PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892887

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892887

Artificial Intelligence (AI) Chipsets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

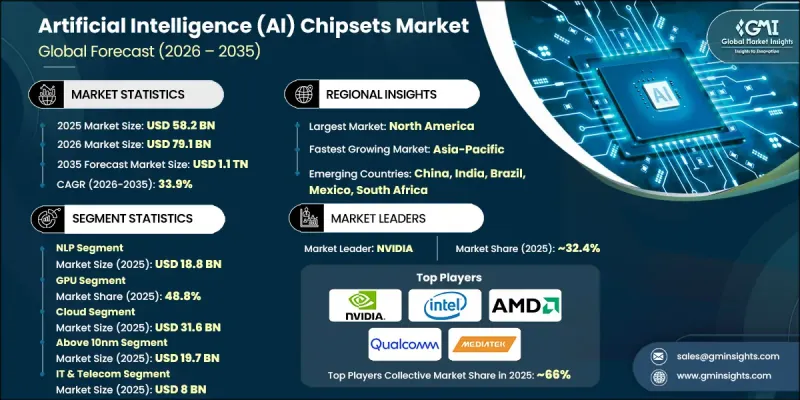

The Global Artificial Intelligence (AI) Chipsets Market was valued at USD 58.2 billion in 2025 and is estimated to grow at a CAGR of 33.9% to reach USD 1.1 trillion by 2035.

The market growth is fueled by the rising integration of AI across sectors such as healthcare, automotive, consumer electronics, and data centers. Increasing demand for high-performance computing, edge AI devices, AI-enabled IoT applications, and machine learning workloads is driving adoption worldwide. Advances in semiconductor technologies, energy-efficient processor architectures, and AI-optimized chip designs are transforming the market, enabling faster and more intelligent computations. Companies are focusing on developing specialized GPUs, NPUs, and ASICs to accelerate deep learning, neural networks, and AI processing, supporting applications from autonomous vehicles to predictive analytics. This shift toward AI-dedicated architectures is reshaping how industries deploy intelligent systems while optimizing energy efficiency and operational performance.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $58.2 Billion |

| Forecast Value | $1.1 Trillion |

| CAGR | 33.9% |

The natural language processing (NLP) segment generated USD 18.8 billion in 2025. NLP chipsets are designed to accelerate language-based AI applications, such as virtual assistants, chatbots, real-time translation, and sentiment analysis, enabling faster model training and real-time inference. Their adoption across enterprises, healthcare, e-commerce, and smart devices drives significant market demand.

The GPU segment accounted for a 48.8% share in 2025 due to its exceptional parallel processing capability, high computational efficiency, and ability to handle complex AI workloads. GPUs facilitate rapid machine learning, deep learning, and neural network computations, making them essential for applications in robotics, cloud computing, automotive, and healthcare, reinforcing their dominant position in AI chipsets.

North America Artificial Intelligence (AI) Chipsets Market held a 31.6% share in 2025. Market expansion in the region is driven by early adoption of AI technologies, strong industrial investment in data centers and cloud computing, and growing deployment of edge AI and autonomous systems. The presence of major AI chipset manufacturers, government support, research initiatives, and high demand for energy-efficient, high-performance processors for machine learning and real-time analytics further strengthen the regional market.

Key companies in the Artificial Intelligence (AI) Chipsets Market include Apple Inc., AMD (Advanced Micro Devices), Arm Ltd., NVIDIA Corporation, Intel Corporation, Qualcomm Technologies, Inc., MediaTek Inc., IBM, Hailo, Infineon Technologies Inc., Analog Devices, Inc., Micron Technology Inc., Samsung Electronics Co., Ltd., LG Electronics, ROHM Co., Ltd., STMicroelectronics, Graphcore, Kalray, Groq, Inc., Blaize, Imagination Technologies, NXP Semiconductors, and Alphabet Inc. Companies in the Artificial Intelligence (AI) Chipsets Market are employing multiple strategies to strengthen their market presence. They are heavily investing in research and development to create energy-efficient, high-performance GPUs, NPUs, and AI accelerators. Collaborations and strategic partnerships with cloud service providers, automotive OEMs, and industrial clients enhance adoption and integration across AI applications. Firms are launching specialized processors tailored for edge AI, NLP, and deep learning workloads to meet sector-specific needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional Trends

