PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892899

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892899

Biological Sample Collection Kits Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

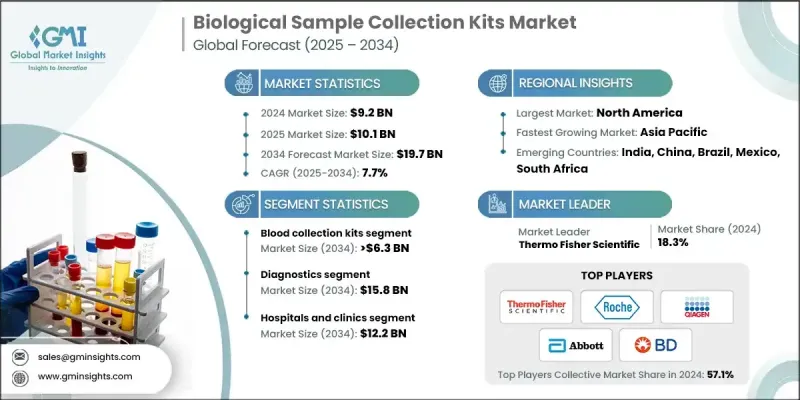

The Global Biological Sample Collection Kits Market was valued at USD 9.2 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 19.7 billion by 2034.

The market continues to grow as demand rises for diagnostic testing, biobanking, and personalized medicine initiatives that rely heavily on accurate biomarker analysis. These kits support laboratories, healthcare facilities, diagnostics companies, and biopharmaceutical organizations by preserving sample quality and ensuring dependable results. A wide range of products, such as blood and urine collection kits, viral transport media, saliva-based systems, and self-sampling tools, enable safe, consistent, contamination-free handling for both clinical and research purposes. The shift toward molecular diagnostics, including next-generation sequencing and PCR-based testing, is expanding the need for specialized kits optimized for advanced analytical platforms. Increasing use of telemedicine is also accelerating the adoption of at-home collection solutions that offer patient convenience and reduce the burden on clinical settings. Additionally, regulatory attention on sample security and traceability is encouraging innovation in barcoded packaging, tamper-resistant designs, and temperature-stable formats. Growing automation in laboratories and the push for kits tailored to specific specimen types are further supporting long-term market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.2 Billion |

| Forecast Value | $19.7 Billion |

| CAGR | 7.7% |

The swabs segment is expected to grow at a CAGR of 7.2% through 2034. Growth is influenced by increasing demand for non-invasive sampling across infectious disease diagnostics, microbiome research, and rapid testing workflows. Their reliability and widespread availability make swabs essential in hospitals, laboratory settings, and point-of-care environments.

The diagnostics segment held a 78.9% share in 2024 and is anticipated to achieve USD 15.8 billion by 2034. Rising rates of chronic and infectious illnesses worldwide are driving consistent use of diagnostic testing to support early detection and treatment planning. Collection kits form a critical part of these workflows by maintaining sample integrity and helping reduce medical costs through timely health assessments.

North America Biological Sample Collection Kits Market accounted for a 32.4% share in 2024. Strong healthcare infrastructure, broad access to advanced diagnostic technologies, and robust research ecosystems continue to support high utilization of biological sampling kits. Increasing case numbers for metabolic, cardiac, oncological, and infectious conditions further reinforce the need for reliable diagnostic tools across the region.

Leading companies active in the Global Biological Sample Collection Kits Market include Abbott, Altona Diagnostics, Becton, Dickinson and Company (BD), CTK Biotech, Hardy Diagnostics, HiMedia Laboratories, Labcorp, Lucence Health, Miraclean Technology, Puritan Medical, QIAGEN, Roche, Seegene, Thermo Fisher Scientific, and VIRCELL MEDICAL. Companies competing in the Biological Sample Collection Kits Market use a variety of strategies to strengthen their presence. Many are expanding product portfolios with specialized kits that support molecular testing, personalized medicine, and at-home diagnostics. Investments in automation-ready systems, tamper-proof designs, and advanced tracking features help improve accuracy and traceability. Firms are enhancing global distribution networks and forming partnerships with laboratories, biotech companies, and healthcare providers to widen market access. Significant focus is placed on compliance with evolving regulatory standards to ensure product reliability across regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of laboratory tests

- 3.2.1.2 Rising usage of lab tests for precise disease diagnosis

- 3.2.1.3 Growing R&D activities and technological advancements in sample collection techniques

- 3.2.1.4 Expansion of biobanking and personalized medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced kits and complexities associated with specimen collection

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of at-home and remote sample collection kits

- 3.2.3.2 Integration of automation and digital tracking solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Growth of portable and home-based biological sample collection kits

- 3.5.1.2 Digital health platforms enabling remote sample tracking

- 3.5.1.3 Patient-friendly self-collection and minimally invasive kits

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-powered sample quality monitoring and predictive analytics

- 3.5.2.2 Wearable and connected sample collection devices

- 3.5.2.3 Smart kits with adaptive stabilization and preservation features

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Integration of AI, digital health, and connected diagnostics

- 3.9.2 Expansion of home-based and self-collection testing solutions

- 3.9.3 Growth in emerging markets with enhanced healthcare infrastructure

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Blood collection kits

- 5.3 Urine collection kits

- 5.4 Swabs

- 5.4.1 Nasopharyngeal (NP) swabs

- 5.4.2 Oropharyngeal (OP) swabs

- 5.4.3 Nasal swabs

- 5.5 Viral transport media

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnostics

- 6.3 Research

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Diagnostic centers

- 7.4 Homecare

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Altona Diagnostics

- 9.3 Becton, Dickinson and Company (BD)

- 9.4 CTK Biotech

- 9.5 Hardy Diagnostics

- 9.6 HiMedia Laboratories

- 9.7 Labcorp

- 9.8 Lucence Health

- 9.9 Miraclean Technology

- 9.10 Puritan Medical

- 9.11 QIAGEN

- 9.12 Roche

- 9.13 Seegene

- 9.14 Thermo Fisher Scientific

- 9.15 VIRCELL MEDICAL