PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892870

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892870

Golf Cart Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

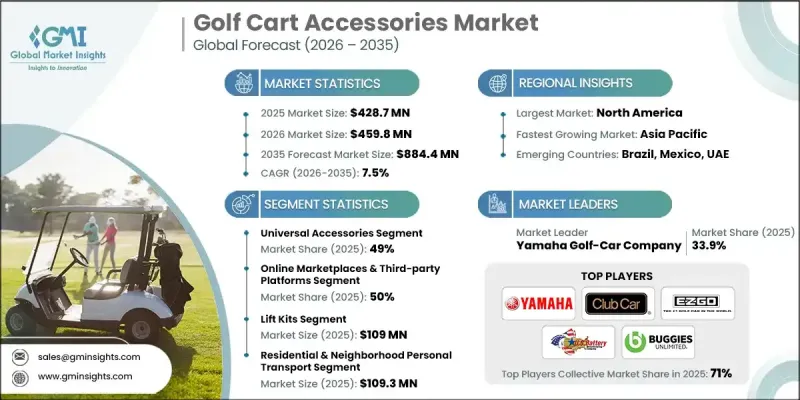

The Global Golf Cart Accessories Market was valued at USD 428.7 million in 2025 and is estimated to grow at a CAGR of 7.5% to reach USD 884.4 million by 2035.

Growth in this market is fueled by increasing demand for personalized and high-performance mobility solutions, wider adoption of electric golf carts, and expansion of recreational and commercial golf course operations. As resorts, gated communities, and urban centers prioritize efficient, sustainable, and convenient transportation, specialized golf cart accessories have become critical to enhance comfort, safety, and functionality for both personal and commercial applications. Advanced technological integration is reshaping the utility and performance of golf carts. Accessories such as energy-efficient lighting, smart security modules, enhanced suspension systems, and ergonomic components improve passenger comfort, operational efficiency, and navigation across diverse terrains while meeting stringent safety standards. Manufacturers are increasingly using corrosion-resistant materials, lightweight designs, and modular components to provide flexible solutions that cater to varying consumer and commercial needs. Market expansion is further driven by the growth of electric golf cart fleets, the adoption of multi-purpose carts in hospitality and campus settings, and increasing demand in industrial facilities, resorts, and gated communities.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $428.7 Million |

| Forecast Value | $884.4 Million |

| CAGR | 7.5% |

The universal accessories segment accounted for a 49% share in 2025 and is expected to grow at a CAGR of 7.5% between 2026 and 2035. Universal accessories dominate due to their compatibility across electric, gas, and hybrid carts, ease of installation, and cost-effectiveness. These products, including lift kits, wheels, tires, lighting systems, and safety enhancements, provide fleet operators and individual users the flexibility to standardize components, reduce inventory needs, and deploy solutions at scale.

The online marketplaces and third-party platforms represented a 50% share in 2025 and are projected to grow at a CAGR of 7% from 2026 to 2035. This segment thrives due to its convenience, broad reach, and ability to serve both individual buyers and fleet operators. Online platforms offer a wide product selection, competitive pricing, and detailed specifications, enabling informed purchase decisions. Integration with logistics networks, real-time inventory updates, and seamless payment systems further strengthen the appeal of these channels, making them preferred options for new purchases and replacement accessories.

U.S. Golf Cart Accessories Market held a 91% share, generating USD 299.2 million in 2024. The region benefits from a mature consumer base, established golf and residential communities, widespread electric and gas-powered cart adoption, and strong awareness of safety and comfort features. North America's advanced manufacturing capabilities and retail networks reinforce its leadership in global golf cart accessory adoption.

Key players in the Golf Cart Accessories Market include EZGO, Polaris Industries, Crown Battery Manufacturing, Buggies Unlimited, Club Car, Trojan Battery Company, Yamaha Golf-Car Company, Golf Cart Gurus, US Battery Manufacturing Company, and Red Hawk. Companies in the Golf Cart Accessories Market are strengthening their presence by investing in innovative, high-performance products that enhance safety, comfort, and efficiency. Manufacturers focus on lightweight, corrosion-resistant, and modular designs to meet diverse customer and commercial needs. Strategic partnerships with distributors, e-commerce platforms, and third-party retailers help expand market reach and improve accessibility. Businesses are also prioritizing technological integration, such as smart security systems, battery-efficient components, and connected features, to differentiate their offerings. Customization options for personal and fleet use further boost competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Accessory

