PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892855

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892855

Bicycle Bottom Bracket Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

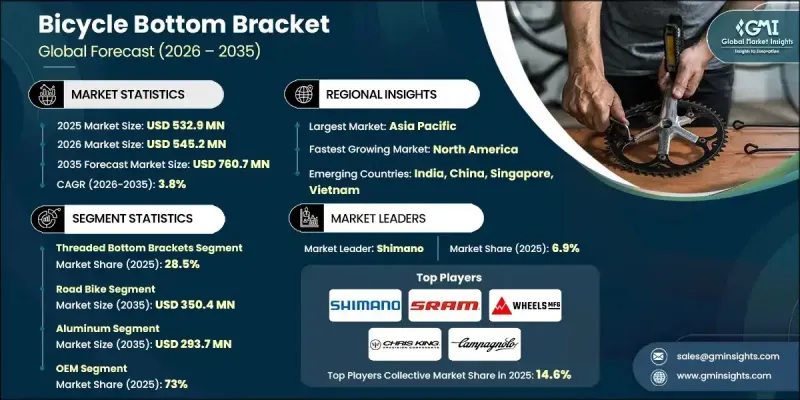

The Global Bicycle Bottom Bracket Market was valued at USD 532.9 million in 2025 and is estimated to grow at a CAGR of 3.8% to reach USD 760.7 million by 2035.

Increasing participation in cycling for fitness, commuting, and leisure continues to elevate the need for durable and efficient power-train components. As riders invest in mid-range and premium bicycles, demand from both OEMs and aftermarket suppliers for long-lasting bottom brackets is expanding. The overall market outlook mirrors the momentum seen across the broader cycling industry, with strong growth trends visible in multiple regions. The rising adoption of electric bicycles is expected to be a major catalyst, as these models require bottom brackets capable of handling higher torque, improved load distribution, and enhanced vibration control. This shift is pushing manufacturers to develop reinforced designs that incorporate advanced bearings and durable materials. With e-bike sales accelerating globally, bicycle brands are placing greater emphasis on bottom bracket systems that deliver longevity and robust performance. Continuous advancements in bearing technology, machining precision, and friction-reduction methods are raising the performance standards within the category. Brands offering products with superior stiffness-to-weight ratios, more effective seals, and longer service intervals are strengthening their competitive edge and contributing to growing upgrade cycles and OEM adoption.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $532.9 Million |

| Forecast Value | $760.7 Million |

| CAGR | 3.8% |

The threaded bottom brackets segment held a 28.5% share in 2025 and is projected to reach USD 177.3 million by 2035. This configuration remains valued for its dependable fit, durable construction, and straightforward installation process. Its continued usage in commuter, touring, steel-frame, and restoration-focused bicycles highlights its ongoing relevance, even as newer frame standards gain traction. Strong aftermarket demand ensures threaded systems remain a vital part of the market.

The road bike application segment held a 51.35% share in 2025 and is anticipated to reach USD 350.4 million by 2035. Road cycling places high importance on efficiency, lightweight components, smooth bearings, and integrated performance. Established markets maintain steady replacement demand, while developing regions present expanding opportunities for premium bottom bracket adoption and regular upgrades.

US Bicycle Bottom Bracket Market was valued at USD 89.9 million in 2025. The rapid rise of gravel riding in the country is increasing the need for bottom brackets that offer robust sealing, contamination resistance, and extended durability. Riders seeking long-term reliability, minimal maintenance, and consistent performance across mixed terrain are driving greater interest in advanced aftermarket solutions.

Leading companies in the Global Bicycle Bottom Bracket Market include Campagnolo, Cane Creek Cycling Components, Chris King Precision Components, Enduro Bearings, Full Speed Ahead, Shimano, SRAM, Token Products, and Wheels Manufacturing. Companies in the Global Bicycle Bottom Bracket Market are strengthening their positions by advancing bearing technology, refining material engineering, and increasing product compatibility across multiple frame standards. Many manufacturers are investing in enhanced sealing systems, precision machining, and friction-reducing coatings to deliver smoother, longer-lasting performance. Product diversification aimed at serving both e-bike platforms and performance cycling segments is becoming a core strategic priority. Partnerships with OEMs help secure long-term integration into new bicycle models, while aftermarket-focused brands continue to expand upgrade options for riders seeking improved durability. Firms are also optimizing manufacturing processes to maintain consistent quality and reduce weight without sacrificing stiffness. Marketing efforts centered on product reliability, ease of maintenance, and technical innovation further reinforce brand competitiveness.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Offering

