PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892849

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892849

Plasma Cutting Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

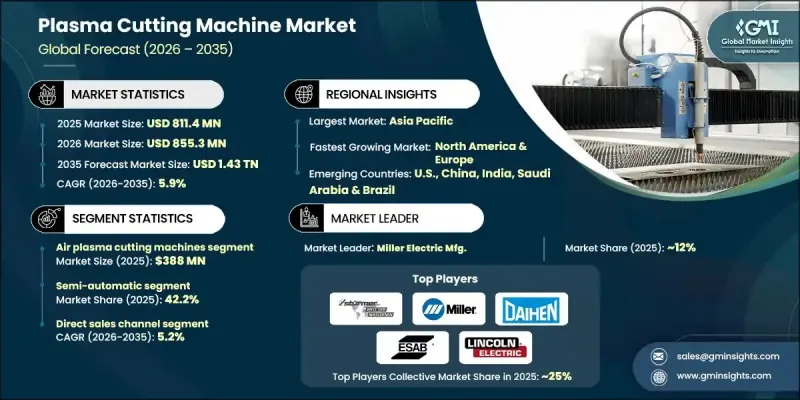

The Global Plasma Cutting Machine Market was valued at USD 811.4 million in 2025 and is estimated to grow at a CAGR of 5.9% to reach USD 1.43 trillion by 2035.

The market is propelled by the rising adoption of CNC technologies and automation in plasma cutting systems. CNC integration allows manufacturers to produce high-precision components consistently, reducing human error and increasing overall production efficiency. Automation also supports the implementation of Industry 4.0 initiatives, including IoT-enabled monitoring, predictive maintenance, and seamless connectivity between manufacturing systems, enhancing productivity. Industries such as aerospace, automotive, and heavy engineering rely heavily on plasma cutting machines due to these capabilities. Additionally, the growing demand for energy-efficient and high-definition plasma systems is driving manufacturers to innovate machines that operate at lower power levels while maintaining superior cut quality. These technologies reduce heat generation during cutting, minimize material wastage, and prevent heat-induced distortion, offering both economic and environmental benefits.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $811.4 Million |

| Forecast Value | $1.43 Trillion |

| CAGR | 5.9% |

The air plasma cutting machines segment generated USD 388 million in 2025 and is expected to grow at a CAGR of 6.2% from 2026 to 2035. Air plasma systems use compressed air as the plasma gas, making them cost-effective and convenient for small and medium-sized enterprises. These machines are highly efficient for cutting mild steel and other widely used metals and are preferred in fabrication and light industrial applications due to their low maintenance requirements and ease of setup compared to oxygen or hydrogen plasma systems.

The direct sales channel held a 64.4% share in 2025 and is anticipated to grow at a CAGR of 5.2% through 2035. Direct engagement allows manufacturers to provide customized cutting solutions, technical support, and timely delivery of spare parts, strengthening customer relationships and improving operational efficiency.

U.S. Plasma Cutting Machine Market generated USD 138.9 million in 2025 and is expected to grow at a CAGR of 3.5% from 2026 to 2035. The country's advanced industrial base, strong manufacturing infrastructure, and early adoption of automation technologies drive high demand for CNC-controlled and high-definition plasma cutting machines. Key sectors such as automotive, aerospace, and heavy machinery require precision cutting, boosting market growth.

Major players operating in the Plasma Cutting Machine Market include Voortman Steel, Haco, ERMAKSAN, Lincoln Electric Holdings, Inc., Hypertherm, Inc., C & G Systems, Victor Technologies, Komatsu Cutting Systems, Miller Electric Mfg, DAIHEN Corporation, AJAN ELEKTRONIK, Sturmer Maschinen GmbH, Koike Aronson, Jinan Huaxia Machinery Equipment Co., Ltd., ACM Inc., Ador Welding Ltd., and ESAB Welding and Cutting Products. Companies in the Plasma Cutting Machine Market are employing multiple strategies to strengthen their market foothold. They are heavily investing in research and development to introduce high-definition, energy-efficient, and IoT-enabled plasma systems. Strategic collaborations with automotive, aerospace, and heavy engineering firms help expand customer reach and ensure product customization. Geographic expansion and the development of local service and support networks enhance accessibility for clients.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Cutting technology

- 2.2.3 Operation

- 2.2.4 End Use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Widespread adoption of CNC and automation

- 3.2.1.2 Energy-efficient models & high-definition technology

- 3.2.1.3 Rapid urbanization and infrastructure projects

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Intense competition from alternative technologies

- 3.2.2.2 High capital costs & adoption barriers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Cutting technology

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Cutting Technology, 2022 - 2035, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Air plasma cutting machines

- 5.3 Oxygen plasma cutting machines

- 5.4 Nitrogen plasma cutting machines

- 5.5 Hydrogen plasma cutting machine

Chapter 6 Market Estimates & Forecast, By Operation, 2022 - 2035, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-automatic

- 6.4 Manual

Chapter 7 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Manufacturing

- 7.4 Aerospace and defense

- 7.5 Shipping and maritime

- 7.6 Construction and infrastructure

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ACM Inc.

- 10.2 Ador Welding Ltd.

- 10.3 AJAN ELEKTRONIK

- 10.4 C & G Systems

- 10.5 ERMAKSAN

- 10.6 ESAB Welding and Cutting Products

- 10.7 DAIHEN Corporation

- 10.8 Haco

- 10.9 Hypertherm, Inc.

- 10.10 Jinan Huaxia Machinery Equipment Co. Ltd.

- 10.11 Kjellberg Finsterwalde Plasma und Maschinen GmbH

- 10.12 Koike Aronson

- 10.13 Komatsu cutting systems

- 10.14 Lincoln Electric Holdings, Inc.

- 10.15 Miller Electric Mfg

- 10.16 Sturmer maschinen gmbh

- 10.17 Victor Technologies

- 10.18 Voortman Steel