PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892882

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892882

Digital Freight Brokerage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

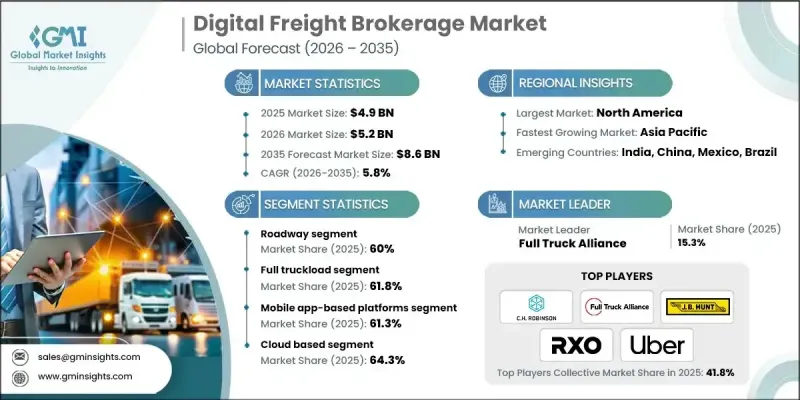

The Global Digital Freight Brokerage Market was valued at USD 4.9 billion in 2025 and is estimated to grow at a CAGR of 5.8% to reach USD 8.6 billion by 2035.

Market growth is accelerating as shippers increasingly rely on automated freight-matching systems and digital tools that provide real-time access to carrier capacity. Cost efficiency remains a major motivation, with shippers turning to online platforms to streamline operations, minimize manual processes, and lower transportation expenses. Digital brokerage platforms help reduce empty miles by optimizing load assignments, which enhances asset utilization, raises carrier earnings, and improves overall service dependability. The rise in international shipments processed digitally and the push for stronger compliance oversight have also reinforced the adoption of automated allocation technologies. At the same time, the industry is moving rapidly toward AI-driven forecasting models that improve pricing accuracy and lane-level performance visibility. These predictive capabilities help stabilize costs while strengthening service efficiency, further boosting the demand for digital brokerage tools across all freight categories.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.9 Billion |

| Forecast Value | $8.6 Billion |

| CAGR | 5.8% |

The cloud-based category accounted for a 64.3% share in 2025, strengthened by the rapid shift toward cloud-enabled freight systems. A significant portion of new freight management platforms now depend on cloud architecture, supported by global cloud investments that are accelerating the modernization of logistics operations.

The mobile app-based platforms segment held a 61.3% share in 2025. Widespread smartphone adoption and driver engagement tools continue to drive usage, allowing instant access to load postings, documents, and location-based matching capabilities.

U.S. Digital Freight Brokerage Market held 86.2% share and generated USD 1.76 billion in 2025. Strong digital networks, high road freight volumes, and expanding last-mile demand support platform adoption throughout the region. Independent truckers and smaller fleets are increasingly using mobile-enabled load notifications and telematics connectivity to secure consistent capacity.

Key companies in the Global Digital Freight Brokerage Market include C.H. Robinson, Coyote Logistics, Echo Global Logistics, Full Truck Alliance, J.B. Hunt, Landstar System, RXO, Total Quality Logistics (TQL), Uber, and XPO. Market leaders are strengthening their competitive positions by investing in AI-based matching engines, predictive analytics, and automated pricing tools that enhance operational accuracy and provide faster load-to-carrier pairing. Companies are expanding cloud-native platforms to improve scalability and reliability for shippers and carriers. Many are integrating telematics data, real-time tracking, and digital documentation to create seamless end-to-end workflows. Strategic partnerships with carriers, logistics service providers, and supply chain software companies also help expand network density and load availability. Businesses are focusing on mobile-first solutions to support driver engagement and speed up transactions. Continuous enhancements in compliance automation, platform security, and user experience further support market differentiation and long-term customer retention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Transportation Mode

- 2.2.3 Service

- 2.2.4 Platform

- 2.2.5 Deployment Model

- 2.2.6 Organization Size

- 2.2.7 Application

- 2.2.8 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Growth in E-commerce freight volumes

- 3.2.1.3 Shift toward automated brokerage workflows

- 3.2.1.4 Expansion of visibility and tracking tools

- 3.2.1.5 Integration of telematics and fleet data

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fragmented carrier ecosystem

- 3.2.2.2 Concerns about data privacy and platform dependence

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of integrated multimodal platforms

