PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892829

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892829

Post-acute Care Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

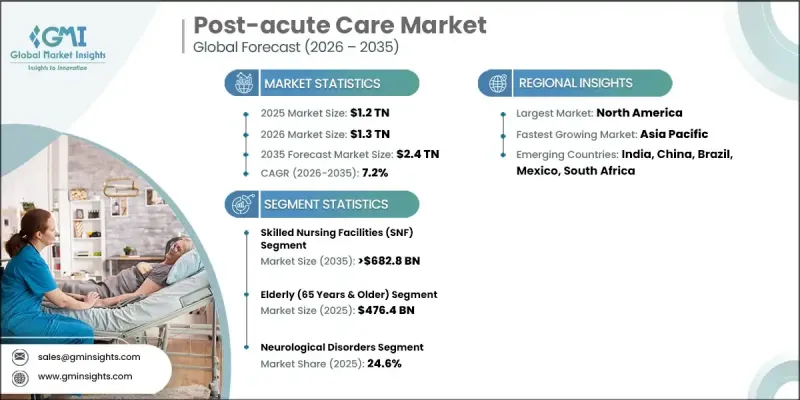

The Global Post-acute Care Market was valued at USD 1.2 trillion in 2025 and estimated to grow at a CAGR of 7.2% to reach USD 2.4 trillion by 2035.

The growth is supported by the rising preference for home-based and community-centered recovery services, continued innovation in rehabilitation technologies, and the growing prevalence of chronic and age-related health conditions. Global demographic shifts are also contributing to sustained demand, as the share of individuals aged 65 years and older reached 10% of the global population in 2022. These factors are increasing the need for extended recovery care following hospital discharge, driving utilization of home healthcare services, skilled nursing facilities, and inpatient rehabilitation settings. The market is further supported by healthcare systems seeking cost-effective recovery pathways that improve outcomes while reducing hospital readmissions. As patient expectations evolve, post-acute care providers are becoming an essential component of the broader care continuum, supporting long-term recovery, mobility improvement, and chronic condition management across diverse patient populations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.2 Trillion |

| Forecast Value | $2.4 Trillion |

| CAGR | 7.2% |

The adoption of digital health solutions is transforming post-acute care delivery. Technologies such as remote rehabilitation platforms, wearable monitoring devices, AI-supported recovery analytics, and automated therapy systems enable continuous patient oversight and personalized treatment planning. These advancements support earlier intervention and improved recovery efficiency. Home- and community-based care models are increasingly favored due to cost advantages and higher patient satisfaction, encouraging providers to expand in-home therapy, remote monitoring, and skilled nursing programs. This shift is gradually repositioning post-acute care toward a more decentralized, patient-centered delivery model.

The skilled nursing facilities segment accounted for a 31.5% share in 2025. Demand for these facilities is driven by the need for continuous clinical supervision, structured rehabilitation services, and comprehensive recovery support following hospital stays. Pressure to reduce inpatient length of stay continues to strengthen referral volumes to skilled nursing providers.

The population aged 65 years and older generated USD 476.4 billion in 2025 and is expected to grow at a CAGR of 7.1% through 2035. Increasing longevity and higher rates of mobility limitations and chronic conditions are driving sustained demand for rehabilitation, monitoring, and long-term recovery services.

U.S. Post-acute Care Market generated USD 490.6 billion in 2025 and will grow at a CAGR of 6.4% from 2026 to 2035. The shift toward value-based care models continues to strengthen the role of post-acute providers in improving outcomes and ensuring care continuity across healthcare systems.

Key companies operating in the Global Post-acute Care Market include Encompass Health, Brookdale Senior Living, Amedisys, Genesis Healthcare, Select Medical, CareCentrix, Evernorth Health, Benchmark Senior Living, Athena Health Care Systems, Covenant Care, Alden Network, VITAS Healthcare, Vineyard Post Acute, Bella Vista Health Center, and SYMPHONY CARE NETWORK. Companies in the Post-acute Care Market adopt multiple strategies to reinforce their market position and expand service reach. Providers invest in home-based care models and remote monitoring technologies to align with patient preferences and cost-efficiency goals. Strategic expansion through partnerships and acquisitions helps broaden geographic coverage and service portfolios. Emphasis on clinical quality, outcomes measurement, and value-based care alignment strengthens relationships with hospitals and payers. Workforce development initiatives support skilled staffing across nursing and rehabilitation services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Service trends

- 2.2.3 Age group trends

- 2.2.4 Condition trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases and comorbidities

- 3.2.1.2 Shift to value-based care and pressure to reduce hospital readmissions

- 3.2.1.3 Increasing patient preference for home- and community-based care

- 3.2.1.4 Advances in telehealth and remote patient monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Reimbursement uncertainty and policy/regulatory changes

- 3.2.2.2 Fragmented care coordination across providers and settings

- 3.2.2.3 Competition from skilled nursing facilities and outpatient centers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of telehealth and remote monitoring services

- 3.2.3.2 Growth of hospital-at-home and home-based acute care programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Consumer insights

- 3.8 Future market trends

- 3.9 Overview and benefits

- 3.10 Value-based care model in post-acute care

- 3.11 Post-acute care - Investment outlook

- 3.12 Start-up scenario

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive positioning matrix

- 4.4 Competitive analysis of major market players

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New service launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Skilled nursing facilities (SNF)

- 5.3 Home health agencies (HHA)

- 5.4 Long-term care hospitals (LTCHs)

- 5.5 Hospice care

- 5.6 Inpatient rehabilitation facilities (IRF)

- 5.7 Other services

Chapter 6 Market Estimates and Forecast, By Age Group, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Elderly (65 years & older)

- 6.3 Adult (45-64 years)

- 6.4 Other age groups

Chapter 7 Market Estimates and Forecast, By Condition, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Neurological disorders

- 7.3 Brain injury

- 7.4 Amputations

- 7.5 Spinal cord injury

- 7.6 Wound management

- 7.7 Other conditions

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alden Network

- 9.2 Amedisys

- 9.3 Athena Health Care Systems

- 9.4 Bella Vista Health Center

- 9.5 Benchmark Senior Living

- 9.6 Brookdale Senior Living

- 9.7 CareCentrix

- 9.8 Covenant Care

- 9.9 Encompass Health

- 9.10 Evernorth Health

- 9.11 Genesis Healthcare

- 9.12 Select Medical

- 9.13 SYMPHONY CARE NETWORK

- 9.14 Vineyard Post Acute

- 9.15 VITAS Healthcare