PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892845

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892845

Dietary Fibers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

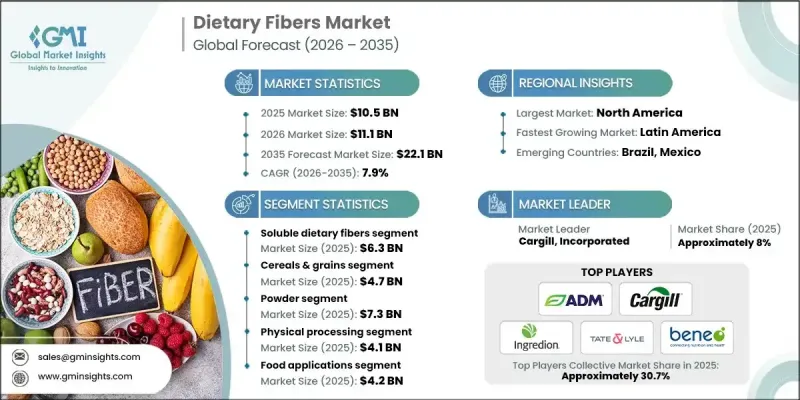

The Global Dietary Fibers Market was valued at USD 10.5 billion in 2025 and is estimated to grow at a CAGR of 7.9% to reach USD 22.1 billion by 2035.

The market growth is fueled by increasing consumer awareness about health and wellness, particularly the importance of gut health and overall well-being. Consumers are actively seeking ways to improve digestive function and prevent lifestyle-related and chronic diseases such as obesity, diabetes, and cardiovascular disorders. This shift toward preventive nutrition is driving food and beverage manufacturers to innovate and produce fiber-enriched products that meet the demands of health-conscious buyers. The rising interest in functional foods, supplements, and beverages fortified with dietary fibers is also contributing to the market's rapid expansion, as consumers increasingly adopt fiber-rich diets to manage weight, control blood sugar, and reduce the risk of chronic illnesses.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $10.5 Billion |

| Forecast Value | $22.1 Billion |

| CAGR | 7.9% |

The soluble dietary fibers segment was valued at USD 6.3 billion in 2025 and is expected to grow at a CAGR of 8.2% from 2026 to 2035. Soluble fibers are gaining traction due to their benefits in digestive health, cholesterol management, and glycemic control. Functional foods, beverages, and dietary supplements are increasingly incorporating soluble fibers as consumer interest in preventive nutrition grows.

The cereals and grains segment reached USD 4.7 billion in 2025 and is projected to grow at a CAGR of 8.1% during 2026-2035. Fibers from cereals and grains are widely used in bakery, snack, and beverage applications, allowing manufacturers to develop a variety of fortified foods that address functional nutrition needs. Their versatility in processing enables innovation across multiple product categories.

North America Dietary Fibers Market accounted for USD 3.1 billion in 2025. Increasing awareness of gut health, weight management, and preventive nutrition is driving the region's demand for fiber-enriched functional foods, beverages, and dietary supplements. A well-established retail infrastructure and high consumer health awareness are supporting steady market growth.

Key players in the Global Dietary Fibers Market include Tate & Lyle PLC, Archer Daniels Midland Company (ADM), Ingredion Incorporated, BENEO GmbH, and Cargill, Incorporated. Companies in the Global Dietary Fibers Market are employing strategies such as investing in research and development to create novel fiber types with enhanced functional properties and health benefits. They are expanding product portfolios to include ready-to-use functional ingredients for food and beverage applications. Strategic partnerships with food manufacturers and ingredient suppliers help broaden market reach, while acquisitions and collaborations strengthen regional presence. Companies are also focusing on consumer education campaigns, marketing fiber-rich solutions for weight management, digestive health, and chronic disease prevention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Source

- 2.2.4 Form

- 2.2.5 Processing Method

- 2.2.6 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Soluble Dietary Fibers

- 5.2.1 Beta-Glucan

- 5.2.1.1 Oat Beta-Glucan

- 5.2.1.2 Barley Beta-Glucan

- 5.2.1.3 Yeast Beta-Glucan

- 5.2.1.4 Mushroom Beta-Glucan

- 5.2.2 Psyllium Husk

- 5.2.3 Inulin & Inulin-Type Fructans

- 5.2.3.1 Chicory Root Inulin

- 5.2.3.2 Jerusalem Artichoke Inulin

- 5.2.3.3 Agave Inulin

- 5.2.4 Pectin

- 5.2.4.1 High-Methoxyl Pectin

- 5.2.4.2 Low-Methoxyl Pectin

- 5.2.5 Polydextrose

- 5.2.6 Fructooligosaccharides (FOS)