- 2.2.3 Power compatibility

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of electric golf carts

- 3.2.1.2 Expansion of golf courses, resorts, and gated communities

- 3.2.1.3 Technological innovations in accessories

- 3.2.1.4 Growing demand for personalized/customized solutions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of premium accessories

- 3.2.2.2 Limited aftermarket standardization

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of smart and connected accessories

- 3.2.3.2 Expansion in emerging markets

- 3.2.3.3 Aftermarket services and fleet upgrades

- 3.2.3.4 Sustainability-driven innovation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 EPA environmental regulations

- 3.4.2 DOE energy efficiency standards

- 3.4.3 Ada accessibility requirements

- 3.4.4 State & local LSV regulations

- 3.4.5 NAICS & sic classification standards

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current Technology

- 3.7.1.1 Electric powertrain technology

- 3.7.1.2 Gas/petrol powertrain technology

- 3.7.1.3 Charging infrastructure

- 3.7.1.4 Current accessory technologies

- 3.7.2 Emerging Technologies

- 3.7.2.1 Advanced battery technology

- 3.7.2.2 Battery management systems (BMS)

- 3.7.2.3 Autonomous driving systems

- 3.7.1 Current Technology

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Best-Selling Golf Cart Accessories

- 3.12.1 Windshields

- 3.12.2 Seat kits

- 3.12.3 Lighting kits

- 3.12.4 Storage & utility add-ons

- 3.12.5 Weather protection

- 3.12.6 Wheels & tires

- 3.12.7 Battery & electrical accessories

- 3.12.8 Safety accessories

- 3.12.9 Aesthetic enhancement kits

- 3.13 Product Innovation Pipeline

- 3.14 Cost Structure of Accessories

- 3.14.1 Material cost share

- 3.14.2 Labor cost share

- 3.14.3 Value-add cost (design, customization)

- 3.14.4 Import duties if products are sourced from China/Thailand/US

- 3.15 Consumer buying behavior

- 3.15.1 Customer preference

- 3.15.2 Replacement Cycle & Wear-and-Tear Rates

- 3.15.3 Distribution Channel Economics

- 3.16 Aftermarket vs OEM strategy

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Accessory, 2022 - 2035 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Golf cart covers

- 5.3 Golf cart enclosures

- 5.4 Lift kits

- 5.5 Wheels and tires

- 5.6 Lights and lighting accessories

- 5.7 Security systems

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Power Compatibility, 2022 - 2035 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Universal accessories

- 6.3 Electric cart-specific accessories

- 6.4 Gas/petrol cart-specific accessories

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Residential & neighborhood personal transport

- 7.3 Golf course play & operations

- 7.4 Hospitality & resort guest services

- 7.5 Campus mobility

- 7.6 Industrial & warehouse material handling

- 7.7 Airport & large passenger venue

- 7.8 Government & municipal facility operations

- 7.9 Healthcare patient & equipment transport

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($ Mn, Units)

- 8.1 Key trends

- 8.2 Online marketplaces & third-party platforms

- 8.3 Direct-to-consumer

- 8.4 Single-tier distribution

- 8.5 Multi-tier distribution

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 Caddyshack Golf Cars

- 10.1.2 Club Car, Inc.

- 10.1.3 Crown Battery Manufacturing

- 10.1.4 Exide Technologies

- 10.1.5 E-Z-GO

- 10.1.6 Garia A/S

- 10.1.7 JH Global Services

- 10.1.8 Polaris Industries Inc. (GEM)

- 10.1.9 Trojan Battery Company

- 10.1.10 Yamaha Motor Co., Ltd.

- 10.2 Regional Player

- 10.2.1 Buggies Unlimited

- 10.2.2 Delta-Q Technologies

- 10.2.3 Golf Cart King

- 10.2.4 LESTER Electrical

- 10.2.5 Madjax (NIVEL Holdings)

- 10.2.6 Navitas Vehicle Systems

- 10.2.7 Nivel Parts & Manufacturing Co.

- 10.2.8 Red Hawk Golf Cart Parts & Accessories

- 10.2.9 Star EV Corporation

- 10.2.10 Tomberlin

- 10.3 Emerging Players

- 10.3.1 Advanced EV

- 10.3.2 Allied Lithium

- 10.3.3 Eco Battery

- 10.3.4 Evolution Electric Vehicles

- 10.3.5 RELiON Battery