PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892828

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892828

Guidewires Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

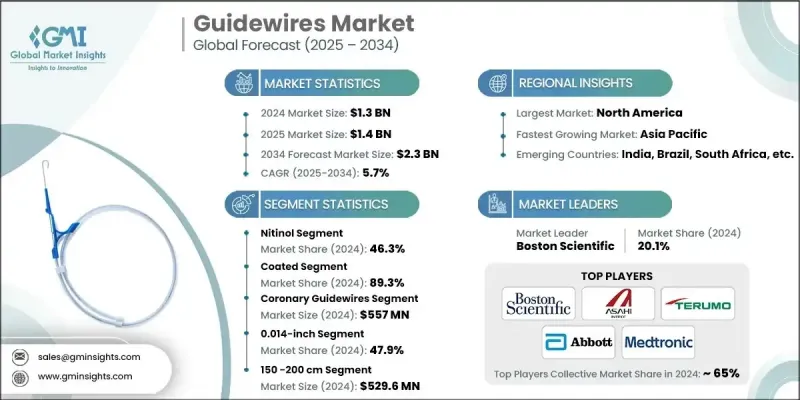

The Global Guidewires Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 2.3 billion by 2034.

Market expansion is driven by the rising elderly population, increasing prevalence of lifestyle-related disorders, supportive reimbursement policies in developed countries, and growing rates of cardiovascular diseases. Technological advancements in guidewire design, such as smart and bioresorbable models, are further fueling adoption. The shift in healthcare from traditional open surgeries to minimally invasive procedures, including Percutaneous Coronary Intervention (PCI), neurovascular interventions, and endovascular therapies, is significantly contributing to market growth. These procedures reduce trauma, shorten hospital stays, and accelerate recovery. Guidewires play a critical role in enabling clinicians to navigate complex vascular structures with precision, improving procedural success and patient outcomes. Expansion of healthcare infrastructure in emerging economies is also creating new opportunities for guidewire deployment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 5.7% |

In 2024, the nitinol segment held a 46.3% share 2024. This segment is expected to continue growing due to favorable reimbursement policies and superior material properties, including shape-memory and super-elasticity, which provide enhanced flexibility and kink resistance for navigating tortuous vessels in cardiovascular, peripheral, and neurovascular procedures.

The coated segment held a 89.3% share in 2024. Coated guidewires, using hydrophilic, anti-thrombogenic, hydrophobic, and silicone-based technologies, are preferred for their clinical efficiency and widespread use in interventional procedures.

North America Guidewires Market accounted for a 37.7% share in 2024. The region benefits from advanced healthcare infrastructure, high procedural volumes, rapid adoption of minimally invasive interventions, and continuous technological innovation. High prevalence of cardiovascular diseases, peripheral artery disease, neurovascular conditions, and urological disorders drives demand for guidewires for both diagnostic and therapeutic applications.

Key players operating in the Global Guidewires Market include Boston Scientific, Medtronic, Abbott Laboratories, Cook Medical, Stryker, B. Braun SE, AngioDynamics, Teleflex, Cordis, Olympus, Merit Medical Systems, ASAHI INTECC, Becton Dickinson and Company, and Terumo. Companies in the Global Guidewires Market are strengthening their position by focusing on technological innovation and product differentiation, including the development of smart, coated, and bioresorbable guidewires. Collaborations with hospitals, research centers, and medical device distributors enhance market penetration and clinical adoption. Firms are expanding their footprint in emerging markets by establishing local manufacturing and distribution networks to meet growing procedural demand. Regulatory compliance and securing favorable reimbursement policies also play a vital role in driving sales. Strategic mergers and acquisitions enable companies to consolidate expertise, expand product portfolios, and access advanced R&D capabilities.a

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends (USD Mn & 000' Units)

- 2.2.2 Material trends (USD Mn & 000' Units)

- 2.2.3 Coating trends

- 2.2.4 Application trends (USD Mn & 000' Units)

- 2.2.5 Diameter trends (USD Mn & 000' Units)

- 2.2.6 Length trends (USD Mn & 000' Units)

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of minimally invasive surgical procedures

- 3.2.1.2 Increasing number of lifestyle disorders in developing countries

- 3.2.1.3 Various reimbursement policies in developed countries

- 3.2.1.4 Growing geriatric population base across the globe

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of guidewires

- 3.2.2.2 Dearth of skilled professionals in developing economies

- 3.2.2.3 Risks associated with guidewires

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of healthcare infrastructure in emerging economies

- 3.2.3.2 Growing adoption of image-guided and robotic-assisted interventions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 China

- 3.4.1 North America

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Enhanced hydrophilic and hydrophobic coating technologies

- 3.5.1.2 Torque-control and steerability optimization

- 3.5.1.3 Integration of multi-layered composite materials

- 3.5.2 Emerging technologies

- 3.5.2.1 Nanotechnology-enhanced surface engineering

- 3.5.2.2 Magnetically guided navigation systems

- 3.5.2.3 3D-printed personalized guidewire prototypes

- 3.5.1 Current technological trends

- 3.6 Future market trends

- 3.6.1 Rising shift toward fully integrated digital interventional suites

- 3.6.2 Growing preference for single-use, sterile, and cost-efficient guidewires

- 3.6.3 Expansion of minimally invasive and outpatient-based interventions

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, by region, 2024

- 3.8.1 By Material

- 3.8.2 By Application

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Nitinol

- 5.3 Stainless steel

- 5.4 Hybrid

- 5.5 Other materials

Chapter 6 Market Estimates and Forecast, By Coating, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Coated

- 6.2.1 Hydrophilic coating

- 6.2.2 Anti-thrombogenic/Heparin coating

- 6.2.3 Hydrophobic coating

- 6.2.4 Silicone coating

- 6.2.5 Tetrafluoroethylene (TFE) coating

- 6.3 Non-coated

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 Coronary guidewires

- 7.3 Peripheral guidewires

- 7.4 Urology guidewires

- 7.5 Neurovascular guidewires

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By Diameter, 2021 - 2034 ($ Mn and Units)

- 8.1 Key trends

- 8.2 0.014 inch

- 8.3 0.018 inch

- 8.4 0.025 inch

- 8.5 0.032 inch

- 8.6 0.035 inch

- 8.7 0.038 inch

Chapter 9 Market Estimates and Forecast, By Length, 2021 - 2034 ($ Mn and Units)

- 9.1 Key trends

- 9.2 80 - 145 cm

- 9.3 150 - 200 cm

- 9.4 210 - 300 cm

- 9.5 Above 305 cm

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Ambulatory surgical centers

- 10.4 Other End use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Abbott Laboratories

- 12.2 AngioDynamics

- 12.3 ASAHI INTECC

- 12.4 B. Braun SE

- 12.5 Becton, Dickinson and Company

- 12.6 Boston Scientific

- 12.7 Cordis

- 12.8 Cook Medical

- 12.9 Medtronic

- 12.10 Merit Medical Systems

- 12.11 Olympus

- 12.12 Stryker

- 12.13 Teleflex

- 12.14 Terumo