PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892852

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892852

Data Center Server Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

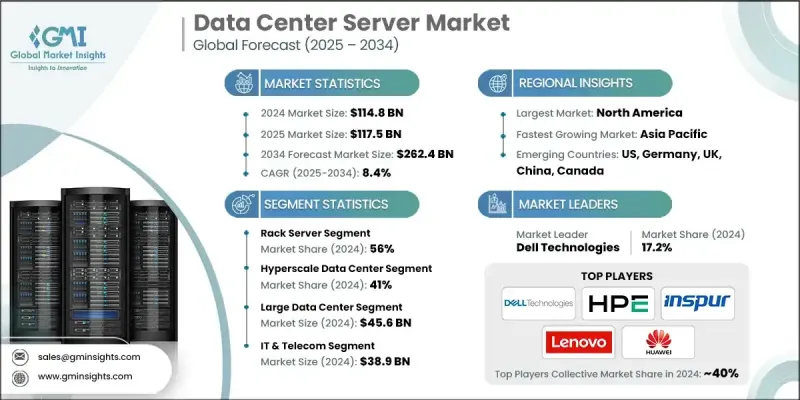

The Global Data Center Server Market was valued at USD 114.8 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 262.4 billion by 2034.

Expanding AI workloads are reshaping compute requirements, as large language model training, inference operations, and accelerated analytics increasingly rely on high-performance GPU and specialized server architectures. Demand is rising rapidly for advanced systems built to support these intensive tasks, pushing data centers to adopt GPU-rich configurations with far higher cooling and power needs than traditional deployments. At the same time, the growing scale of data generated by connected devices, enterprise platforms, industrial automation systems, and mobile applications is prompting organizations to upgrade and expand their compute infrastructure. Industries such as telecom, BFSI, retail, and healthcare process enormous volumes of information that require fast, reliable servers capable of supporting real-time analytics. As companies modernize outdated IT environments and continue shifting toward hybrid and multi-cloud models, scalable server systems become essential to sustaining digital transformation, automation, and data-heavy applications across business operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $114.8 Billion |

| Forecast Value | $262.4 Billion |

| CAGR | 8.4% |

The rack server segment held a 56% share in 2024 and is expected to grow at an 8.8% CAGR through 2034. Rack-mounted systems allow operators to scale capacity efficiently within standardized racks while maintaining high compute density and operational flexibility. Their modularity aligns with current cloud deployments, making them the preferred infrastructure choice across enterprises and hyperscale facilities.

The hyperscale data center category held a 41% share in 2024 and is projected to grow at a CAGR of 9.1% between 2025 and 2034. Hyperscale operators deploy large GPU clusters to power advanced workloads, including recommendation engines, LLM training, and vision models. These environments require dense rack-based computes with advanced networking and thermal management, positioning rack servers as the primary architecture supporting hyperscale growth.

U.S. Data Center Server Market generated USD 49.9 billion in 2024. The country hosts the most extensive concentration of hyperscale facilities worldwide, supported by major cloud providers and their continuous expansion of AI-driven compute clusters. These large deployments consume vast numbers of rack servers each year, strengthening the country's leadership in the region.

Leading companies in the Global Data Center Server Market include Dell Technologies, HPE, Inspur Power Systems, Lenovo, Huawei, Supermicro, Cisco Systems, Fujitsu, IBM, and Sugon. To strengthen their presence in the Data Center Server Market, companies are prioritizing several key strategies. Many are expanding their portfolios with GPU-dense and AI-optimized server platforms designed to support high-performance computing and accelerated workloads. Partnerships with cloud providers, semiconductor manufacturers, and hyperscale operators help streamline integration of next-generation processors, networking, and cooling technologies. Firms are also investing heavily in energy-efficient architecture, liquid cooling, and modular designs that address rising power density challenges. Global manufacturing expansion and supply chain diversification ensure consistent delivery at hyperscale volumes. Additionally, companies are enhancing software-defined capabilities, automation tools, and infrastructure management platforms to deliver full-stack solutions that support modern cloud and hybrid environments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Server

