PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892867

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892867

Press Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

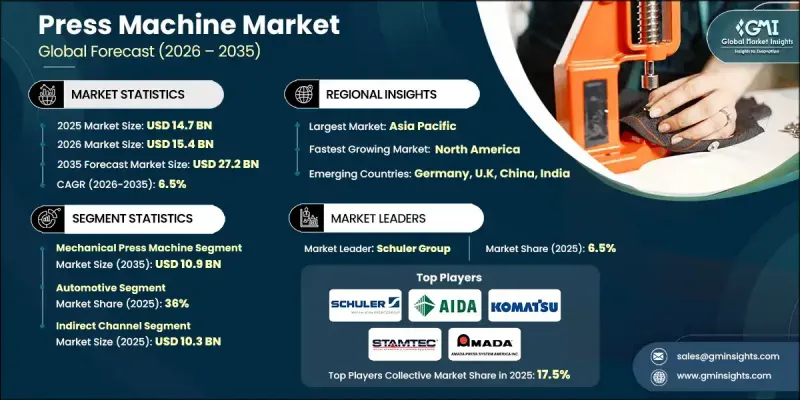

The Global Press Machine Market was valued at USD 14.7 billion in 2025 and is estimated to grow at a CAGR of 6.5% to reach USD 27.2 billion by 2035.

The market is expanding as press machines play a crucial role in manufacturing across multiple industries, including automotive, aerospace, construction, and electronics. These machines are essential for shaping, stamping, forging, and molding operations, and their efficiency directly impacts production output and product quality. The growing demand for advanced press technologies, including servo and hydraulic presses, reflects manufacturers' focus on improving productivity and operational precision. Rising adoption of lightweight and high-strength materials to enhance fuel efficiency and sustainability in vehicle production further drives the market. Policies supporting electrification and industrial modernization, coupled with increasing global vehicle production, have elevated the demand for press machines capable of high-volume, high-precision operations. Companies are continuously innovating to provide automated, energy-efficient, and highly reliable press solutions that meet the evolving needs of modern manufacturing environments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $14.7 Billion |

| Forecast Value | $27.2 Billion |

| CAGR | 6.5% |

The mechanical press machine segment generated USD 5.8 billion in 2025 and is expected to reach USD 10.9 billion by 2035. Mechanical presses remain popular due to their cost-effectiveness, operational flexibility, and suitability for low-cost production applications. Rising global demand for efficient manufacturing solutions is encouraging widespread adoption of mechanical presses across various industries, providing reliable solutions for high-volume metal forming and stamping needs.

The automotive sector accounted for a 36% share in 2025. This dominance is driven by the high demand from automotive manufacturers for precise, efficient production of vehicle components. The need for tight tolerances and efficient mass production has prompted manufacturers to invest in advanced press technologies that enhance productivity, reduce material waste, and improve product quality.

United States Press Machine Market held 87.4% share in 2024. The growth is fueled by strong automotive and aerospace production as well as large-scale infrastructure investments. Government initiatives supporting industrial modernization, precision manufacturing, and semiconductor production have further increased the need for high-performance press machines in metal forming, component fabrication, and high-precision manufacturing applications.

Major companies operating in the Global Press Machine Market include AIDA, Komatsu, Amada Press System, Schuler Group, Macrodyne Technologies, Beckwood Press, Bruderer, Bliss-Bret, Nidec Minster, Isgec Heavy Engineering, SMS Group, Sutherland Presses, Yangli Group, Shieh Yih Machinery Industry, and Stamtec. Companies in the Press Machine Market are strengthening their position by investing in research and development to introduce advanced, energy-efficient, and automated press solutions. Strategic partnerships and collaborations with OEMs and Tier-1 suppliers allow firms to expand market reach and optimize production processes. They focus on customizing presses for high-precision and high-volume manufacturing while integrating smart technologies for predictive maintenance and operational monitoring. Expanding local production facilities and service networks improves delivery timelines and after-sales support. Standardizing technical specifications and adhering to regulatory and safety standards enhances credibility and customer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Capacity

- 2.2.4 Automation

- 2.2.5 Application

- 2.2.6 End Use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion in the manufacturing industries

- 3.2.1.2 Growing emphasis on automation in manufacturing industries

- 3.2.1.3 Rapid growth in the urbanization and industrialization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and intensive maintenance requirement

- 3.2.2.2 Volatility in raw material prices & supply chain disruptions

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of servo press technology for precision & energy efficiency

- 3.2.3.2 Integration of IoT & predictive maintenance solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Type

- 3.6.2 By Region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 8462; 8465)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Mechanical press

- 5.3 Hydraulic press

- 5.4 Servo press

- 5.5 Pneumatic press

Chapter 6 Market Estimates & Forecast, By Capacity, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Up to 500 tons

- 6.3 500 tons to 2000 tons

- 6.4 Above 2000 tons

Chapter 7 Market Estimates & Forecast, By Automation, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual press machines

- 7.3 Semi-automated press machines

- 7.4 Fully automated press machines

- 7.5 Smart/IoT-enabled press machines

Chapter 8 Market Estimates & Forecast, By Application, 2022-2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Metalworking

- 8.3 Woodworking

- 8.4 Plastic manufacturing

- 8.5 Others (Rubber, composites, etc.)

Chapter 9 Market Estimates & Forecast, By End Use, 2022-2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Aerospace & defense

- 9.3 Automotive

- 9.4 General machinery & equipment

- 9.5 Electrical & electronics

- 9.6 Others (Healthcare, marine, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 France

- 11.3.3 UK

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AIDA

- 12.2 Amada Press System

- 12.3 Beckwood Press

- 12.4 Bliss-Bret

- 12.5 Bruderer

- 12.6 Isgec Heavy Engineering

- 12.7 Komatsu

- 12.8 Macrodyne Technologies

- 12.9 Nidec Minster

- 12.10 Schuler Group

- 12.11 Shieh Yih Machinery Industry

- 12.12 SMS Group

- 12.13 Stamtec

- 12.14 Sutherland Presses

- 12.15 Yangli Group