PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892857

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892857

Digital Textile Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

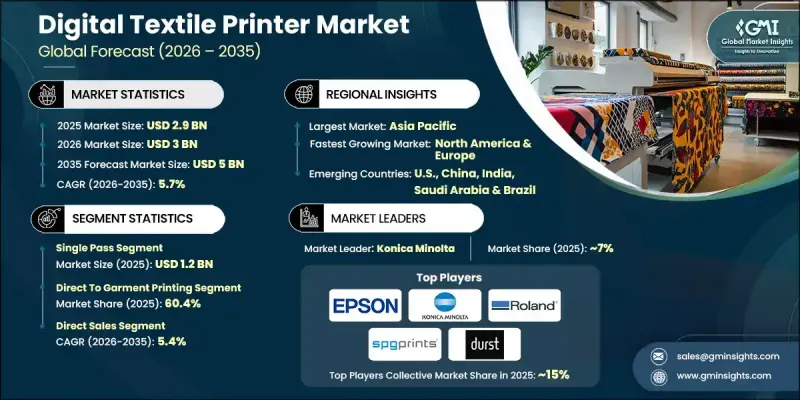

The Global Digital Textile Printer Market was valued at USD 2.9 billion in 2025 and is estimated to grow at a CAGR of 5.7% to reach USD 5 billion by 2035.

This growth is driven by several key trends transforming the textile industry. Consumers increasingly demand on-demand and personalized textiles, prompting manufacturers to adopt faster, more flexible production methods. The rise of fast fashion, online shopping platforms, and social media-driven trends is pushing textile companies to produce smaller, highly customized batches. Digital textile printing enables brands to deliver these products with reduced setup times, faster turnaround, and lower inventory costs compared to traditional printing methods. Advancements in technology, including single-pass print heads, AI-driven color management systems, and automated workflows, further boost efficiency, precision, and productivity. High-resolution printing across diverse textile types while minimizing downtime and production costs makes digital textile printers increasingly essential for the modern apparel and home decor sectors.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.9 Billion |

| Forecast Value | $5 Billion |

| CAGR | 5.7% |

The single-pass printers segment generated USD 1.2 billion in 2025 and is expected to grow at a CAGR of 5.7% from 2026 to 2035. These printers complete entire designs in a single pass, dramatically reducing production time and allowing manufacturers to meet demand for rapid-turnaround fashion and bulk orders, making them ideal for e-commerce and personalized apparel production.

The direct-to-garment (DTG) printing segment held a 60.4% share in 2025 and is projected to grow at a CAGR of 6% from 2026 to 2035. DTG technology allows high-quality, full-color designs to be printed directly onto finished garments without complex setups, supporting on-demand production and e-commerce-driven business models. Its adaptability attracts small and medium enterprises, custom apparel businesses, and online platforms offering personalized clothing.

U.S. Digital Textile Printer Market was valued at USD 370 million in 2025 and is expected to grow at a CAGR of 4.6% from 2026 to 2035. Strong fashion, home decor, and technical textile industries drive demand for advanced printing technologies that support mass customization and rapid design turnaround. On-demand production models, micro-factory setups, and sustainability initiatives, including waterless printing and low-impact inks, further fuel market growth.

Key players in the Global Digital Textile Printer Market include Aleph S.r.l., Durst Group, EFI (Electronics For Imaging), Epson, Hollanders Printing Systems, JK Group, Konica Minolta, Kornit Digital, Mimaki Engineering, MS Printing Solutions, Mutoh, Reggiani Machine, Roland DG, Seiko Epson Corporation, and SPGPrints. Companies in the Global Digital Textile Printer Market are expanding their footprint by investing in advanced printing technologies, such as AI-assisted color management, single-pass printing, and automated workflow systems, to increase efficiency and precision. Strategic partnerships with textile manufacturers, fashion brands, and e-commerce platforms enable wider adoption of digital printing solutions. Firms are also focusing on sustainable and eco-friendly printing methods to meet environmental regulations and consumer demand. Expanding global distribution networks, enhancing after-sales support, and offering training programs help strengthen market presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Ink type

- 2.2.4 Material

- 2.2.5 Technology

- 2.2.6 Printing process

- 2.2.7 Application

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Consumer demand for personalization & on-demand production

- 3.2.1.2 Water-saving and eco-friendly inks

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investments & operating costs

- 3.2.2.2 Ink quality, durability & sustainability hurdles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Plotter

- 5.3 Scanner

- 5.4 Single pass

Chapter 6 Market Estimates & Forecast, By Ink Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Reactive ink

- 6.3 Acid ink

- 6.4 Disperse ink

- 6.5 Pigment ink

- 6.6 Other

Chapter 7 Market Estimates & Forecast, By Material, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Cotton

- 7.3 Polyester

- 7.4 Silk

- 7.5 Blended fabrics

Chapter 8 Market Estimates & Forecast, By Technology, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Thermal inkjet

- 8.3 Piezoelectric inkjet

- 8.4 Continuous inkjet

- 8.5 Thermal transfer

- 8.6 Electrostatic

- 8.7 Electrophotography

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Printing Process, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct to garment printing

- 9.3 Direct to fabrics

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Fashion and clothing industry

- 10.3 Home furnishing

- 10.4 Automotive and transportation

- 10.5 Healthcare and medical

- 10.6 Sports and fitness industry

- 10.7 Advertising and marketing

- 10.8 Others (aerospace, education, construction)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Indonesia

- 12.4.7 Malaysia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Aleph S.r.l.

- 13.2 Durst Group

- 13.3 EFI (Electronics For Imaging)

- 13.4 Epson

- 13.5 Hollanders Printing Systems

- 13.6 JK Group

- 13.7 Konica Minolta

- 13.8 Kornit Digital

- 13.9 Mimaki Engineering

- 13.10 MS Printing Solutions

- 13.11 Mutoh

- 13.12 Reggiani Machine

- 13.13 Roland DG

- 13.14 Seiko Epson Corporation

- 13.15 SPGPrints