- 2.2.3 Data Center

- 2.2.4 Data Center Size

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Semiconductor & component suppliers

- 3.1.1.2 Server OEMs

- 3.1.1.3 Cooling, rack infrastructure & power delivery vendors

- 3.1.1.4 Data center operators

- 3.1.1.5 Cloud platforms & service providers

- 3.1.1.6 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid growth of cloud computing & hyperscale expansion

- 3.2.1.2 Explosion of AI, machine learning & high-performance computing (HPC)

- 3.2.1.3 Increasing data generation across industries

- 3.2.1.4 Growth of edge computing for low-latency applications

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Power & cooling constraints limit high-density server deployments

- 3.2.2.2 Rising energy costs pressure TCO and server refresh decisions

- 3.2.2.3 Supply chain volatility and semiconductor shortages delay server shipments

- 3.2.3 Market opportunities

- 3.2.3.1 Accelerated adoption of AI-optimized and GPU-accelerated servers

- 3.2.3.2 Growth of edge computing opens new server deployment footprints

- 3.2.3.3 Transition to liquid cooling creates hardware upgrade cycles

- 3.2.3.4 Rise of ARM-based servers and alternative architectures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology trends & innovation ecosystem

- 3.7.1 Current technologies

- 3.7.1.1 x86-based server architectures

- 3.7.1.2 GPU-accelerated compute systems for AI/HPC

- 3.7.1.3 Traditional air-cooling with advanced airflow management

- 3.7.1.4 Virtualization & hypervisor platforms

- 3.7.2 Emerging technologies

- 3.7.2.1 CXL-based disaggregated & composable infrastructure

- 3.7.2.2 Silicon photonics & optical interconnects for AI clusters

- 3.7.2.3 Sustainable & energy-efficient server designs

- 3.7.2.4 AI-driven autonomous data center operations & optimization

- 3.7.1 Current technologies

- 3.8 Patent analysis

- 3.9 Price trend analysis

- 3.9.1 By region

- 3.9.2 By Products

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Risk analysis & management

- 3.12.1 Operational risk assessment

- 3.12.2 Financial risk evaluation

- 3.12.3 Technology & cybersecurity risks

- 3.12.4 Risk mitigation strategies

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Use cases

- 3.15 Best case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Server, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Rack

- 5.3 Tower

- 5.4 Blade

- 5.5 Micro

- 5.6 GPU/Accelerated

Chapter 6 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Enterprise

- 6.3 Colocation

- 6.4 Hyperscale

- 6.5 Edge

Chapter 7 Market Estimates & Forecast, By Data Center Size, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Small data centers

- 7.3 Medium data center

- 7.4 Large data center

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 IT & Telecom

- 8.3 BFSI

- 8.4 Government & Defense

- 8.5 Healthcare

- 8.6 Retail & E-commerce

- 8.7 Manufacturing

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Thailand

- 9.4.7 Indonesia

- 9.4.8 Singapore

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Leaders

- 10.1.1 Cisco Systems

- 10.1.2 Dell Technologies

- 10.1.3 Fujitsu

- 10.1.4 Hewlett Packard Enterprise (HPE)

- 10.1.5 Huawei

- 10.1.6 IBM

- 10.1.7 Inspur Power Systems

- 10.1.8 Lenovo

- 10.1.9 Oracle

- 10.1.10 Sugon

- 10.1.11 Supermicro

- 10.1.12 Wiwynn

- 10.2 Regional Champions

- 10.2.1 Atos

- 10.2.2 Canovate Elektronik

- 10.2.3 NEC

- 10.2.4 OVHcloud

- 10.2.5 Penguin Computing

- 10.2.6 Quanta Cloud Technology

- 10.2.7 Tyan Computer

- 10.2.8 ZT Systems

- 10.3 Emerging Players

- 10.3.1 Broadberry Data Systems

- 10.3.2 Jabil

- 10.3.3 Oxide Computer Company