PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892810

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892810

Electron Microscope Sample Preparation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

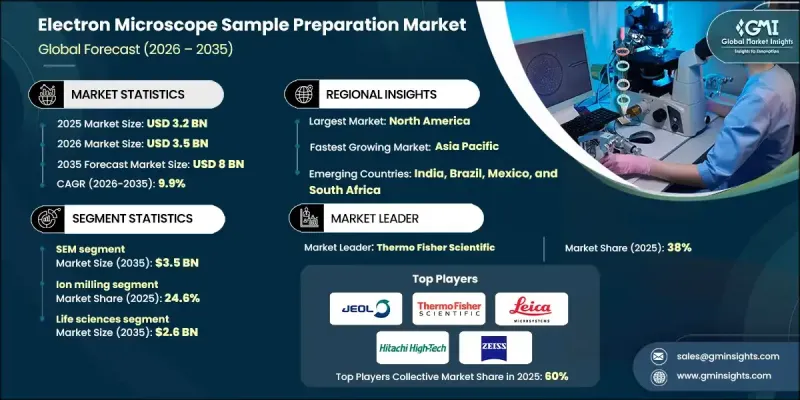

The Global Electron Microscope Sample Preparation Market is valued at USD 3.2 billion in 2025 and is estimated to grow at a CAGR of 9.9% to reach USD 8 billion by 2035.

Market expansion is driven by sustained growth in pharmaceutical and biopharmaceutical development, rising healthcare investment across developed and emerging economies, broader adoption of electron microscopy, and continuous progress in nanotechnology and materials research. Sample preparation is a critical stage that directly determines image quality and analytical accuracy in electron microscopy. It involves carefully controlled processes designed to preserve specimen structure, maintain stability under electron exposure, and ensure imaging consistency at extremely high resolutions. As research complexity increases, demand rises for advanced preparation systems that support precision, reproducibility, and efficiency. Manufacturers are responding with technology-driven solutions that improve workflow automation, reduce sample damage, and support increasingly sensitive materials. Strategic investments in innovation and global expansion are strengthening supplier capabilities across research, healthcare, and industrial applications. As electron microscopy continues to play a central role in advanced analysis, sample preparation solutions are becoming indispensable tools that support reliable results and long-term research productivity.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.2 Billion |

| Forecast Value | $8 Billion |

| CAGR | 9.9% |

The SEM-related segment will reach USD 3.5 billion by 2035. This category maintains strong adoption due to its adaptability, user accessibility, and broad utilization across scientific and industrial research. High-quality sample preparation remains essential to achieve consistent surface imaging and prevent measurement distortion, reinforcing demand for specialized preparation equipment.

The life sciences segment will grow at a CAGR of 10.2% and reach USD 2.6 billion by 2035. Growth is supported by increasing reliance on nanoscale visualization in biological and biomedical research. Accurate preparation is vital to maintain structural fidelity and minimize analytical interference, particularly for highly sensitive specimens.

North America Electron Microscope Sample Preparation Market held a 34.4% share in 2025. The region benefits from advanced research infrastructure, early technology adoption, and strong investment across scientific and industrial innovation ecosystems. Continuous integration of next-generation preparation technologies supports sustained regional leadership.

Key companies operating in the Global Electron Microscope Sample Preparation Market include Thermo Fisher Scientific, JEOL, Leica Microsystems (Danaher Corporation), Carl Zeiss, Gatan (AMETEK), Ted Pella, Quorum Technologies (Judges Scientific), Hitachi High-Technologies Corporation, Denton Vacuum, Allied High-Tech Products, Electron Microscopy Sciences, Tousimis, Struers, Safematic, Anatech USA, COXEM, Nanoscience Instruments, Vac Coat, Vac Techniche, E.A. Fischione Instruments, Boeckeler Instruments, KYKY Technology, Ferrovac, Technoorg Linda, Engineering Office M. Wohlwend, HHV Group, Linkam Scientific Instruments, Kammrath & Weiss, CryoCapCell, Cressington Scientific Instruments, and Buehler Instruments. Companies in the Global Electron Microscope Sample Preparation Market are strengthening their competitive position through sustained investment in advanced technologies, automation, and precision engineering. Manufacturers focus on developing systems that improve workflow efficiency, reduce variability, and support increasingly complex analytical requirements. Strategic collaborations with research institutions and industrial users help align product development with real-world applications. Geographic expansion and localized service networks improve customer access and support long-term relationships.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Equipment type trends

- 2.2.4 Industry trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing biopharmaceutical and pharmaceutical industry

- 3.2.1.2 Rising healthcare expenditure in developing as well as developed regions

- 3.2.1.3 Increasing applications of electron microscopy

- 3.2.1.4 Advancements in nanotechnology and material sciences

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with electron microscopy

- 3.2.2.2 Complexity in equipment handling

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of automated sample preparation systems

- 3.2.3.2 Increasing focus on material science and advanced composites

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Scanning electron microscope

- 5.2.1 Tabletop/benchtop

- 5.2.2 Conventional

- 5.3 Field emission scanning electron microscope

- 5.4 Transmission electron microscope

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Process, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Ion milling

- 6.3 Coating

- 6.4 High pressure freezing process

- 6.5 Freeze fracture process

- 6.6 Cryo transfer process

- 6.7 Plasma cleaning process

- 6.8 Critical point drying process

- 6.9 Other sample preparation processes

Chapter 7 Market Estimates and Forecast, By Industry, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Academics

- 7.3 Life sciences

- 7.4 Material sciences

- 7.5 Semiconductor research

- 7.6 Other industries

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Allied High-Tech Products

- 9.2 Anatech USA

- 9.3 Boeckeler Instruments

- 9.4 Carl Zeiss

- 9.5 COXEM

- 9.6 Cressington Scientific Instruments

- 9.7 CryoCapCell

- 9.8 Denton Vacuum

- 9.9 E.A. Fischione Instruments

- 9.10 Electron Microscopy Sciences

- 9.11 Engineering Office M. Wohlwend

- 9.12 Ferrovac

- 9.13 Gatan (AMETEK)

- 9.14 HHV (Hind High Vacuum (HHV) Group)

- 9.15 Hitachi High-Technologies Corporation (Hitachi)

- 9.16 JEOL

- 9.17 Kammrath & Weiss

- 9.18 KYKY Technology

- 9.19 Leica Microsystems (Danaher Corporation)

- 9.20 Linkam Scientific Instruments

- 9.21 Nanoscience Instruments

- 9.22 Quorum Technologies (Judges Scientific)

- 9.23 Safematic

- 9.24 Struers

- 9.25 Technoorg Linda

- 9.26 Ted Pella

- 9.27 Thermo Fisher Scientific

- 9.28 Tousimis

- 9.29 Vac Coat

- 9.30 Vac Techniche