PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892813

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892813

Veterinary Sutures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

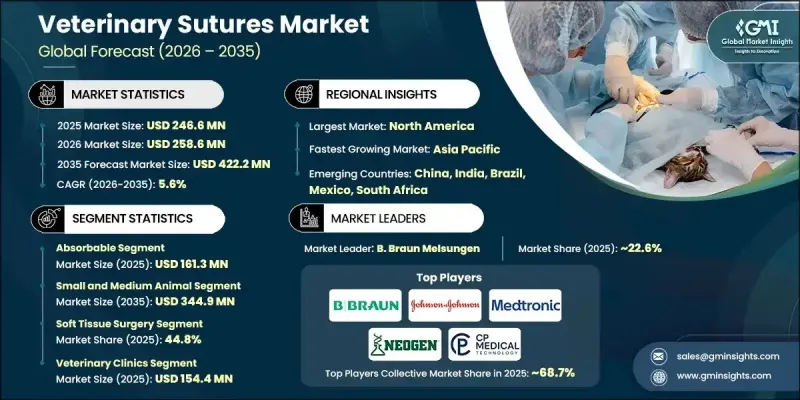

The Global Veterinary Sutures Market was valued at USD 246.6 million in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 422.2 million by 2035.

The market is driven by the rising pet population and the growing prevalence of chronic and lifestyle-related conditions among animals. With pets increasingly regarded as family members, demand for advanced veterinary care, including surgical procedures, has surged. Veterinary sutures are critical medical tools used by veterinarians to close wounds and secure surgical incisions, ensuring proper healing. The market benefits from innovations in suture materials that reduce infection risks and enhance tissue repair, improving clinical outcomes. Expansion of veterinary hospitals and clinics across both developed and emerging regions has improved access to surgical care. Sutures, available in absorbable and non-absorbable forms, are designed for biocompatibility, durability, and safety across species, ensuring effective wound management and faster recovery. As animal healthcare awareness grows, adoption of advanced veterinary sutures continues to rise globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $246.6 Million |

| Forecast Value | $422.2 Million |

| CAGR | 5.6% |

The absorbable sutures segment held a 65.4% share, valued at USD 161.3 million in 2025. Absorbable sutures, including polyglycolic acid, polyglactin, and other types, are favored for convenience since they do not require removal, reducing the need for follow-up visits. Their broad applicability across soft tissue surgeries, routine wound closures, and internal procedures contributes to their dominance, making them highly preferred by veterinarians and pet owners.

The small and medium animal segment is projected to reach USD 344.9 million by 2035. Growth in this segment is fueled by the increasing population of dogs, cats, and other small to medium pets, along with pet owners' willingness to invest in advanced veterinary care. These animals undergo a variety of surgical procedures, from routine operations to complex interventions, creating consistent demand for diverse suture types.

North America Veterinary Sutures Market held the largest share of 39.7% in 2025. Market growth in the region is driven by a substantial pet population, strong awareness of animal health, and a well-established veterinary care infrastructure. The rising adoption of pet insurance also supports market expansion by enabling owners to invest more in quality surgical care.

Key companies active in the Global Veterinary Sutures Market include B. Braun Melsungen, Vetersut, CP Medical, Medtronic, Orion Sutures, AIP Medical, Vitrex Medical, SMI, DemeTECH Corporation, Dolphin Sutures, Johnson & Johnson, Cencora, Lotus Surgicals, and KATSAN. Companies in the Veterinary Sutures Market are leveraging multiple strategies to strengthen their market presence. They are focusing on research and development to create advanced, biocompatible, and infection-resistant suture materials. Strategic collaborations with veterinary hospitals and clinics enhance product adoption. Expanding distribution networks across emerging and developed regions ensures wider reach and accessibility. Many firms are also adopting digital marketing and e-commerce platforms to target pet owners and veterinary professionals directly. In addition, companies are investing in training programs for veterinarians to promote optimal suture usage, while mergers, acquisitions, and partnerships are employed to increase market share and accelerate entry into new regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Animal type trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing pet ownership and pet humanization trend

- 3.2.1.2 Rising livestock population in developing countries

- 3.2.1.3 Advancements in suture materials

- 3.2.1.4 Growing healthcare expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced sutures

- 3.2.2.2 Limited awareness in emerging markets

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for minimally invasive and advanced surgical techniques

- 3.2.3.2 Growing adoption of pet insurance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Global animal population statistics

- 3.6.1 Pet population statistics

- 3.6.1.1 Dogs

- 3.6.1.2 Cats

- 3.6.2 Livestock population statistics

- 3.6.1 Pet population statistics

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Absorbable sutures

- 5.2.1 Polyglycolic acid suture

- 5.2.2 Polyglactin suture

- 5.2.3 Other absorbable sutures

- 5.3 Non-absorbable sutures

- 5.3.1 Nylon suture

- 5.3.2 Polyester suture

- 5.3.3 Other non-absorbable sutures

Chapter 6 Market Estimates and Forecast, By Animal Type, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Small and medium animals

- 6.3 Large animals

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Soft tissue surgery

- 7.3 Orthopedic surgery

- 7.4 Dental surgery

- 7.5 Ophthalmic surgery

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary clinics

- 8.3 Veterinary hospitals

- 8.4 Research centers and academia

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AIP Medical

- 10.2 B. Braun Melsungen

- 10.3 Cencora

- 10.4 CP Medical

- 10.5 DemeTECH Corporation

- 10.6 Dolphin Sutures

- 10.7 Johnson & Johnson

- 10.8 KATSAN

- 10.9 Lotus Surgicals

- 10.10 Medtronic

- 10.11 Neogen Corporation

- 10.12 Orion Sutures

- 10.13 SMI

- 10.14 Vetersut

- 10.15 Vitrex medical