PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892903

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892903

Automotive Curtain Airbags Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

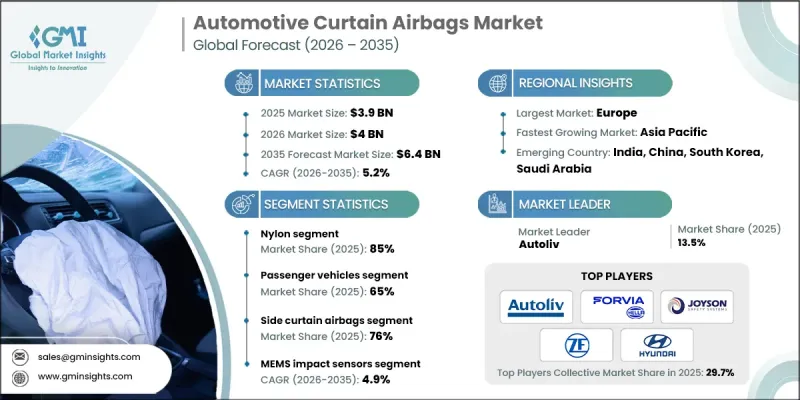

The Global Automotive Curtain Airbags Market was valued at USD 3.9 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 6.4 billion by 2035.

Steady growth in SUV and crossover sales is a major driver, as wider cabins and taller rooflines increase the need for head protection systems. Automakers are progressively equipping more vehicles with curtain airbags as standard features, making advanced safety solutions available at competitive pricing worldwide. The evolution of EV skateboard platforms is reshaping vehicle architecture, influencing how sensors and safety systems are positioned. This shift enables better integration of curtain airbags, prompting suppliers to engineer lighter, compact inflatable designs and improved textile materials capable of providing strong protection in increasingly constrained cabin spaces. With global regulations tightening across multiple regions, OEMs are required to deliver side-impact protection across nearly all vehicle classes. Rising consumer focus on vehicle safety is also pushing automakers to differentiate their lineups with advanced passive safety systems that comply with regional standards and appeal to buyers who prioritize comprehensive occupant protection.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.9 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 5.2% |

The nylon material segment accounted for an 85% share in 2025 and is projected to grow at a CAGR of 4.2% through 2035. Future developments in nylon-polyester hybrids, next-generation nylon formulations, and bio-based polyamides are expected to improve performance while addressing sustainability goals. Advancements in fiber chemistry continue to narrow the performance gap between nylon and alternative materials.

The passenger vehicle segment held a 65% share in 2025 and is anticipated to grow at a CAGR of 5.5% from 2026 to 2035. Adoption patterns vary depending on vehicle class: high-end models have widespread use of curtain airbag systems, while mid-range vehicles have seen rapid integration. Entry-level markets still face cost limitations, but overall adoption is rising as regulatory requirements strengthen and as safety becomes a higher priority among consumers worldwide.

US Automotive Curtain Airbags Market reached USD 871.5 million in 2025. Regulatory authorities have been expanding requirements for side-impact and ejection mitigation testing, encouraging manufacturers to adopt more advanced curtain airbags optimized for larger SUVs and pickup trucks. These updated systems offer broader coverage and better rollover performance than earlier designs.

Key companies operating in the Automotive Curtain Airbags Market include Autoliv, Continental, Hella, Hyundai, Joyson Safety Systems, Kolon Industries, Neaton Auto Products Manufacturing, Toyoda Gosei, and ZF Friedrichshafen. Companies within the Automotive Curtain Airbags Market are strengthening their competitive presence by advancing material technology, reducing system weight, and developing compact inflators that improve deployment efficiency. Many manufacturers are collaborating closely with automakers to design airbag systems tailored to new EV platforms and evolving vehicle geometries. Investments in improved textile engineering, enhanced sensor integration, and high-performance inflator mechanisms form a major part of ongoing R&D. Firms are also prioritizing compliance with global regulatory updates to secure broader OEM adoption. Expanding production capacity in strategic regions, focusing on cost-efficient manufacturing, and ensuring consistent quality control help companies maintain strong international footprints.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022-2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Sensor

- 2.2.5 Vehicle

- 2.2.6 Sales channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing emphasis on occupant safety compliance

