PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892907

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892907

Cryogenic Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

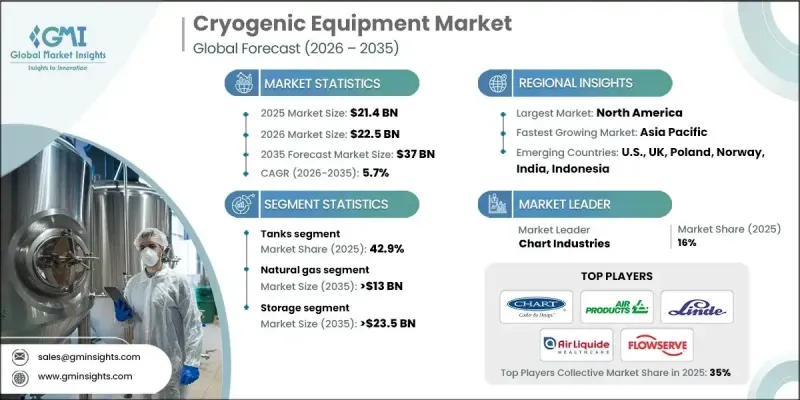

The Global Cryogenic Equipment Market was valued at USD 21.4 billion in 2025 and is estimated to grow at a CAGR of 5.7% to reach USD 37 billion by 2035.

Market growth is driven by the increasing adoption of advanced liquefaction systems for natural gas storage and the rising integration of automated valve assemblies that optimize low-temperature operations. The growing deployment of cryogenic pumps for LNG bunkering, coupled with emission reduction initiatives across the marine sector, is shaping design priorities. Cryogenic equipment encompasses specialized devices and systems for producing, handling, storing, and transporting materials at extremely low temperatures, essential for liquefying gases such as nitrogen, oxygen, hydrogen, helium, and natural gas. Rising adoption of vacuum-insulated piping, modular cryogenic tanks, and skid-mounted systems is enhancing efficiency and flexibility, while IoT-enabled sensors and predictive maintenance tools are improving operational reliability. Increasing utilization of cryogenic vaporizers, compressors, and flexible capacity solutions in industrial and petrochemical applications is redefining installation practices and creating opportunities for innovation in ultra-low temperature operations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $21.4 Billion |

| Forecast Value | $37 Billion |

| CAGR | 5.7% |

The valves segment is expected to reach USD 4 billion by 2035, driven by a preference for stainless steel and nickel alloys and adherence to stringent performance standards. Advanced valve designs focused on zero-emission operations are aligning with sustainability objectives, enabling safer and more efficient handling of cryogenic fluids.

The oxygen segment is projected to grow at a CAGR of 5.5% by 2035. Rising adoption of oxygen vaporizers and high-capacity storage systems is supporting industrial processes, including aerospace fueling applications. Integration of oxygen cryogenic pumps is further driving niche applications that demand precise and reliable low-temperature management.

U.S. Cryogenic Equipment Market held 85.7% share, generating USD 4.2 billion in 2025. Strong adoption of cryogenic tanks, coupled with peak shaving facilities, supports seasonal power demand management. Increasing deployment of IoT-enabled cryogenic pumps and predictive maintenance solutions is enabling smart and automated plant operations, improving efficiency and safety across the industry.

Major players active in the Global Cryogenic Equipment Market include Emerson Electric, Air Liquide, Chart Industries, Flowserve Corporation, Linde, Cryostar, Air Products and Chemicals, Kelvin International, IWI Cryogenic Vaporization Systems (India) Pvt. Ltd., Cryogas Equipment, CRYOSPAIN, BRUGG Pipes, Abhijit Enterprises, Cryoworld, Shell-n-Tube, Demaco, AIR WATER, Auguste Cryogenics, SLB, Cryogenic OGS, and Vacuum Barrier. Companies in the Cryogenic Equipment Market are focusing on multiple strategies to enhance their market presence and strengthen their competitive position. Key approaches include investing in R&D to develop next-generation, energy-efficient, and modular cryogenic solutions. Firms are pursuing strategic partnerships, joint ventures, and acquisitions to expand geographic reach and technological capabilities. Product differentiation through advanced materials, automated valve assemblies, and IoT-enabled monitoring systems is being emphasized to meet industry-specific requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Cryogen type trends

- 2.5 Application trends

- 2.6 End use trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of cryogenic equipment

- 3.8 Emerging opportunities & trends

- 3.9 Digitalization and IoT integration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Tanks

- 5.3 Valves

- 5.4 Vaporizers

- 5.5 Pumps

- 5.6 Pipe

- 5.7 Others

Chapter 6 Market Size and Forecast, By Cryogen Type, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Nitrogen

- 6.3 Oxygen

- 6.4 Natural gas

- 6.5 Argon

- 6.6 Other cryogens

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Storage

- 7.3 Distribution

Chapter 8 Market Size and Forecast, By End Use, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 O&G industry

- 8.3 Power

- 8.4 Food & beverage

- 8.5 Chemical

- 8.6 Rubber & plastics

- 8.7 Metallurgy

- 8.8 Healthcare

- 8.9 Shipping

- 8.10 Agriculture, forestry & fishing

- 8.11 Other industries

Chapter 9 Market Size and Forecast, By Region, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 Italy

- 9.3.4 Spain

- 9.3.5 France

- 9.3.6 Poland

- 9.3.7 Norway

- 9.3.8 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Indonesia

- 9.4.5 Thailand

- 9.4.6 Malaysia

- 9.4.7 Philippines

- 9.4.8 South Korea

- 9.4.9 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Kuwait

- 9.5.4 Oman

- 9.5.5 Turkey

- 9.5.6 Qatar

- 9.5.7 Egypt

- 9.5.8 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Peru

Chapter 10 Company Profiles

- 10.1 Abhijit Enterprises

- 10.2 Air Liquide

- 10.3 Air Products and Chemicals

- 10.4 AIR WATER

- 10.5 Auguste Cryogenics

- 10.6 BRUGG Pipes

- 10.7 Chart Industries

- 10.8 Cryogas Equipment

- 10.9 Cryogenic OGS

- 10.10 CRYOSPAIN

- 10.11 Cryostar

- 10.12 Cryoworld

- 10.13 Demaco

- 10.14 Emerson Electric

- 10.15 Flowserve Corporation

- 10.16 Hypro

- 10.17 INOXCVA

- 10.18 IWI Cryogenic Vaporization Systems (India) Pvt. Ltd.

- 10.19 Kelvin International

- 10.20 Linde

- 10.21 Shell-n-Tube

- 10.22 SLB

- 10.23 Vacuum Barrier