PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892841

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892841

Baby Feeding Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

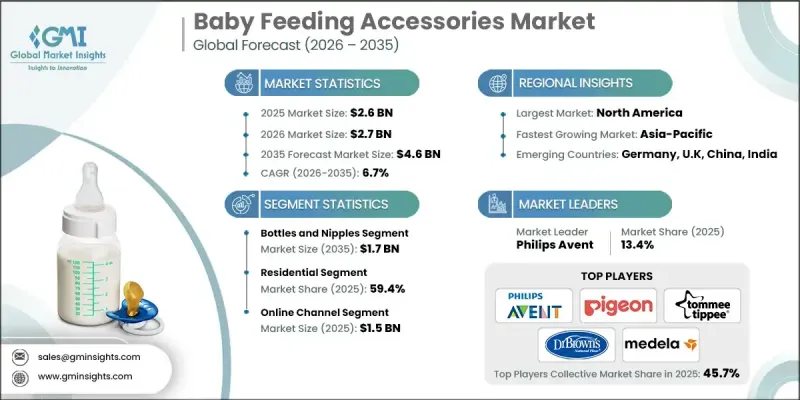

The Global Baby Feeding Accessories Market was valued at USD 2.6 billion in 2025 and is estimated to grow at a CAGR of 6.7% to reach USD 4.6 billion by 2035.

Demand continues to grow as parents worldwide increasingly prioritize sustainable and health-conscious feeding solutions. The shift toward eco-friendly materials, supported by government sustainability efforts aimed at reducing reliance on single-use plastics, is influencing manufacturers to design accessories made from durable and environmentally responsible materials. Technology integration is also transforming the sector, with smart feeding devices gaining traction among digitally connected parents who seek convenience and precision during feeding routines. Expanding online retail networks are further boosting product accessibility, enabling a broader range of consumers to explore feeding accessories tailored to infants' evolving nutritional needs. Rising awareness of diet-related requirements has also pushed parents to search for specialized feeding tools that can support organic choices, allergen management, and formula preparation. As households continue to emphasize infant wellness and convenience, the market is positioned for sustained advancement.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.6 Billion |

| Forecast Value | $4.6 Billion |

| CAGR | 6.7% |

The bottles and nipples category generated USD 1 billion in 2025 and is projected to increase to USD 1.7 billion by 2035. Manufacturers are continually enhancing design features to support parents who balance breastfeeding and bottle feeding, incorporating ergonomic elements that help create smoother feeding transitions. Many brands also focus on reducing discomfort during feeding by integrating advanced venting mechanisms and improved nipple structures designed to support healthy digestion.

The residential end-use segment accounted for a 59.4% share in 2025. Higher household spending power, coupled with rising attention to infant nutrition, has strengthened product adoption across homes. Technological progress in baby feeding accessories has also contributed to stronger engagement, as connected warming devices and formula preparation systems offer greater control and monitoring through compatible mobile applications, giving parents convenient oversight of feeding routines.

U.S. Baby Feeding Accessories Market held an 82.3% share in 2024. Elevated disposable incomes, strong adherence to infant health guidelines, and strict safety standards continue to drive consumer preference for high-quality feeding solutions. Regulatory emphasis on BPA-free materials and advanced feeding tools has influenced market adoption, while premium brands remain favored for their focus on ergonomic design and smart technology. The growing number of working parents has further accelerated interest in efficient and time-saving accessories.

Key companies active in the Global Baby Feeding Accessories Market include Chicco, Comotomo, Dr. Brown's, Evenflo, Goodbaby International, Lansinoh, MAM Baby, Medela, Munchkin, Nuby, NUK, Philips Avent, Pigeon, Playtex Baby, and Tommee Tippee. Leading manufacturers in the baby feeding accessories space are strengthening their market presence by prioritizing product innovation, sustainability, and digital connectivity. Many brands are expanding their portfolios with eco-friendly materials to meet the rising demand for environmentally responsible products. Companies are also integrating smart technology into feeding devices to appeal to tech-savvy parents seeking greater convenience and accuracy. Strong omnichannel distribution strategies, especially through e-commerce platforms, allow these companies to reach wider audiences with personalized product offerings. In addition, extensive investment in ergonomic design and safety-focused materials helps build consumer trust. Collaborations with healthcare professionals, along with consistent branding and targeted marketing campaigns, further reinforce their competitive advantage and enhance customer loyalty across global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Material

