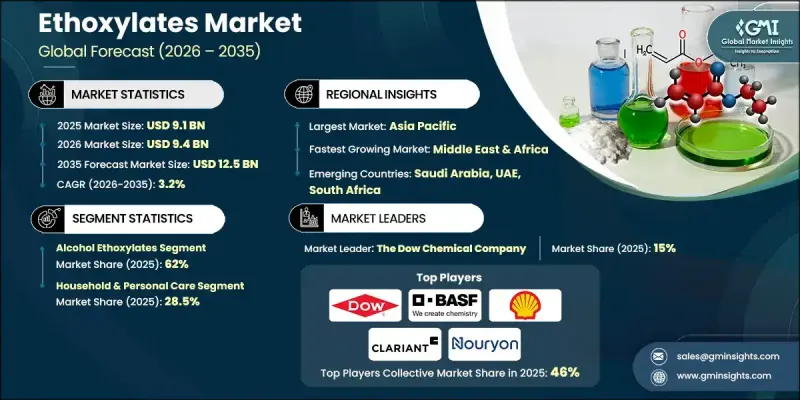

The Global Ethoxylates Market was valued at USD 9.1 billion in 2025 and is estimated to grow at a CAGR of 3.2% to reach USD 12.5 billion by 2035.

The ethoxylates industry plays a pivotal role across a wide range of industrial and consumer applications. Market evaluation includes production trends, pricing patterns, regional consumption, and demand across multiple product families and applications. Growth is closely aligned with the expansion of personal care, agrochemical, and industrial manufacturing sectors, underpinned by innovations in the broader chemicals industry. Distribution is highly concentrated in Asia-Pacific, North America, and Europe due to established chemical manufacturing bases, agricultural activity, and robust consumer goods industries. Emerging markets in the Middle East, Africa, and Latin America are contributing to growth as domestic production scales up to meet increasing consumer demand, gradually diversifying global supply and consumption. Alcohol ethoxylates dominate due to performance efficiency, regulatory compliance, and cost advantages, while specialty grades command premium pricing for technical specifications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $9.1 Billion |

| Forecast Value | $12.5 Billion |

| CAGR | 3.2% |

The alcohol ethoxylates segment held a 62% share in 2025 and is projected to grow at a CAGR of 2.7% through 2035. They serve as key ingredients in most cleaning and personal care formulations due to their excellent emulsifying and detergent properties. Fatty amine ethoxylates remain essential in agrochemical applications for enhancing pesticide spreading and penetration. Additionally, methyl ester ethoxylates are emerging as a sustainable alternative, combining mildness for cosmetic and industrial uses with ecological advantages.

The household and personal care applications segment held a 28.5% share in 2025, with expected growth at a CAGR of 2.6% from 2026 to 2035. Ethoxylates are critical for emulsification, cleansing, and formulation stability in shampoos, cleansers, and skincare products. In agrochemicals, ethoxylates act as wetting agents that improve pesticide efficacy in precision farming. In upstream oil and gas, they are utilized as additives in drilling fluids and demulsifiers, enhancing operational reliability in extraction processes.

North America Ethoxylates Market accounted for a 19.7% share in 2025 and is expanding rapidly. Advanced chemical manufacturing capabilities and strong sustainability regulations make the region a strategic growth hub. Demand for environmentally compliant formulations and specialty chemical innovations provides opportunities for high-performance ethoxylates targeting industrial applications.

Key players in the Global Ethoxylates Market include BASF SE, Arkema SA, Croda International PLC, INEOS Group Limited, Clariant AG, The Dow Chemical Company, Evonik Industries AG, Huntsman International LLC, Nouryon, Royal Dutch Shell PLC, Sasol Limited, Solvay SA, and Stepan Company. Companies in the Global Ethoxylates Market are strengthening their position through multiple strategies. They are investing in research and development to create high-performance and sustainable formulations, expanding production facilities in strategic regions to reduce lead times, and diversifying product portfolios to meet sector-specific needs. Partnerships with end-user industries and distributors enhance market reach, while a focus on regulatory compliance and eco-friendly innovations ensures long-term competitiveness. Firms are also leveraging digitalization and advanced analytics for supply chain optimization and cost efficiency, ensuring timely delivery and improved customer satisfaction across industrial and consumer segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for eco-friendly surfactants

- 3.2.1.2 Consumer preference shift

- 3.2.1.3 Brand sustainability commitments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental concerns regarding APEs/NPEs

- 3.2.2.2 Aquatic toxicity

- 3.2.3 Market opportunities

- 3.2.3.1 Bio-based ethoxylates market expansion

- 3.2.3.2 Specialty ethoxylates development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Alcohol ethoxylates

- 5.2.1 Natural alcohol ethoxylates

- 5.2.2 Synthetic alcohol ethoxylates

- 5.2.3 Linear alcohol ethoxylates (LAE)

- 5.2.4 Branched alcohol ethoxylates (BAE)

- 5.3 Fatty amine ethoxylates

- 5.4 Fatty acid ethoxylates

- 5.5 Methyl ester ethoxylates (MEE)

- 5.6 Glyceride ethoxylates

- 5.7 Alkylphenol ethoxylates (APEs)

- 5.7.1 Nonylphenol ethoxylates (NPEs)

- 5.7.2 Octylphenol ethoxylates (OPEs)

- 5.8 Others

- 5.8.1 Carbonate ethoxylates (CO2-based)

- 5.8.2 Enzymatically produced ethoxylates

- 5.8.3 High-Purity pharmaceutical-grade ethoxylates

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Household & personal care

- 6.2.1 Laundry & dishwashing detergent

- 6.2.2 Industrial & institutional cleaning

- 6.2.3 Personal care

- 6.3 Agrochemicals

- 6.3.1 Herbicides

- 6.3.2 Fungicides

- 6.3.3 Insecticides

- 6.3.4 Fertilizers & micronutrients

- 6.4 Oil & gas

- 6.4.1 Enhanced oil recovery (EOR)

- 6.4.2 Foam control & wetting agents

- 6.4.3 Lubricants & emulsifiers

- 6.4.4 Demulsification

- 6.5 Pharmaceuticals

- 6.5.1 Drug solubilization & delivery

- 6.5.2 Biologics & biosimilars

- 6.5.3 Excipients & emulsifiers

- 6.5.4 Medical device sterilization (EtO-related)

- 6.6 Textile processing

- 6.6.1 Scouring & wetting

- 6.6.2 Dyeing & finishing

- 6.7 Paints & coatings

- 6.7.1 Emulsion polymerization

- 6.7.2 Wetting & dispersing agents

- 6.7.3 Protective coatings

- 6.7.4 Architectural coatings

- 6.7.5 Industrial coatings

- 6.8 Pulp & paper

- 6.8.1 Deinking agents

- 6.8.2 Dispersing agents

- 6.8.3 Defoamers

- 6.9 Leather processing

- 6.10 Others

Chapter 7 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 BASF SE

- 8.2 Royal Dutch Shell PLC

- 8.3 The Dow Chemical Company

- 8.4 Clariant AG

- 8.5 Nouryon

- 8.6 Huntsman International LLC

- 8.7 Sasol Limited

- 8.8 Stepan Company

- 8.9 Evonik Industries AG

- 8.10 Solvay SA

- 8.11 INEOS Group Limited

- 8.12 Croda International PLC

- 8.13 Arkema SA

- 8.14 SABIC (Saudi Basic Industries Corporation)