PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892900

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892900

Automotive Torque Converter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

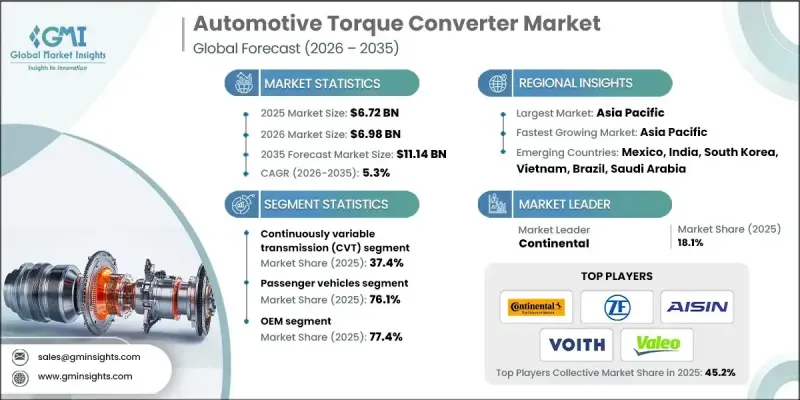

The Global Automotive Torque Converter Market was valued at USD 6.72 billion in 2025 and is estimated to grow at a CAGR of 5.3% to reach USD 11.14 billion by 2035.

Growth is driven by the rising adoption of automatic transmissions, which offer a smoother, easier driving experience, particularly in urban areas. Torque converters are transforming traditional vehicles by replacing complex clutch and gear mechanisms with hydraulic fluid-based systems, allowing vehicles to operate without a clutch pedal. Increasing consumer preference for automatic transmission in both passenger cars and commercial fleets is boosting market demand. Torque converters also enhance fuel efficiency compared to manual transmissions, which further encourages adoption. Markets with high penetration of automatic vehicles, including the U.S. and the U.K., continue to create significant opportunities for both new vehicle production and aftermarket component replacement. As global urbanization and hybrid vehicle adoption grow, torque converters are becoming essential for seamless and efficient vehicle operation.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.72 Billion |

| Forecast Value | $11.14 Billion |

| CAGR | 5.3% |

The continuously variable transmission (CVT) segment held a 37.4% share in 2025 due to its superior fuel efficiency and ability to allow engines to operate at optimal revolutions per minute. CVTs provide a smooth, seamless driving experience that is increasingly favored in city environments.

The passenger vehicle segment generated USD 5.11 billion in 2025, reflecting high demand for automatic transmission vehicles. The rise of hybrid electric vehicles (HEVs) and manufacturers' push for advanced automatic transmission technology is driving growth in this segment.

United States Automotive Torque Converter Market reached USD 1.82 billion in 2025, up from USD 1.75 billion in 2024. Technological advancements are encouraging U.S.-based OEMs to adopt more efficient torque converters that help meet Corporate Average Fuel Economy (CAFE) standards. While battery-electric vehicles often do not require torque converters, HEVs and plug-in hybrids rely on advanced, compact converters to maximize efficiency and performance.

Key players in the Automotive Torque Converter Market include Schaeffler Technologies, BorgWarner, Exedy, Aisin Seiki, Allison Transmission, Continental, Voith, ZF Friedrichshafen, Valeo, and Delphi Technologies. Companies are strengthening their Automotive Torque Converter Market positions by developing high-efficiency and compact torque converters suitable for hybrid and plug-in hybrid electric vehicles. Strategic R&D investments are focused on improving fuel economy, reducing emissions, and enhancing durability. Leading manufacturers are forming alliances with OEMs to integrate advanced torque converters into next-generation automatic transmissions and continuously variable transmissions (CVTs). Technological innovation, including hydraulic optimization and lightweight materials, is being used to improve performance while lowering costs. Market leaders are also expanding global production capabilities and establishing service and aftermarket networks to ensure long-term customer support.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Transmission