- 3.2.1.2 Rising adoption of SUVs and crossovers

- 3.2.1.3 Technological advancements in adaptive airbag systems

- 3.2.1.4 Production expansion in emerging automotive hubs

- 3.2.1.5 Shift toward sustainable materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system integration and component costs

- 3.2.2.2 Limited safety regulations in emerging markets

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in autonomous and semi-autonomous vehicles

- 3.2.3.2 Aftermarket replacement and recall-driven demand

- 3.2.3.3 Expansion into commercial vehicles and fleets

- 3.2.3.4 Sustainability-driven procurement shifts

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States- FMVSS 214 side impact protection

- 3.4.1.2 Canada- CMVSS 214 side impact protection

- 3.4.2 Europe

- 3.4.2.1 Germany-UN regulation 135 pole side impact protection

- 3.4.2.2 United Kingdom-UNECE regulation 95 lateral impact protection

- 3.4.2.3 France-EU general safety regulation 2019/2144

- 3.4.2.4 Italy-UN regulation 21 interior fittings safety

- 3.4.2.5 Spain-EU regulation 661/2009 general vehicle safety

- 3.4.3 Asia Pacific

- 3.4.3.1 China-GB 20071 side impact protection

- 3.4.3.2 India-AIS-099 side impact regulation

- 3.4.3.3 Japan-JNCAP side impact crashworthiness protocol

- 3.4.3.4 Australia-ADR 72 side impact protection

- 3.4.3.5 South Korea-KMVSS side impact crash protection

- 3.4.4 Latin America

- 3.4.4.1 Brazil-Contran resolution 518 side impact protection

- 3.4.4.2 Mexico-NOM-194-SCFI vehicle safety standard

- 3.4.4.3 Argentina-IRAM-AITA 1-20 side impact standard

- 3.4.5 Middle East & Africa

- 3.4.5.1 South Africa-SANS 20079 side impact protection

- 3.4.5.2 Saudi Arabia-SASO 2915 vehicle safety regulation

- 3.4.5.3 UAE-UAE.S 5010-5 vehicle crash protection

- 3.4.5.4 Turkey-UNECE regulation 95 side impact protection

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Price trends

- 3.8.1 By Product

- 3.8.2 By region

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future market outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Side curtain airbags

- 5.2.1 Nylon

- 5.2.2 Polyester

- 5.3 Front curtain airbags

- 5.3.1 Nylon

- 5.3.2 Polyester

- 5.4 Rear curtain airbags

- 5.4.1 Nylon

- 5.4.2 Polyester

Chapter 6 Market Estimates & Forecast, By Material, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Nylon

- 6.3 Polyester

Chapter 7 Market Estimates & Forecast, By Sensor, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 MEMS Impact Sensors

- 7.3 Rollover Gyro Sensors

- 7.4 Unified Safety ECUs

Chapter 8 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger vehicles

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUVs

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCVs)

- 8.3.2 Medium commercial vehicles (MCVs)

- 8.3.3 Heavy commercial vehicles (HCVs)

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.3.10 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Autoliv

- 11.1.2 ZF Friedrichshafen

- 11.1.3 Joyson Safety Systems

- 11.1.4 Continental

- 11.1.5 Hyundai

- 11.1.6 Toyoda Gosei

- 11.1.7 Daicel

- 11.1.8 Bosch Passive Safety Systems

- 11.1.9 Magna International

- 11.1.10 Denso

- 11.1.11 Valeo

- 11.1.12 Delphi Automotive / BorgWarner

- 11.2 Regional Players

- 11.2.1 Forvia Hella

- 11.2.2 Kolon Industries

- 11.2.3 Nihon Plast

- 11.2.4 Porcher Industries

- 11.2.5 Toray Industries

- 11.2.6 Sumitomo

- 11.2.7 SEIREN

- 11.2.8 Toyota Boshoku

- 11.2.9 Ashimori Industry

- 11.2.10 U-Shin

- 11.3 Emerging & Niche Players

- 11.3.1 Yanfeng Automotive Trim Systems

- 11.3.2 Wuhu Ruili Automobile Airbag

- 11.3.3 ARC Automotive

- 11.3.4 Tata AutoComp Systems

- 11.3.5 Ningbo Joyson Electronic

- 11.3.6 Changzhou Changrui