- 2.2.4 Age Group

- 2.2.5 Price Range

- 2.2.6 Technology

- 2.2.7 Standards

- 2.2.8 Sustainability

- 2.2.9 End Use

- 2.2.10 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing lifestyle standards

- 3.2.1.2 Increasing disposable income

- 3.2.1.3 Urbanization & working parents

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Price sensitivity

- 3.2.2.2 Regulatory compliance & safety standards

- 3.2.3 Opportunities

- 3.2.3.1 Eco-friendly & sustainable products

- 3.2.3.2 Smart & connected feeding solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By product type

- 3.6.2 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Consumer behaviour analysis

- 3.13.1 Purchasing patterns

- 3.13.2 Preference analysis

- 3.13.3 Regional variations in consumer behaviour

- 3.13.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022-2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Bottles and nipples

- 5.2.1 Plastic bottles

- 5.2.2 Glass bottles

- 5.2.3 Silicone nipples

- 5.3 Breastfeeding accessories

- 5.4 Baby feeding utensils

- 5.4.1 Baby spoons & forks

- 5.4.2 Baby bowls

- 5.4.3 Baby pacifiers

- 5.4.4 Plates

- 5.4.5 Others (cups, tray, etc.)

- 5.5 Baby formula dispensers

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2022-2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Metallic

- 6.3 Non-Metallic

- 6.3.1 Plastic

- 6.3.2 Silicone

- 6.3.3 Others

Chapter 7 Market Estimates & Forecast, By Age Group, 2022-2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Below 12 months

- 7.3 12 months to 3 years

- 7.4 Above 3 years

Chapter 8 Market Estimates & Forecast, By Price Range, 2022-2035 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low (Below 50 USD)

- 8.3 Medium (50 to 100 USD)

- 8.4 High/Premium (Above 100 USD)

Chapter 9 Market Estimates & Forecast, By Technology, 2022-2035 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Anti-colic & vented systems

- 9.3 Smart/connected feeding accessories

- 9.4 Self-sterilizing products

- 9.5 Temperature monitoring & control

- 9.6 Traditional products

Chapter 10 Market Estimates & Forecast, By Standards, 2022-2035 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 BPA-free certified products

- 10.3 Phthalate-free certified products

- 10.4 FDA food contact approved

- 10.5 JPMA/baby safety alliance verified

Chapter 11 Market Estimates & Forecast, By Sustainability, 2022-2035 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Biodegradable materials

- 11.3 Recyclable products

- 11.4 Organic materials

- 11.5 Carbon-neutral & offset products

- 11.6 Conventional products

Chapter 12 Market Estimates & Forecast, By End Use, 2022-2035 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Residential

- 12.3 Commercial

- 12.3.1 Day care

- 12.3.2 Nursing centers

- 12.3.3 Others

Chapter 13 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Online retail

- 13.2.1 Ecommerce

- 13.2.2 Company owned website

- 13.3 Offline

- 13.3.1 Supermarket/hypermarket

- 13.3.2 Specialty stores

- 13.3.3 Other retail formats

Chapter 14 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 Germany

- 14.3.2 France

- 14.3.3 UK

- 14.3.4 Italy

- 14.3.5 Spain

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 India

- 14.4.3 Japan

- 14.4.4 South Korea

- 14.4.5 Australia

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.5.3 Argentina

- 14.6 MEA

- 14.6.1 South Africa

- 14.6.2 Saudi Arabia

- 14.6.3 UAE

Chapter 15 Company Profiles

- 15.1 Chicco

- 15.2 Comotomo

- 15.3 Dr. Brown's

- 15.4 Evenflo

- 15.5 Goodbaby International

- 15.6 Lansinoh

- 15.7 MAM Baby

- 15.8 Medela

- 15.9 Munchkin

- 15.10 Nuby

- 15.11 NUK

- 15.12 Philips Avent

- 15.13 Pigeon

- 15.14 Playtex Baby

- 15.15 Tommee Tippee