PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892895

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892895

Cardiac Ablation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

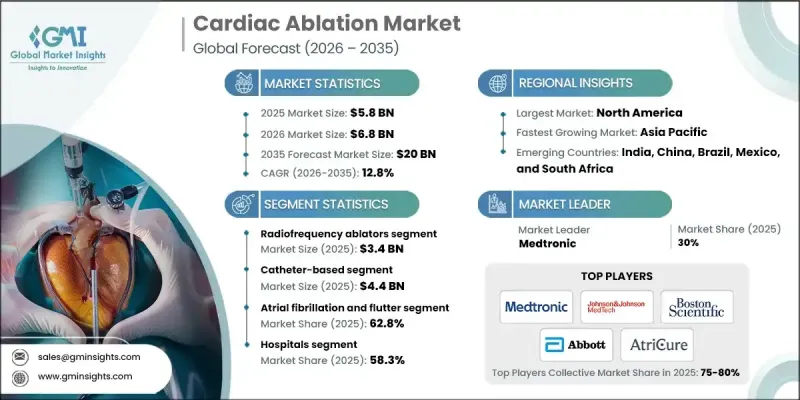

The Global Cardiac Ablation Market was valued at USD 5.8 billion in 2025 and is estimated to grow at a CAGR of 12.8% to reach USD 20 billion by 2035.

This market expansion is fueled by the rising prevalence of cardiovascular diseases, particularly cardiac arrhythmias, along with the increasing demand for minimally invasive procedures and innovations in ablation technologies. The growing aging population, lifestyle changes, and higher incidence of comorbidities such as diabetes and hypertension are contributing to the surge in arrhythmia cases. Patients often require interventions beyond conventional drug therapies, making cardiac ablation a critical solution. These procedures provide effective long-term management of arrhythmias, reducing hospital admissions and enhancing quality of life. As healthcare systems focus on lowering mortality and managing chronic cardiac conditions, advanced ablation technologies are gaining traction worldwide, driving the market. The adoption of minimally invasive procedures is a significant factor propelling the cardiac ablation market. These techniques offer reduced surgical trauma, shorter hospital stays, faster recovery, and lower complication rates compared to traditional open-heart surgery. Catheter-based radiofrequency and cryoablation procedures provide effective treatment while minimizing discomfort and improving patient outcomes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.8 Billion |

| Forecast Value | $20 Billion |

| CAGR | 12.8% |

The radiofrequency ablators segment accounted for USD 3.4 billion in 2025, holding a 58.1% share. These devices treat arrhythmias by delivering controlled heat to cardiac tissue, creating small lesions that block abnormal electrical signals and restore normal heart rhythm. RF ablation is widely regarded as the gold standard in arrhythmia therapy due to its proven clinical success.

The catheter-based segment reached USD 4.4 billion in 2025. Catheter-based ablation uses thin, flexible tubes inserted through blood vessels to access the heart and deliver energy to arrhythmogenic tissue. This minimally invasive approach reduces patient trauma, shortens recovery, and lowers hospital stays. Rising atrial fibrillation prevalence and growing preference for minimally invasive interventions have made catheter-based ablation the dominant treatment method globally.

U.S. Cardiac Ablation Market was valued at USD 2.3 billion in 2025, reflecting the high prevalence of cardiovascular diseases. The country leads in the adoption and development of ablation technologies due to its advanced healthcare infrastructure, high procedural volumes, and continuous investment in innovative solutions. Advanced ablation systems provide precise treatment, high success rates, and reduced complications, reinforcing market growth.

Key players in the Cardiac Ablation Market include Medtronic, Boston Scientific, Abbott Laboratories, Olympus, Japan Lifeline, AtriCure, Biotronik, Johnson & Johnson MedTech, Koninklijke Philips, MicroPort Scientific, CardioFocus, Osypka Medical, and AngioDynamics. Companies in the Cardiac Ablation Market are adopting multiple strategies to strengthen their market position. They are heavily investing in research and development to introduce innovative and high-precision ablation devices. Strategic partnerships, collaborations, and mergers are being pursued to expand global reach and enhance technology portfolios. Geographic expansion into emerging markets is a key focus to capture rising demand. Firms are also emphasizing product differentiation through advanced catheter designs, energy modalities, and software integration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Approach trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of patients suffering from cardiovascular diseases including cardiac arrhythmias

- 3.2.1.2 Rising demand for minimally invasive procedures

- 3.2.1.3 Technological advancements in cardiac ablation devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk associated with cardiac ablation procedures

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption of pulsed field ablation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Radiofrequency ablators

- 5.3 Electrical ablators

- 5.4 Cryoablation devices

- 5.5 Ultrasound ablators

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Approach, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Catheter-based

- 6.3 Open/Surgical

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Atrial Fibrillation and flutter

- 7.3 Tachycardia

- 7.3.1 Atrial tachycardia

- 7.3.2 Ventricular tachyarrhythmias

- 7.3.3 Other tachycardia

- 7.4 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Cardiac centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 AngioDynamics

- 10.3 AtriCure

- 10.4 Biotronik

- 10.5 Boston Scientific

- 10.6 CardioFocus

- 10.7 Japan Lifeline

- 10.8 Johnson & Johnson MedTech

- 10.9 Koninklijke Philips

- 10.10 Medtronic

- 10.11 MicroPort Scientific

- 10.12 Olympus

- 10.13 Osypka Medical