PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892805

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892805

Aesthetic Medicine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

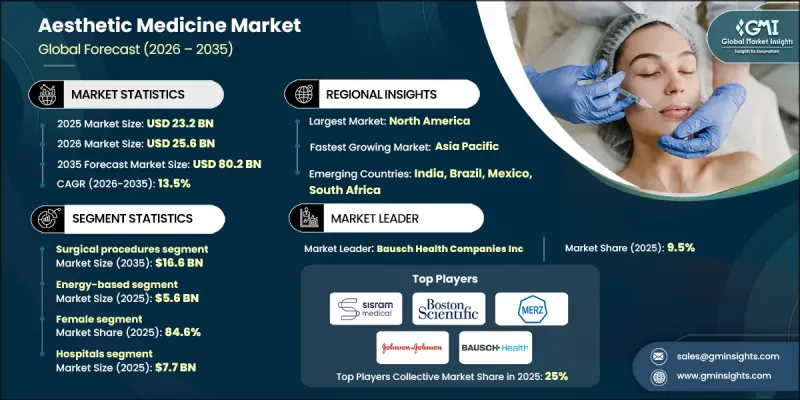

The Global Aesthetic Medicine Market was valued at USD 23.2 billion in 2025 and is estimated to grow at a CAGR of 13.5% to reach USD 80.2 billion by 2035.

The market's rapid expansion is fueled by increasing consumer awareness of aesthetic treatments, continuous technological innovations in medical aesthetic devices, rising obesity rates, and a growing preference for non-invasive procedures. Aesthetic medicine focuses on enhancing physical appearance through minimally invasive or non-surgical interventions, addressing concerns such as wrinkles, pigmentation, skin texture, hair restoration, and body contouring. The growing prevalence of obesity has become a significant driver, as individuals seek solutions to reshape and refine their bodies beyond traditional weight-loss methods. With obesity affecting both health and self-esteem, demand for treatments like liposuction, tummy tucks, body contouring, and non-invasive fat reduction is surging. The field combines surgical and non-surgical techniques to correct skin laxity, cellulite, scars, excess fat, unwanted hair, and hyperpigmentation, aiming to improve both appearance and confidence.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $23.2 Billion |

| Forecast Value | $80.2 Billion |

| CAGR | 13.5% |

The surgical procedures segment reached USD 4.7 billion in 2025 and is projected to reach USD 16.6 billion by 2035. These procedures provide comprehensive solutions for concerns including facial rejuvenation, body contouring, breast augmentation, and rhinoplasty, offering long-lasting and transformative results for patients seeking significant changes in appearance.

The energy-based segment accounted for USD 5.6 billion in 2025. These solutions offer precise, non-invasive or minimally invasive treatments with minimal downtime. Utilizing advanced technologies such as lasers, radiofrequency, ultrasound, and intense pulsed light (IPL), energy-based devices address a variety of cosmetic concerns, including skin rejuvenation, hair removal, tattoo removal, and body contouring.

North America Aesthetic Medicine Market held a 39.5% share in 2024. Growth in the region is supported by heightened consumer awareness, widespread adoption of advanced technologies, and a cultural emphasis on physical appearance. A large population with significant interest in cosmetic procedures is driving demand for both surgical and non-surgical interventions.

Key players operating in the Global Aesthetic Medicine Market include Johnson & Johnson, Boston Scientific Corporation, Huadong Medicine Co., Ltd, GC Aesthetics plc, Apax Partners, SharpLight Technologies Inc., Sisram Medical Ltd, Bausch Health Companies Inc., Merz Pharma, Vitruvian Partners LLP, and El.En. S.p.A. Companies in the Global Aesthetic Medicine Market are strengthening their presence by investing in research and development to create innovative, minimally invasive devices with higher efficacy and lower recovery times. Strategic partnerships and collaborations with distributors and healthcare providers are enhancing market reach and patient access. Firms are also focusing on expanding into emerging regions, offering training programs for clinicians, and integrating digital solutions such as AI-assisted treatment planning. Sustainability initiatives, personalized treatment options, and product diversification are being used to differentiate offerings and build long-term brand loyalty, while targeted marketing campaigns raise consumer awareness and drive adoption of advanced aesthetic procedures.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Product trends

- 2.2.4 Gender trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing awareness regarding aesthetic procedures

- 3.2.1.2 Technological advancements associated with medical aesthetic devices

- 3.2.1.3 Rising prevalence of obesity

- 3.2.1.4 Increasing adoption of non-invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with aesthetic procedures

- 3.2.2.2 Lack of reimbursement and stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and digital technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2025

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Surgical procedures

- 5.3 Non-surgical procedures

Chapter 6 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Energy-based

- 6.2.1 Laser-based aesthetic device

- 6.2.2 Radiofrequency (RF)-based aesthetic device

- 6.2.3 Light-based aesthetic device

- 6.2.4 Ultrasound aesthetic device

- 6.2.5 Other energy-based products

- 6.3 Non-energy-based

- 6.3.1 Botulinum toxin

- 6.3.2 Dermal fillers

- 6.3.3 Implants

- 6.3.3.1 Facial implants

- 6.3.3.2 Breast implants

- 6.3.3.3 Other implants

- 6.3.4 Other non-energy-based products

Chapter 7 Market Estimates and Forecast, By Gender, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Male

- 7.2.1 18 years and below

- 7.2.2 19-34 years

- 7.2.3 35-50 years

- 7.2.4 51-64 years

- 7.2.5 65 years and above

- 7.3 Female

- 7.3.1 18 years and below

- 7.3.2 19-34 years

- 7.3.3 35-50 years

- 7.3.4 51-64 years

- 7.3.5 65 years and above

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Beauty centers and medical spas

- 8.5 Dermatology clinics

- 8.6 Home settings

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Apax Partners

- 10.2 Boston Scientific Corporation

- 10.3 Bausch Health Companies Inc.

- 10.4 El.En. S.p.A

- 10.5 GC Aesthetics plc

- 10.6 Huadong Medicine Co., Ltd

- 10.7 Johnson & Johnson

- 10.8 Merz Pharma

- 10.9 Sciton, Inc.

- 10.10 SharpLight Technologies Inc

- 10.11 Sisram Medical Ltd

- 10.12 Vitruvian Partners LLP