- 2.2.3 Application

- 2.2.4 Material

- 2.2.5 Distribution channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Growth in global bicycle sales

- 3.2.1.3 Expansion of e-bike market

- 3.2.1.4 Advancements in material technology

- 3.2.1.5 Rising popularity of performance cycling

- 3.2.1.6 Aftermarket customization growth

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Compatibility issues across bb standards

- 3.2.2.2 High cost of advanced materials

- 3.2.3 Market opportunities

- 3.2.3.1 E-bike-specific bb designs

- 3.2.3.2 Growth in gravel/adventure cycling

- 3.2.3.3 Integrated and smart component adoption

- 3.2.3.4 Lightweight frame integration

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US: Consumer Product Safety Commission (CPSC) 16 Code of Federal Regulations (CFR) part 1512

- 3.4.1.2 Canada: International Organization for Standardization (ISO) 4210

- 3.4.2 Europe

- 3.4.2.1 Germany: Deutsches Institut fur Normung (DIN) European Norm (EN) ISO 4210

- 3.4.2.2 UK: European Norm (EN) ISO 4210 / United Kingdom Conformity Assessed (UKCA)

- 3.4.2.3 France: European Norm (EN) ISO 4210

- 3.4.3 Asia Pacific

- 3.4.3.1 China: Guobiao (GB) 3565

- 3.4.3.2 India: Indian Standard (IS) 10613

- 3.4.3.3 Japan: Japanese Industrial Standard (JIS) D 9110

- 3.4.4 Latin America

- 3.4.4.1 Brazil: Associacao Brasileira de Normas Tecnicas (ABNT) Norma Brasileira (NBR) ISO 4210

- 3.4.4.2 Mexico: International Organization for Standardization (ISO) 4210

- 3.4.5 Middle East & Africa

- 3.4.5.1 South Africa: South African National Standard (SANS) 311

- 3.4.5.2 Saudi Arabia: Saudi Standards, Metrology and Quality Organization (SASO) Gulf Standardization Organization (GSO) ISO 4210

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Pricing analysis & market economics

- 3.10.1 By region

- 3.10.2 By Offering

- 3.11 Cost breakdown analysis

- 3.12 Patent analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly Initiatives

- 3.14 Carbon footprint considerations

- 3.15 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Threaded bottom bracket

- 5.3 Press-fit bottom bracket

- 5.4 External bottom bracket

- 5.5 Cartridge bottom bracket

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Road bike

- 6.3 Mountain bike

- 6.4 Racing bike

- 6.5 Gravel bike

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Aluminum

- 7.4 Carbon fiber

- 7.5 Titanium

- 7.6 Composite materials

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By End Use, 2022-2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Professional / Performance Cyclists

- 9.3 Recreational Cyclists

- 9.4 Commuter Users

- 9.5 Bike Manufacturers

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Campagnolo

- 11.1.2 Full Speed Ahead (FSA)

- 11.1.3 Hope Technology

- 11.1.4 Praxis Works

- 11.1.5 Race Face

- 11.1.6 Shimano

- 11.1.7 SRAM

- 11.1.8 Wheels Manufacturing

- 111.9 White Industries

- 11.2 Regional Players

- 11.2.1 Cane Creek Cycling Components

- 11.2.2 Chris King Precision Components

- 11.2.3 MicroSHIFT

- 11.2.4 Stronglight

- 11.2.5 Sugino

- 11.2.6 SunRace

- 11.2.7 Token Products

- 11.2.8 VP Components

- 11.3 Emerging / Disruptor Players

- 11.3.1 BBInfinite

- 11.3.2 C-Bear

- 11.3.3 CeramicSpeed

- 11.3.4 Enduro Bearings

- 11.3.5 Hambini Engineering

- 11.3.6 Kogel Bearings

- 11.3.7 AbsoluteBlack

- 11.3.8 Tripeak Bearings