- 5.2.7 Galactooligosaccharides (GOS)

- 5.2.8 Resistant Maltodextrin/Dextrin

- 5.2.9 Soluble Corn Fiber

- 5.2.10 Guar Gum

- 5.2.11 Locust Bean Gum

- 5.2.12 Acacia (Gum Arabic)

- 5.2.13 Alginate

- 5.2.14 Arabinoxylan

- 5.2.15 Glucomannan

- 5.2.1 Beta-Glucan

- 5.3 Insoluble Dietary Fibers

- 5.3.1 Cellulose

- 5.3.1.1 Microcrystalline Cellulose (MCC)

- 5.3.1.2 Powdered Cellulose

- 5.3.2 Hemicellulose

- 5.3.3 Lignin

- 5.3.4 Resistant Starch

- 5.3.4.1 RS1 (Physically Inaccessible)

- 5.3.4.2 RS2 (Granular Starch)

- 5.3.4.3 RS3 (Retrograded Starch)

- 5.3.4.4 RS4 (Chemically Modified)

- 5.3.4.5 RS5 (Amylose-Lipid Complex)

- 5.3.5 Chitin & Chitosan

- 5.3.6 Wheat Bran/Cereal Bran

- 5.3.7 Corn Bran

- 5.3.8 Hydroxypropylmethylcellulose (HPMC)

- 5.3.9 Mixed Plant Cell Wall Fibers

- 5.3.9.1 Sugar Cane Fiber

- 5.3.9.2 Apple Fiber

- 5.3.9.3 Citrus Fiber

- 5.3.1 Cellulose

Chapter 6 Market Estimates and Forecast, By Source, 2022 - 2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Cereals & Grains

- 6.2.1 Wheat

- 6.2.2 Oats

- 6.2.3 Barley

- 6.2.4 Corn

- 6.2.5 Rice

- 6.2.6 Rye

- 6.3 Fruits & Vegetables

- 6.3.1 Citrus

- 6.3.2 Apple

- 6.3.3 Banana

- 6.3.4 Root Vegetables (Chicory, Potato)

- 6.3.5 Other Fruits (Berries, Guava)

- 6.4 Legumes

- 6.4.1 Beans

- 6.4.2 Peas

- 6.4.3 Lentils

- 6.4.4 Soybeans

- 6.5 Nuts & Seeds

- 6.5.1 Chia Seeds

- 6.5.2 Flaxseed

- 6.5.3 Psyllium

- 6.5.4 Almonds

- 6.6 Other Sources

- 6.6.1 Seaweed/Algae

- 6.6.2 Fungi/Mushrooms

- 6.6.3 Yeast

- 6.6.4 Microbial/Fermentation-Derived

Chapter 7 Market Estimates and Forecast, By Form, 2022 - 2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.2.1 Fine/Ultrafine Powder

- 7.2.2 Coarse Powder

- 7.2.3 Flavored Powder

- 7.2.4 Unflavored Powder

- 7.3 Liquid/Gel

- 7.3.1 Liquid Concentrate

- 7.3.2 Syrup

- 7.4 Solid Dosage Forms

- 7.4.1 Capsules

- 7.4.2 Caplets/Tablets

- 7.4.3 Gummies

- 7.4.4 Wafers

- 7.5 Convenience Formats

- 7.5.1 Single-Serve Packets

- 7.5.2 On-the-Go Formats

Chapter 8 Market Estimates and Forecast, By Processing Method, 2022 - 2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Physical Processing

- 8.2.1 Mechanical Milling/Grinding

- 8.2.2 Steam Explosion

- 8.2.3 Extrusion

- 8.2.3.1 Single-Screw Extrusion

- 8.2.3.2 Twin-Screw Extrusion

- 8.2.3.3 Blasting Extrusion

- 8.2.4 High Hydrostatic Pressure (HHP)

- 8.2.5 Microwave-Assisted Extraction

- 8.2.6 Ultrafine/Superfine Grinding

- 8.2.7 High-Pressure Homogenization (HPH)

