PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892876

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892876

Induction Heating System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

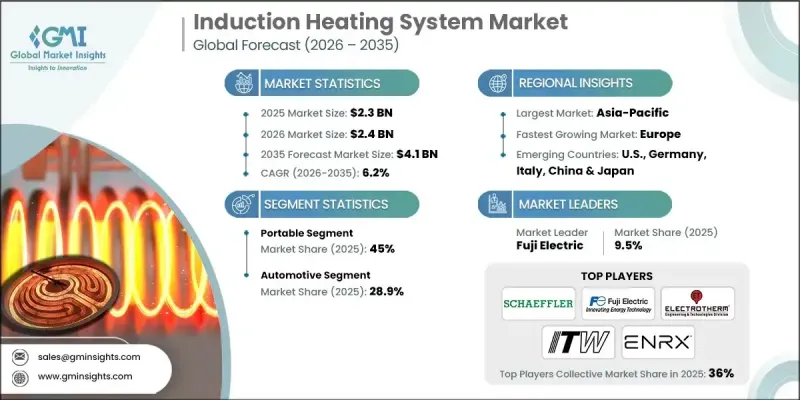

The Global Induction Heating System Market was valued at USD 2.3 billion in 2025 and is estimated to grow at a CAGR of 6.2% to reach USD 4.1 billion by 2035.

Market growth is reinforced by the shift toward precise, contact-free, and energy-efficient heating technologies across multiple industrial sectors. Rising adoption in automotive, metalworking, aerospace, and electronics environments continues to strengthen demand as manufacturers seek solutions that minimize energy waste, improve cycle times, and reduce operational costs. Induction heating systems operate by generating heat through electromagnetic induction rather than direct contact, allowing materials, primarily metals, to be heated quickly and with controlled accuracy. Increasing government emphasis on boosting domestic manufacturing is also driving expansion by encouraging the establishment and modernization of production facilities that rely on efficient thermal technologies. As industries work to lower emissions and eliminate combustion-based processes, induction heating is becoming a preferred method for achieving cleaner, safer, and more precise heating. Continued advancements in industrial automation, expansions in global manufacturing output, and rising attention to sustainability are expected to support long-term market momentum.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 6.2% |

The portable induction heating system segment held a 45% share in 2025 and is forecasted to grow at more than 6% through 2035. This segment benefits from the demand for compact, energy-efficient solutions used for maintenance, repair, and on-site assembly tasks. Adoption continues to rise in sectors such as oil and gas, automotive, aerospace, and general manufacturing. Improvements in lightweight construction, digital interfaces, and power electronics further enhance performance and user convenience.

The automotive induction heating system segment held a 28.9% share in 2025 and is expected to reach USD 1 billion by 2035. The industry is expanding as manufacturers rely on faster and cleaner heating processes for various production tasks. Induction heating enables efficient hardening, bonding, brazing, and shrink-fitting, supporting the growing need for automation, improved component quality, and increasing output tied to electric vehicle manufacturing and lightweight material usage.

U.S. Induction Heating System Market held 72% share in 2025, generating USD 371.4 million in revenue. The country's momentum is driven by rising demand for clean and accurate industrial heating systems, particularly within automotive and metal processing sectors. Strong national support for advanced manufacturing and domestic production initiatives continues to enhance market growth.

Key companies operating in the Global Induction Heating System Market include Inductotherm Group, Ultraflex Power Technologies, Fuji Electric, Radyne Corporation, ENRX, Microtech Induction, Electrotherm, Uchino, Da-ichi Kiden, Interpower Induction, Advanced Corporation for Materials & Equipment, Schaeffler (Singapore), ITW Welding Singapore, Rapid-Heat Systems, Heatrotherm, TM Induction Heating, KBG Induction, KITASHIBA ELECTRIC, Lu-Chiuan Heating Elements Ind, Solidheat Industries, Chengdu Jinkezhi Electronic, Ambrell Corporation, Abhay Induction Tech, Neturen Co., and Thermo International. Companies in the Induction Heating System Market strengthen their competitive standing by prioritizing continuous product innovation, expanding manufacturing capabilities, and developing high-efficiency solutions aligned with sustainability goals. Many firms invest in digital controls, smart monitoring systems, and advanced power electronics to improve precision and energy performance. Strategic partnerships with OEMs and industrial manufacturers help expand application reach, while modular product platforms allow customization for diverse end-use industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Product trends

- 2.1.3 End Use trends

- 2.1.4 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of induction heating systems

- 3.8 Emerging opportunities & trends

- 3.9 Investment analysis & future prospects

- 3.10 Sustainability initiatives & industry 4.0 integration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Portable

- 5.3 Stationary

Chapter 6 Market Size and Forecast, By End Use, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Aerospace

- 6.4 Power generation

- 6.5 Shipbuilding

- 6.6 Oil & Gas

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Abhay Induction Tech Pvt. Ltd.

- 8.2 Advanced Corporation for Materials & Equipments

- 8.3 Ambrell Corporation

- 8.4 Chengdu Jinkezhi Electronic Co., Ltd.

- 8.5 Da-ichi Kiden Co., Ltd.

- 8.6 Electrotherm

- 8.7 Enrx

- 8.8 Fuji Electric

- 8.9 Heatrotherm

- 8.10 Inductotherm Group

- 8.11 Interpower Induction

- 8.12 ITW Welding Singapore Pte Ltd.

- 8.13 KBG Induction

- 8.14 KITASHIBA ELECTRIC CO., LTD.

- 8.15 Lu-Chiuan Heating Elements Ind Co., Ltd.

- 8.16 Microtech Induction Pvt. Ltd.

- 8.17 Neturen Co. Ltd.

- 8.18 Radyne Corporation

- 8.19 Rapid-Heat Systems Ltd.

- 8.20 Schaeffler (Singapore) Pte. Ltd.

- 8.21 Solidheat Industries Pte. Ltd.

- 8.22 Thermo International

- 8.23 TM Induction Heating

- 8.24 Uchino Co. Ltd.

- 8.25 Ultraflex Power Technologies