PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892889

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892889

Antibacterial Glass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

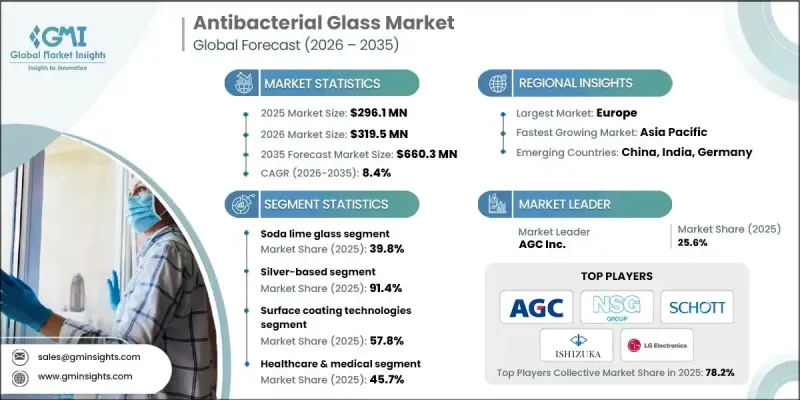

The Global Antibacterial Glass Market was valued at USD 296.1 million in 2025 and is estimated to grow at a CAGR of 8.4% to reach USD 660.3 million by 2035.

The market is experiencing strong growth as industries increasingly prioritize hygiene-focused solutions across healthcare, consumer electronics, and commercial applications. Companies are investing in innovative offerings, driving the development of high-performance, value-added products. Borosilicate glass is expected to see sustained growth due to its superior thermal and chemical resistance, making it highly suitable for laboratories and food-contact applications. Silver-based antimicrobial products continue to dominate due to their proven effectiveness against a broad spectrum of microorganisms and long-lasting performance. Meanwhile, copper, zinc, and titanium-based antimicrobial products are emerging as eco-friendly, fast-acting, and UV-activated alternatives. North America leads adoption due to heightened hygiene awareness in hospitals and laboratories, while Europe, particularly Germany, is integrating antibacterial glass into construction, transportation, and industrial sectors. Rapid urbanization and growing healthcare investments have driven remarkable growth in the Asia Pacific region.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $296.1 Million |

| Forecast Value | $660.3 Million |

| CAGR | 8.4% |

The soda lime glass segment held a 39.8% share in 2025 and is anticipated to grow at a CAGR of 7% by 2035. This type of glass is cost-effective, widely available, and commonly used for public spaces and household applications. Borosilicate glass, with enhanced thermal and chemical resistance, is gradually capturing markets previously dominated by soda lime glass, particularly in laboratories, pharmaceuticals, and food-contact applications.

The silver-based antibacterial glass segment accounted for a 91.4% share in 2025 and is expected to grow at a CAGR of 8.2% through 2035. Silver remains the most widely used antimicrobial agent due to its ability to inactivate a wide variety of pathogens. It is highly compatible with different glass types and finds extensive use in hospitals, large public facilities, and electronic product manufacturing.

North America Antibacterial Glass Market held a 28.1% share in 2025, driven by advancements in healthcare infrastructure, stringent hygiene regulations, and rising adoption of antimicrobial technology across medical, consumer electronics, and building sectors. Hospitals, research laboratories, and public facilities increasingly use antibacterial glass to minimize infection risks and ensure hygiene compliance.

Leading players in the Global Antibacterial Glass Market include AGC Inc., AGI Glaspac, Fuyao Glass Industry Group Co., Ltd., HMI Glass, Ishizuka Glass Co., Ltd., LC Corporations, Nippon Sheet Glass Co., Ltd. (NSG Group / Pilkington), Saint Gobain, Schott AG, and Xinyi Glass Holdings Limited. Companies in the Global Antibacterial Glass Market strengthen their position by focusing on product innovation and R&D to develop high-performance, durable, and eco-friendly glass products. They invest in advanced coating technologies, expand regional manufacturing capabilities, and form strategic partnerships to enhance distribution networks. Regulatory compliance, brand differentiation, and marketing of superior antimicrobial solutions help attract institutional and consumer clients. Firms also adopt cost optimization and sustainability initiatives, while targeting high-growth regions through localized operations to maintain a competitive edge and increase market penetration globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Glass type

- 2.2.3 Antimicrobial agent

- 2.2.4 Manufacturing technology

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for hygiene-focused solutions in healthcare and public spaces.

- 3.2.1.2 Growing use in consumer electronics and high-touch household surfaces.

- 3.2.1.3 Increasing awareness of contamination risks in food and beverage industries.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs limiting adoption in price-sensitive markets.

- 3.2.2.2 Technical limitations in integrating antimicrobial properties without affecting glass quality.

- 3.2.2.3 Regulatory and safety compliance requirements across different regions.

- 3.2.3 Market opportunities

- 3.2.3.1 Development of innovative coatings and nanotechnology-based antimicrobial solutions.

- 3.2.3.2 Expansion in emerging markets with rising hygiene awareness.

- 3.2.3.3 Growing demand in automotive, transportation, and industrial applications.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By glass type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Glass Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Soda Lime Glass

- 5.3 Borosilicate Glass

- 5.4 Aluminosilicate Glass

- 5.5 Glass-Ceramic

- 5.6 Bioactive Glass

- 5.7 Specialty Coated Float Glass

Chapter 6 Market Estimates and Forecast, By Antimicrobial Agent, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Surface Coating Technologies

- 6.2.1 Sol-Gel Coating Method

- 6.2.2 Spray/Dip Coating Method

- 6.2.3 Physical Vapor Deposition (PVD)/Chemical Plating

- 6.2.4 Burn-In/High-Temperature Embedding

- 6.2.5 Photocatalytic On-Line Coating

- 6.3 Bulk Integration Technologies

- 6.3.1 Conventional Melting/Additive Incorporation

- 6.3.2 Ion-Exchange Method

- 6.3.3 Chemical Strengthening with Antimicrobial Integration

- 6.4 Hybrid/Advanced Technologies

- 6.4.1 Glass-Ceramic Formation

- 6.4.2 Nanoparticle/Nanotechnology Integration

Chapter 7 Market Estimates and Forecast, By Manufacturing Technology, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Silver-Based Antibacterial Glass

- 7.3 Copper-Based Antibacterial Glass

- 7.4 Zinc-Based Antibacterial Glass

- 7.5 Titanium-Based (TiO2/Photocatalytic) Antibacterial Glass

- 7.6 Multi-Ion Combination Antibacterial Glass

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Healthcare & Medical

- 8.3 Food & Beverage

- 8.4 Consumer Electronics

- 8.5 Building & Construction

- 8.6 Transportation & Automotive

- 8.7 Military & Defense

- 8.8 Residential/Household

- 8.9 Laboratory & Research

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 AGC Inc.

- 10.2 AGI Glaspac

- 10.3 Fuyao Glass Industry Group Co., Ltd.

- 10.4 HMI Glass

- 10.5 Ishizuka Glass Co., Ltd.

- 10.6 LC Corporations

- 10.7 Nippon Sheet Glass Co., Ltd. (NSG Group / Pilkington)

- 10.8 Saint-Gobain

- 10.9 Schott AG

- 10.10 Xinyi Glass Holdings Limited