- 8.3 Chemical Processing

- 8.3.1 Acid Extraction

- 8.3.2 Alkaline Extraction

- 8.3.3 Oxidation

- 8.3.4 Chemical Modification

- 8.4 Enzymatic Processing

- 8.4.1 Cellulase Treatment

- 8.4.2 Hemicellulase/Xylanase Treatment

- 8.4.3 Pectinase Treatment

- 8.4.4 Amylase/Protease Treatment

- 8.5 Biological/Fermentation Processing

- 8.5.1 Lactic Acid Bacteria Fermentation

- 8.5.2 Fungal Fermentation

- 8.5.3 Yeast Fermentation

- 8.5.4 Solid-State Fermentation (SSF)

- 8.6 Hybrid/Combined Methods

- 8.6.1 Fermentation + Microfluidization

- 8.6.2 Enzymatic + Ultrasound

- 8.6.3 Extrusion + Alkaline Treatment

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Food Applications

- 9.2.1 Bakery

- 9.2.1.1 Bread & Rolls

- 9.2.1.2 Biscuits & Cookies

- 9.2.1.3 Cakes & Muffins

- 9.2.1.4 Pastries

- 9.2.2 Breakfast Cereals & Snacks

- 9.2.2.1 Ready-to-Eat Cereals

- 9.2.2.2 Hot Cereals

- 9.2.2.3 Cereal Bars

- 9.2.2.4 Nutrition Bars

- 9.2.2.5 Snack Crackers

- 9.2.3 Confectionery

- 9.2.3.1 Chocolate

- 9.2.3.2 Candies & Gummies

- 9.2.3.3 Sugar-Free Confectionery

- 9.2.4 Dairy & Dairy Alternatives

- 9.2.4.1 Yogurt

- 9.2.4.2 Ice Cream & Frozen Desserts

- 9.2.4.3 Cheese & Cheese Alternatives

- 9.2.4.4 Fluid Milk & Milk Alternatives

- 9.2.4.5 Plant-Based Dairy Alternatives

- 9.2.5 Meat & Meat Alternatives

- 9.2.5.1 Sausages

- 9.2.5.2 Processed Meat Products

- 9.2.5.3 Plant-Based Meat Alternatives

- 9.2.6 Infant & Toddler Nutrition

- 9.2.6.1 Infant Formula

- 9.2.6.2 Baby Food

- 9.2.6.3 Toddler Nutrition Products

- 9.2.7 Other Food Applications

- 9.2.7.1 Pasta & Noodles

- 9.2.7.2 Soups & Sauces

- 9.2.7.3 Dressings & Condiments

- 9.2.7.4 Ready Meals

- 9.2.1 Bakery

- 9.3 Beverage Applications

- 9.3.1 Functional Beverages

- 9.3.2 Nutrition Shakes

- 9.3.3 Smoothies

- 9.3.4 Carbonated Beverages

- 9.3.5 Juice & Juice Drinks

- 9.3.6 Powdered Beverage Mixes

- 9.4 Pharmaceutical Applications

- 9.4.1 Laxatives

- 9.4.2 Cholesterol Management

- 9.4.3 Diabetes Management

- 9.4.4 Medical Nutrition (Enteral/Parenteral)

- 9.5 Dietary Supplements

- 9.5.1 Digestive Health Supplements

- 9.5.2 Weight Management Supplements

- 9.5.3 Prebiotic Supplements

- 9.5.4 Sports Nutrition

- 9.6 Animal Nutrition

- 9.6.1 Companion Animal (Pet Food)

- 9.6.2 Livestock Feed

- 9.6.3 Aquaculture

- 9.7 Other Applications

- 9.7.1 Personal Care & Cosmetics

- 9.7.2 Biodegradable Packaging Materials

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion, Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 Archer Daniels Midland Company (ADM)

- 11.2 Cargill, Incorporated

- 11.3 Ingredion Incorporated

- 11.4 Tate & Lyle PLC

- 11.5 BENEO GmbH

- 11.6 Sudzucker Group

- 11.7 Roquette Freres

- 11.8 Kerry Group

- 11.9 J. Rettenmaier & Sohne GmbH & Co. KG

- 11.10 SunOpta, Inc.

- 11.11 Taiyo Kagaku Co., Ltd.

- 11.12 Nexira

- 11.13 Fiberstar, Inc.

- 11.14 Emsland Group

- 11.15 AGT Food and Ingredients

- 11.16 Shandong Minqiang Biotechnology Co., Ltd.

- 11.17 Grain Processing Corporation

- 11.18 Tereos Syral

- 11.19 Farbest-Tallman Foods Corporation

- 11.20 Cosucra Groupe Warcoing SA