- 3.2.3.2 Adoption of AI based pricing and matching

- 3.2.3.3 Growth of cross border digital corridors

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 FMCSA Regulations

- 3.4.1.2 Canadian Transportation Agency (CTA) Guidelines

- 3.4.2 Europe

- 3.4.2.1 EU transport regulations

- 3.4.2.2 E-freight directive

- 3.4.2.3 General data protection regulation (GDPR)

- 3.4.2.4 UK GDPR

- 3.4.2.5 Digital tachograph rules

- 3.4.3 Asia Pacific

- 3.4.3.1 Administrative measures for road freight

- 3.4.3.2 Cybersecurity law

- 3.4.3.3 Act on Improvement of Logistics Efficiency

- 3.4.3.4 Motor Vehicles Act 2019

- 3.4.3.5 Transport Business Act

- 3.4.3.6 Smart Logistics Initiative

- 3.4.4 Latin America

- 3.4.4.1 National land transport agency (ANTT) regulations

- 3.4.4.2 Federal road transportation law

- 3.4.4.3 Usmca regulations

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE federal transport law

- 3.4.5.2 Saudi transport and logistics regulations

- 3.4.5.3 Road traffic act

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Transportation costs

- 3.8.2 Technology & platform costs

- 3.8.3 Operational costs

- 3.8.4 Regulatory & compliance costs

- 3.8.5 Fuel and energy costs

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Pricing analysis

- 3.11.1 By region

- 3.11.2 By service

- 3.12 Use cases

- 3.13 Best case scenarios

- 3.14 Go-to-Market strategies

- 3.14.1 Region-specific market penetration strategies

- 3.14.2 Key regulatory considerations for new entrants

- 3.14.3 Pricing, service, and differentiation strategies

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Transportation Mode, 2022- 2035 (USD Mn)

- 5.1 Key trends

- 5.2 Roadway

- 5.3 Seaway

- 5.4 Airway

- 5.5 Railway

Chapter 6 Market Estimates & Forecast, By Service, 2022 - 2035 (USD Mn)

- 6.1 Key trends

- 6.2 Full Truckload (FTL)

- 6.3 Less than Truckload (LTL)

- 6.4 Intermodal

Chapter 7 Market Estimates & Forecast, By Platform, 2022 - 2035 (USD Mn)

- 7.1 Key trends

- 7.2 Mobile app-based platforms

- 7.3 Web-based platforms

Chapter 8 Market Estimates & Forecast, By Deployment Model, 2022 - 2035 (USD Mn)

- 8.1 Key trends

- 8.2 Cloud-Based

- 8.3 On-Premises

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Organization Size, 2022 - 2035 (USD Mn)

- 9.1 Key trends

- 9.2 Small & Medium Enterprises (SMEs)

- 9.3 Large Enterprises

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035 (USD Mn)

- 10.1 Key trends

- 10.2 Freight management

- 10.3 Carrier & shipper matching

- 10.4 Price bidding & auction

- 10.5 Real-time tracking & analytics

- 10.6 Automated documentation

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By End Use, 2022 - 2035 (USD Mn)

- 11.1 Key trends

- 11.2 Retail & e-commerce

- 11.3 Automotive

- 11.4 Manufacturing

- 11.5 Consumer goods

- 11.6 Healthcare

- 11.7 Food & beverages

- 11.8 Others

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.3.8 Netherlands

- 12.3.9 Sweden

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Singapore

- 12.4.7 Thailand

- 12.4.8 Indonesia

- 12.4.9 Vietnam

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

- 12.6.4 Turkey

Chapter 13 Company Profiles

- 13.1 Global Players

- 13.1.1 C.H. Robinson

- 13.1.2 Coyote Logistics

- 13.1.3 Echo Global Logistics

- 13.1.4 Hub Group

- 13.1.5 J.B. Hunt

- 13.1.6 Landstar System

- 13.1.7 Total Quality Logistics

- 13.1.8 Uber

- 13.1.9 Worldwide Express

- 13.1.10 XPO

- 13.2 Regional Players

- 13.2.1 Allen Lund

- 13.2.2 ArcBest

- 13.2.3 BNSF Logistics

- 13.2.4 England Logistics

- 13.2.5 GlobalTranz Enterprises

- 13.2.6 MATSON Logistics

- 13.2.7 Schneider

- 13.2.8 Transplace

- 13.2.9 Werner Enterprises

- 13.3 Emerging Players / Disruptors

- 13.3.1 Armstrong Transport Group

- 13.3.2 Ascent Global Logistics

- 13.3.3 Expeditors International

- 13.3.4 NTG Freight

- 13.3.5 Trinity Logistics