PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892877

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892877

Automotive Spark Plug Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

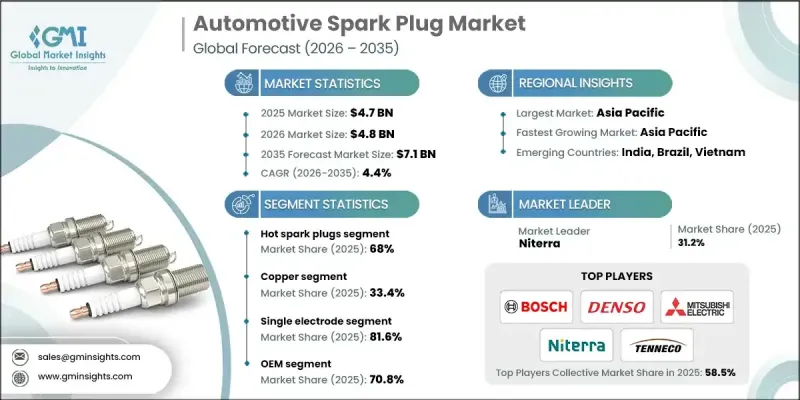

The Global Automotive Spark Plug Market was valued at USD 4.7 billion in 2025 and is estimated to grow at a CAGR of 4.4% to reach USD 7.1 billion by 2035.

Growth is supported by the steady rise in new vehicle production worldwide and continued consumer preference for gasoline-powered models. The shift toward better fuel economy is also driving higher adoption of advanced spark plug technologies, as newer engine architectures are built to maximize efficiency. Manufacturers are expanding the use of materials such as iridium and platinum throughout their portfolios, contributing to more durable and efficient ignition performance. Modern combustion systems now deliver around a 10 percent boost in fuel efficiency, which encourages broader use of premium spark plug components. Expanding urban mobility trends are creating more demand for compact engines that rely on spark-ignited systems. The aftermarket remains a strong contributor as well, particularly as the average age of vehicles surpassed 12 years in 2024, increasing annual replacement cycles. Ongoing improvements in high-performance metals also continue to enhance spark plug lifespan and ignition reliability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.7 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 4.4% |

The hot spark plugs segment held a 68% share in 2025, and this category is expected to expand at a CAGR of 4.7% between 2026 and 2035. These plugs remain favored for conventional gasoline engines because they maintain dependable ignition across a wide temperature range. Their design supports effective heat dissipation, helping limit fouling during low-speed driving that is common in metropolitan settings across major global regions.

The single electrode spark plugs segment held 81.6% share in 2025. They remain the primary option for mass-market passenger cars and two-wheel vehicles, supported by more than 76 million units of global passenger car production in 2024. Most entry-level and mid-tier engines still depend on single electrode systems, which offer predictable operation and low maintenance costs. This makes them especially appealing for the aftermarket in regions with a large base of aging vehicles.

China Automotive Spark Plug Market held 46.8% share in 2024 and generated USD 824.4 million in 2025. Growth is tied to rising vehicle sales and rapid urban expansion, which continue to boost passenger car production beyond 28 million units. This accelerates OEM demand and replacement cycles in both major cities and smaller communities. Two-wheel mobility remains a large component of the transportation landscape, with around 7 million motorcycles and scooters produced in 2024, most of which relied on copper or platinum spark plugs, ensuring strong ongoing replacement needs.

