PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892807

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892807

Automotive Memory Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

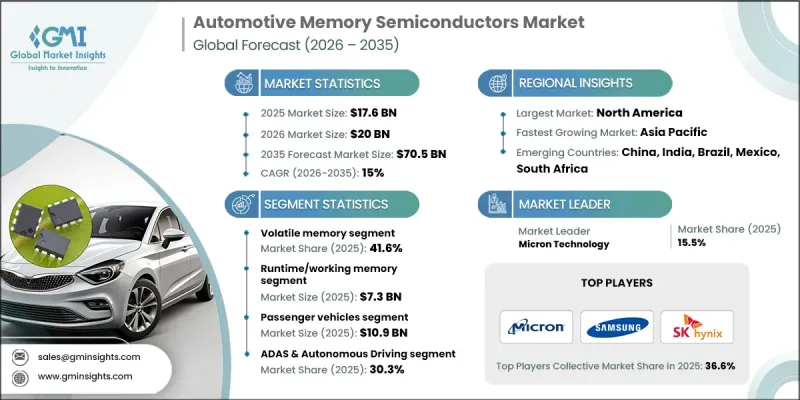

The Global Automotive Memory Semiconductors Market was valued at USD 17.6 billion in 2025 and is estimated to grow at a CAGR of 15% to reach USD 70.5 billion by 2035.

The industry is experiencing strong momentum driven by rising demand for sophisticated automotive electronics, increasing production of electric vehicles, and the rapid emergence of connected mobility systems. These components are becoming essential in advanced driver-assistance features, in-vehicle entertainment platforms, and evolving autonomous functions. Growing reliance on intelligent sensors and high-speed data processing fuels the need for memory capable of supporting real-time workloads in next-generation vehicles. As automation scales, vehicles require memory architectures that deliver higher capacity, reduced latency, and long-term durability. This shift encourages manufacturers to develop automotive-grade components built to meet rigorous safety and reliability criteria. The accelerating transition toward EVs and hybrid models is also creating significant opportunities, as electrified vehicles depend on complex electronic control units and battery management systems that rely on high-performance memory for continuous monitoring of safety, efficiency, and system behavior.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $17.6 Billion |

| Forecast Value | $70.5 Billion |

| CAGR | 15% |

The volatile memory segment accounted for 41.6% share in 2025. Its prominence stems from its central function in handling real-time operations and short-term data loads within modern vehicles. DRAM, the primary volatile memory, enables rapid interaction between vehicle sensors, infotainment controllers, energy-management units, and other mission-critical modules. Its speed, responsiveness, and optimized power usage make it fundamental to intelligent, connected vehicle platforms.

The runtime or working memory segment reached USD 7.3 billion in 2025. This segment dominates because it performs the most demanding processing tasks tied to immediate data communication across electronic control units, connectivity systems, battery oversight modules, and advanced safety technologies. DRAM continues to serve as the backbone of runtime memory due to its high performance and stability. Expanding use of EVs, automated driving systems, and integrated connectivity features continues to support strong demand in this category.

North America Automotive Memory Semiconductors Market held a 27.5% share in 2025. The region is witnessing substantial progress fueled by the widespread adoption of electric and automated vehicle technologies and strong uptake of intelligent car platforms. A combination of advanced semiconductor engineering, large-scale manufacturing strength, and increased investment from memory technology providers is reinforcing market expansion. Policy support for electric mobility and next-generation automotive innovation further accelerates growth.

Key companies active in the Global Automotive Memory Semiconductors Market include Everspin Technologies, Infineon Technologies, Kingston Technology, GigaDevice Semiconductor, Kioxia Holdings, Macronix International, Micron Technology, Integrated Silicon Solution (ISSI), Renesas Electronics, Powerchip Technology, SK hynix, Swissbit, Samsung Electronics, Western Digital, and Transcend Information. Key strategies used by companies in the Global Automotive Memory Semiconductors Market center on enhancing performance capabilities, expanding product durability, and strengthening partnerships across the automotive ecosystem. Many firms are investing in advanced fabrication technologies to boost endurance, reduce latency, and support high-bandwidth applications required by automated and electric vehicles. Companies are also prioritizing automotive-grade qualification standards to improve reliability under extreme conditions. Collaborations with OEMs and Tier-1 suppliers are expanding to ensure seamless integration of memory solutions into complex vehicle architectures. Additionally, businesses are diversifying memory portfolios, optimizing power efficiency, and scaling production capacity to meet rising global demand while improving their competitive position.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Technologies trends

- 2.2.2 Functional Role trends

- 2.2.3 Vehicle Type trends

- 2.2.4 Application trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of Advanced Driver Assistance Systems (ADAS) and autonomous driving

- 3.2.1.2 Growing vehicle electrification (EVs and HEVs)

- 3.2.1.3 Integration of infotainment and connected car systems

- 3.2.1.4 Advancements in automotive-grade memory

- 3.2.1.5 Expansion of vehicle-to-everything (V2X) communication

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing and qualification costs of automotive-grade semiconductors

- 3.2.2.2 Rapid technology evolution

- 3.2.3 Market opportunities

- 3.2.4 Emergence of Software-Defined Vehicles (SDVs)

- 3.2.5 Edge AI and Machine Learning in Vehicles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2022-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2026-2035)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability roi analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Technologies, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Volatile Memory

- 5.2.1 DRAM

- 5.2.2 SRAM

- 5.3 Non-Volatile Memory (NVM)

- 5.4 NOR Flash

- 5.5 NAND Flash

- 5.6 EEPROM / NVRAM

- 5.7 Emerging / Advanced Memory

- 5.8 MRAM

- 5.9 FRAM

- 5.10 ReRAM / PCM

- 5.11 Automotive Managed Memory Solutions

Chapter 6 Market Estimates and Forecast, By Functional Role, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Runtime / Working Memory

- 6.3 Code Storage

- 6.4 Data Storage

Chapter 7 Market Estimates and Forecast, By Vehicle Type, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Passenger Vehicles

- 7.3 Light Commercial Vehicles

- 7.4 Heavy Commercial Vehicles

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 ADAS & Autonomous Driving

- 8.3 Infotainment & Digital Cockpit

- 8.4 Powertrain & Battery Management

- 8.5 Body, Chassis & Safety Electronics

- 8.6 Instrument Cluster & Display Systems

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Everspin Technologies

- 10.2 GigaDevice Semiconductor

- 10.3 Infineon Technologies

- 10.4 Integrated Silicon Solution (ISSI)

- 10.5 Kingston Technology

- 10.6 Kioxia Holdings

- 10.7 Macronix International

- 10.8 Micron Technology

- 10.9 Powerchip Technology

- 10.10 Renesas Electronics

- 10.11 Samsung Electronics

- 10.12 SK hynix

- 10.13 Swissbit

- 10.14 Transcend Information

- 10.15 Western Digital