- 2.2.3 Converter

- 2.2.4 Vehicle

- 2.2.5 Sales Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing global automatic transmission penetration

- 3.2.1.2 Growth in passenger vehicle production

- 3.2.1.3 Commercial vehicle & off-highway vehicle growth

- 3.2.1.4 Aftermarket & service market growth

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 EV adoption reducing automatic transmission demand

- 3.2.2.2 Manual transmission preference in price-sensitive markets

- 3.2.3 Market opportunities

- 3.2.3.1 Hybrid electric vehicle (HEV) segment growth

- 3.2.3.2 Partnerships with OEMs on system-level optimization

- 3.2.3.3 Sustainability & circular economy integration

- 3.2.3.4 Aftermarket performance & racing segments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States: U.S. Corporate Average Fuel Economy (CAFE) Standards

- 3.4.1.2 Canada: Canada's federal light-duty vehicle standards

- 3.4.2 Europe

- 3.4.2.1 Germany: German Road Traffic Licensing Regulations (StVZO)

- 3.4.2.2 France: French Vehicle Type-Approval Framework

- 3.4.2.3 United Kingdom: UK Vehicle Certification Agency (VCA)

- 3.4.3 Asia Pacific

- 3.4.3.1 China: China VI Vehicle Emission Standards

- 3.4.3.2 Japan: Japan Automobile Type Approval (JATA) Regulations

- 3.4.3.3 India: Bharat Stage Emission Standards

- 3.4.4 Latin America

- 3.4.4.1 Brazil: Brazilian PROCONVE Vehicle Emission Program

- 3.4.4.2 Argentina: Argentina National Automotive Safety Standards

- 3.4.4.3 Mexico: Mexican NOM Vehicle Emission and Safety Standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE: UAE Federal Vehicle Safety & Emission Regulations

- 3.4.5.2 South Africa: South African National Road Traffic Regulations

- 3.4.5.3 Saudi Arabia: SASO Fuel Economy and Vehicle Safety Standards

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.10.1 Manufacturing cost structure

- 3.10.2 Operational cost analysis

- 3.10.3 Infrastructure cost analysis

- 3.10.4 Cost optimization strategies

- 3.11 Patent analysis

- 3.12 Sustainability and environmental impact

- 3.12.1 Carbon footprint of torque converter production

- 3.12.2 Material recyclability analysis

- 3.12.3 Eco-friendly manufacturing practices

- 3.12.4 Lifecycle assessment

- 3.13 Best case scenarios

- 3.14 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Transmission, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Automated manual transmission (AMT)

- 5.3 Dual- Clutch transmission (DCT)

- 5.4 Continuously variable transmission (CVT)

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Converter, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Single-stage

- 6.3 Multi-stage

- 6.4 Lockup

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger Vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUVs

- 7.3 Commercial Vehicles

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Singapore

- 9.4.7 Malaysia

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.4.10 Thailand

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 ZF Friedrichshafen

- 10.1.2 Schaeffler

- 10.1.3 Valeo

- 10.1.4 EXEDY

- 10.1.5 Aisin

- 10.1.6 BorgWarner

- 10.1.7 Yutaka Giken

- 10.1.8 Allison Transmission

- 10.1.9 JATCO

- 10.1.10 Punch Powertrain

- 10.1.11 Voith

- 10.1.12 Delphi Technologies

- 10.2 Regional companies

- 10.2.1 Zhejiang Torch Auto Parts

- 10.2.2 Hubei Aviation Precision Machinery Technology

- 10.2.3 Zhejiang Wanliyang

- 10.2.4 Transtar Industries

- 10.2.5 Florida Torque Converter

- 10.2.6 RevMax Converters

- 10.2.7 TCI Automotive

- 10.3 Emerging companies

- 10.3.1 Circle D Specialties

- 10.3.2 Coan Engineering

- 10.3.3 Hughes Performance

- 10.3.4 Hays Performance (Holley)

- 10.3.5 Sonnax Transmission Company