- 2.2.2 Product Trends

- 2.2.3 Technology Trends

- 2.2.4 Processing Type Trends

- 2.2.5 Node Size Trends

- 2.2.6 Industry Vertical Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand from automotive industry

- 3.2.1.2 Increasing demand for smart homes & smart cities across the globe

- 3.2.1.3 Increasing integration of AI in smartphone & smart wearable devices

- 3.2.1.4 Growing industrial automation across the globe

- 3.2.1.5 Growth of AI inferencing hardware in data centers

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High development and production costs

- 3.2.2.2 Heat dissipation and power consumption issues

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of Generative AI and Edge AI Applications

- 3.2.3.2 Growing Adoption Across Healthcare, Finance, and Industry 4.0

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2022-2035 (USD Million)

- 5.1 Key trends

- 5.2 GPU

- 5.3 ASIC

- 5.4 FPGA

- 5.5 CPU

Chapter 6 Market Estimates & Forecast, By Technology, 2022-2035 (USD Million)

- 6.1 Key trends

- 6.2 NLP

- 6.3 RPA

- 6.4 Computer Vision

- 6.5 Network Security

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Processing Type, 2022-2035 (USD Million)

- 7.1 Key trends

- 7.2 Edge

- 7.3 Cloud

Chapter 8 Market Estimates & Forecast, By Industry Vertical, 2022-2035 (USD Million)

- 8.1 Key trends

- 8.2 Consumer Electronics

- 8.2.1 Smartphones & Tablets

- 8.2.2 Laptops & PCs

- 8.2.3 Wearables

- 8.2.4 AR/VR/MR Devices

- 8.2.5 Smart Home Devices

- 8.2.6 Others

- 8.3 Media & Advertising

- 8.4 BFSI

- 8.5 IT & Telecom

- 8.5.1 Cloud Data Centers

- 8.5.2 Edge Data Centers

- 8.5.3 Cybersecurity & Threat Detection

- 8.5.4 AI-powered 5G/6G RAN Solutions

- 8.5.5 Others

- 8.6 Retail

- 8.7 Healthcare

- 8.7.1 Medical Imaging & Diagnostics

- 8.7.2 Drug Discovery & Genomics

- 8.7.3 Wearable Health Monitoring Devices

- 8.7.4 Hospital Automation & Workflow Management

- 8.7.5 Telemedicine & Virtual Health Platforms

- 8.7.6 Others

- 8.8 Automotive

- 8.8.1 Advanced Driver Assistance Systems (ADAS)

- 8.8.2 Autonomous Vehicles (AV Compute Units)

- 8.8.3 In-Vehicle Infotainment (IVI)

- 8.8.4 V2X Communication Systems

- 8.8.5 Others

- 8.9 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alphabet Inc.

- 10.2 AMD (Advanced Micro Devices)

- 10.3 Analog Devices, Inc.

- 10.4 Apple Inc.

- 10.5 Arm Ltd.

- 10.6 Blaize

- 10.7 Graphcore

- 10.8 Groq, Inc.

- 10.9 Hailo

- 10.10 Huawei Technologies Co., Ltd.

- 10.11 IBM

- 10.12 Imagination Technologies

- 10.13 Infineon Technologies Inc

- 10.14 Intel Corporation

- 10.15 Kalray

- 10.16 LG Electronics

- 10.17 MediaTek Inc.

- 10.18 Micron Technology Inc

- 10.19 NVIDIA Corporation

- 10.20 NXP Semiconductors

- 10.21 Qualcomm Technologies, Inc

- 10.22 ROHM Co., Ltd.

- 10.23 Samsung Electronics Co., Ltd.

- 10.24 STMicroelectronics

- 10.25 Texas Instruments Incorporated