PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892901

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892901

Industrial Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

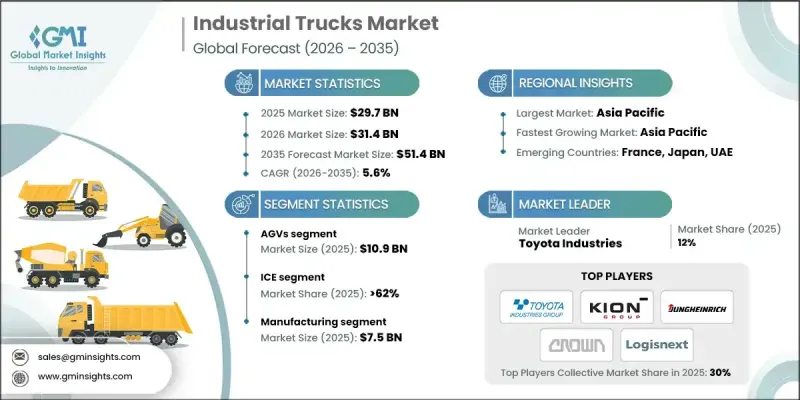

The Global Industrial Trucks Market was valued at USD 29.7 billion in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 51.4 billion by 2035.

The rapid acceleration of e-commerce continues to reshape supply chains, pushing businesses to adopt faster and more efficient material-handling solutions. Rising online order volumes are driving companies to invest in large distribution hubs and smaller fulfillment sites to keep pace with expectations for rapid delivery. This increasing activity is elevating the need for forklifts, pallet trucks, and autonomous vehicles that support high-speed movement of goods throughout warehouse operations. As organizations prioritize quick internal transport and improved throughput, industrial trucks are becoming a vital competitive advantage in logistics environments. Advancements in warehouse automation including robotics, sensor-based systems, and integrated storage technologies are further propelling demand, as companies seek to optimize labor, maximize accuracy, and better utilize valuable warehouse space. This shift is particularly evident in dense urban markets, where automated processes are improving workflows and supporting higher productivity levels.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $29.7 Billion |

| Forecast Value | $51.4 Billion |

| CAGR | 5.6% |

The AGVs segment generated USD 10.9 billion in 2025. Automated guided vehicles operate independently using technologies such as laser-based navigation, induction systems, and imaging tools. These vehicles follow mapped routes and can modify their paths in real time, enabling safe and efficient transportation of materials throughout warehouses without the need for manual operation. Their ability to move pallets, containers, and other goods with consistency and precision has made them an integral part of modern material-handling environments.

The ICE segment held a 62% share in 2025. Internal combustion engine trucks remain heavily relied upon for demanding material-handling activities both indoors and outdoors. These vehicles, powered by diesel, gasoline, or LPG, are known for high torque and durability, making them suitable for industries that require lifting and transporting heavy loads under challenging conditions. Their performance capabilities are crucial in sectors including mining, large-scale manufacturing, and construction.

U.S. Industrial Trucks Market accounted for a 75% share and generated USD 6.3 billion in 2025. The expansion of warehouses, paired with the accelerated adoption of automation technologies, continues to drive strong demand across manufacturing, logistics, and e-commerce operations. Growing interest in electric-powered equipment and enhanced handling solutions reflects ongoing corporate sustainability goals and safety compliance requirements. The presence of major global original equipment manufacturers and significant investment in next-generation material-handling technologies positions the U.S. as a key center for innovation within the industrial trucks sector.

Major companies in the Industrial Trucks Market include Anhui Heli, BYD Company, Clark Material Handling Company, Combilift, Crown Equipment, Doosan Corporation Industrial Vehicle, Hangcha Group, Hyster-Yale Materials Handling, Hyundai Heavy Industries, Jungheinrich AG, KION Group AG, Komatsu, Manitou Group, Mitsubishi Logisnext, and Toyota Industries. Companies in the Industrial Trucks Market are strengthening their competitive position by expanding electric and automated product lines that support sustainability goals and reduce operating costs. Many manufacturers are integrating advanced telematics and fleet management systems to provide real-time data on performance, maintenance, and utilization. Continuous investment in autonomous technologies such as AGVs and semi-automated forklifts helps improve productivity and minimize reliance on manual labor. Firms are also diversifying their global production bases to improve supply stability and reduce lead times.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Propulsion

- 2.2.4 Operator type

- 2.2.5 End use industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 E-commerce expansion & warehouse automation

- 3.2.1.2 Adoption of Industry 4.0 technologies

- 3.2.1.3 Growth in manufacturing, construction, and logistics sectors

- 3.2.1.4 Labour shortages in developed markets

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High upfront costs & maintenance expenses

- 3.2.2.2 Supply chain disruptions & component shortages

- 3.2.3 Opportunities

- 3.2.3.1 Electric & zero-emission trucks

- 3.2.3.2 Automated guided vehicles (AGVs) & autonomous trucks

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 AGVs

- 5.3 Hand, platform and pallet trucks

- 5.4 Order pickers

- 5.5 Pallet jacks

- 5.6 Side-loaders

- 5.7 Walkie stackers

Chapter 6 Market Estimates and Forecast, By Propulsion, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric

Chapter 7 Market Estimates and Forecast, By Operator, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automated

- 7.4 Fully automated

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Automotive

- 8.4 Retail & e-commerce

- 8.5 Construction & mining

- 8.6 Manufacturing

- 8.7 Pharmaceuticals

- 8.8 Logistics & warehousing

- 8.9 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Anhui Heli

- 10.2 BYD Company

- 10.3 Clark Material Handling Company

- 10.4 Combilift

- 10.5 Crown Equipment

- 10.6 Doosan Corporation Industrial Vehicle

- 10.7 Hangcha Group

- 10.8 Hyster-Yale Materials Handling

- 10.9 Hyundai Heavy Industries

- 10.10 Jungheinrich AG

- 10.11 KION Group AG

- 10.12 Komatsu

- 10.13 Manitou Group

- 10.14 Mitsubishi Logisnext

- 10.15 Toyota Industries