PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892871

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892871

Europe Industrial Refrigeration Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

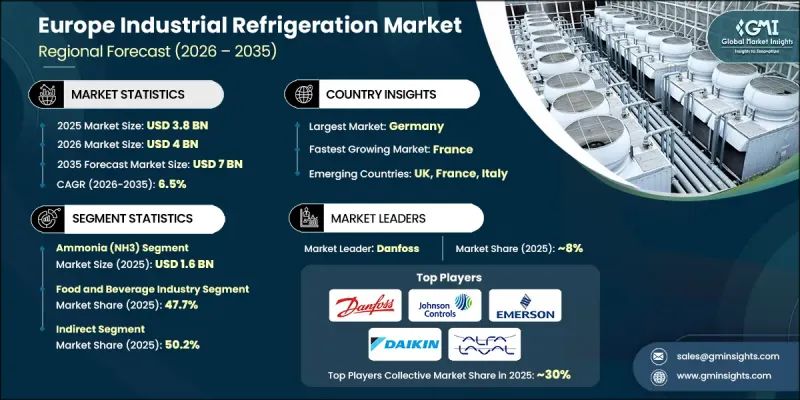

Europe Industrial Refrigeration Market was valued at USD 3.8 billion in 2025 and is estimated to grow at a CAGR of 6.5% to reach USD 7 billion by 2035.

Demand across the region continues to rise as cold chain networks expand and consumption of temperature-sensitive foods and pharmaceuticals accelerates. The surge in frozen and processed products, paired with the rapid growth of online grocery fulfillment, is creating a stronger need for reliable, energy-efficient refrigeration throughout transportation and storage. Modernization efforts across Europe are also giving the industry a significant boost, with large-scale upgrades underway in logistics hubs, chemical facilities, and food processing sites across countries including Germany, Italy, and France. Digital transformation plays a major role in shaping system performance, as facilities integrate connected monitoring technologies, predictive maintenance tools, and automated controls that optimize operational efficiency. Additionally, stringent European environmental policies continue to push industries toward sustainable, low-GWP solutions, reinforcing the shift to environmentally responsible refrigeration practices.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.8 Billion |

| Forecast Value | $7 Billion |

| CAGR | 6.5% |

The ammonia segment reached USD 1.6 billion in 2025 and is projected to grow at a CAGR of 7.5% from 2026 to 2035. Its minimal environmental footprint and strong energy-efficiency profile make it a leading refrigerant choice in Europe's regulated landscape, especially for large industrial sites that prioritize long-term operational savings.

The food & beverage segment held 47.7% share in 2025 and is expected to grow at a CAGR of 6.7% through 2035. Europe's mature food manufacturing ecosystem relies heavily on dependable, high-performance refrigeration to meet safety regulations and support growing demand for packaged foods, frozen meals, and export-oriented perishables. Investments in cold storage expansion and advanced, digitally controlled refrigeration systems continue to rise as sustainability and cost efficiency become central industry priorities.

Germany Industrial Refrigeration Market generated USD 1.6 billion in 2025. Its strong pharmaceutical and biotechnology landscape requires highly reliable temperature-controlled infrastructure for sensitive medical and research products. Regulatory pressure to adopt energy-efficient and low-emission technologies is also prompting widespread upgrades across industrial facilities, accelerating innovation throughout the country.

Leading companies in the Europe Industrial Refrigeration Market include Alfa Laval, Carel, Daikin Europe, Danfoss, Emerson, EVAPCO, Frascold, Haier, Johnson Controls, Kelvion, LU-VE, Mayekawa Europe, MTA, SCM Frigo, and Star Refrigeration. Companies active in the Europe Industrial Refrigeration Market are reinforcing their competitive position by prioritizing energy-efficient technologies, sustainable refrigerants, and digitally enhanced systems. Many manufacturers are expanding their portfolios to include low-GWP solutions that align with EU environmental regulations while reducing long-term operating costs for customers. Strategic investments in IoT-enabled controllers, predictive maintenance platforms, and automation capabilities help operators improve system reliability and minimize downtime. Firms are also strengthening regional footprints through partnerships with industrial facilities, after-sales service expansion, and targeted acquisitions to enhance product reach. Training programs for technicians, combined with R&D investments in high-performance components, further support customer adoption and long-term loyalty across Europe's industrial sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Component

- 2.2.3 Refrigerant type

- 2.2.4 Capacity

- 2.2.5 System configuration type

- 2.2.6 Energy efficiency

- 2.2.7 Automation

- 2.2.8 End use industry

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expanding cold chain logistics, food & pharma demand

- 3.2.1.2 Rapid industrialization & infrastructure expansion

- 3.2.1.3 Technological innovation & digitalization

- 3.2.1.4 Shift to natural & low- GWP refrigerants

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital expenditure & workforce gaps

- 3.2.2.2 Safety technology & retrofit limitations

- 3.2.3 Opportunities

- 3.2.3.1 Green & energy-efficient infrastructure projects

- 3.2.3.2 Technology innovation & sustainability integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Country

- 3.6.2 By Component

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Risk assessment and mitigation

- 3.10 Gap Analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Country

- 4.2.2 By Component

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Compressor

- 5.2.1 Rotary screw compressor

- 5.2.2 Centrifugal compressor

- 5.2.3 Reciprocating compressors

- 5.2.4 Diaphragm compressors

- 5.2.5 Others

- 5.3 Condenser

- 5.4 Evaporator

- 5.5 Controls

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Refrigerant Type, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Ammonia (NH3)

- 6.3 Freon (CFCs, HCFCs, HFCs)

- 6.4 CO2 (Carbon Dioxide)

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Capacity, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Below 500KW

- 7.3 0.5 - 1MW

- 7.4 1-5 MW

- 7.5 Above 5MW

Chapter 8 Market Estimates & Forecast, By System Configuration Type, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Packaged and self-contained systems

- 8.3 Remote and split systems

- 8.4 Modular and containerized systems

Chapter 9 Market Estimates & Forecast, By Energy Efficiency Class, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Class A (Highest Efficiency)

- 9.3 Class B-C (High Efficiency)

- 9.4 Class D-E (Medium Efficiency)

- 9.5 Class F-G (Lower Efficiency)

Chapter 10 Market Estimates & Forecast, By Automation Level, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Manual

- 10.3 Semi-automated systems

- 10.4 Fully automated

Chapter 11 Market Estimates & Forecast, By End Use Industry, 2022 - 2035, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Food and beverage industry

- 11.3 Chemical and petrochemical industry

- 11.4 Pharmaceutical industry

- 11.5 Logistics and cold chain

- 11.6 Others

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Direct

- 12.3 Indirect

Chapter 13 Market Estimates & Forecast, By Country, 2022 - 2035, (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Germany

- 13.3 UK

- 13.4 France

- 13.5 Italy

- 13.6 Spain

Chapter 14 Company Profiles

- 14.1 Alfa Laval

- 14.2 Carel

- 14.3 Daikin Europe

- 14.4 Danfoss

- 14.5 Emerson

- 14.6 EVAPCO

- 14.7 Frascold

- 14.8 Haier

- 14.9 Johnson Controls

- 14.10 Kelvion

- 14.11 LU-VE

- 14.12 Mayekawa Europe

- 14.13 MTA

- 14.14 SCM Frigo

- 14.15 Star Refrigeration