Key companies participating in the Automotive Spark Plug Market include ACDelco, Autolite, Bosch, DENSO Corporation, Hyundai Mobis, MAHLE, Mitsubishi Electric, Niterra, Tenneco, and Valeo. Leading Automotive Spark Plug Market is strengthening its presence by expanding advanced material technologies, particularly through wider integration of iridium and platinum to improve durability and ignition precision. Many manufacturers are increasing R&D investments to support next-generation combustion systems and adapt to evolving engine designs. Companies are also focusing on broadening their global manufacturing footprints to reduce costs and improve supply reliability. Strategic collaborations with automakers remain essential for securing long-term OEM contracts, while an enhanced emphasis on aftermarket networks helps capture demand from aging vehicle fleets. In addition, several brands are modernizing their product portfolios with heat-range-optimized designs and cost-efficient options to reach both premium and mass-market customer segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Electrode

- 2.2.5 Sales Channel

- 2.2.6 Vehicle

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Growth in gasoline powered vehicles

- 3.2.1.3 Shift toward high efficiency engines

- 3.2.1.4 Increasing aftermarket activity

- 3.2.1.5 Adoption of precious metal plugs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Increasing penetration of electric vehicles

- 3.2.2.2 Rising raw material costs

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of the global aftermarket

- 3.2.3.2 Development of advanced ignition systems

- 3.2.3.3 Growth in two-wheeler demand in emerging markets

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Electrode material evolution (copper to ruthenium)

- 3.7.1.2 Fine wire technology development

- 3.7.1.3 Multi-electrode design innovations

- 3.7.1.4 Pre-chamber spark plug technology

- 3.7.1.5 IoT & smart diagnostics integration

- 3.7.1.6 Laser welding manufacturing advances

- 3.7.1.7 Heat range optimization technologies

- 3.7.1.8 Next-generation materials

- 3.7.2 Emerging technologies

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 OEM vs aftermarket price differential

- 3.8.2 Regional price variations

- 3.8.3 Raw material cost impact

- 3.8.4 Import/export price analysis

- 3.8.5 Future price trajectory

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent & intellectual property analysis

- 3.11.1 Active patents by electrode material

- 3.11.2 Geographic patent distribution

- 3.11.3 Key patent holders

- 3.11.4 Emerging technology patents (smart plugs)

- 3.11.5 Patent expiration timeline (2024-2034)

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment & Funding Analysis

- 3.13.1 R&D investment trends by manufacturer

- 3.13.2 Alternative fuel adaptation investments

- 3.13.3 Manufacturing capacity expansion

- 3.13.4 Strategic partnerships & joint ventures

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2022 2035 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Hot spark plug

- 5.3 Cold spark plug

Chapter 6 Market Estimates & Forecast, By Material, 2022 - 2035 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Copper

- 6.3 Platinum

- 6.4 Iridium

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Electrode, 2022 - 2035 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Single Electrode

- 7.3 Twin Electrode

- 7.4 Multi-Electrode

- 7.5 Surface Discharge

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 (USD Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Vehicle, 2022 - 2035 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Passenger car

- 9.2.1 Hatchback

- 9.2.2 Sedan

- 9.2.3 SUV

- 9.3 Commercial vehicle

- 9.3.1 Light duty

- 9.3.2 Medium duty

- 9.3.3 Heavy duty

- 9.4 Two-wheeler

- 9.4.1 Motorcycle

- 9.4.2 Scooter

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Netherlands

- 10.3.9 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 ACDelco

- 11.1.2 Autolite

- 11.1.3 Bosch

- 11.1.4 DENSO

- 11.1.5 MAHLE

- 11.1.6 Mitsubishi Electric

- 11.1.7 Niterra

- 11.1.8 Tenneco

- 11.1.9 Valeo

- 11.2 Regional Players

- 11.2.1 BorgWarner

- 11.2.2 Brisk Spark Plug Company

- 11.2.3 E3 Spark Plugs

- 11.2.4 Hella

- 11.2.5 MAGNETI MARELLI PARTS & SERVICES

- 11.2.6 MSD Performance

- 11.2.7 Stitt Spark Plug Company

- 11.2.8 Zhuzhou Torch Spark Plug

- 11.3 Emerging Players / Disruptors

- 11.3.1 Iskra Spark Plugs

- 11.3.2 Nanjing Leidian

- 11.3.3 Prenco Progress & Engineering Corporation

- 11.3.4 Pulstar

- 11.3.5 SMP Automotive

- 11.3.6 Weichai Power