PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892914

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892914

U.S. Equestrian Apparel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

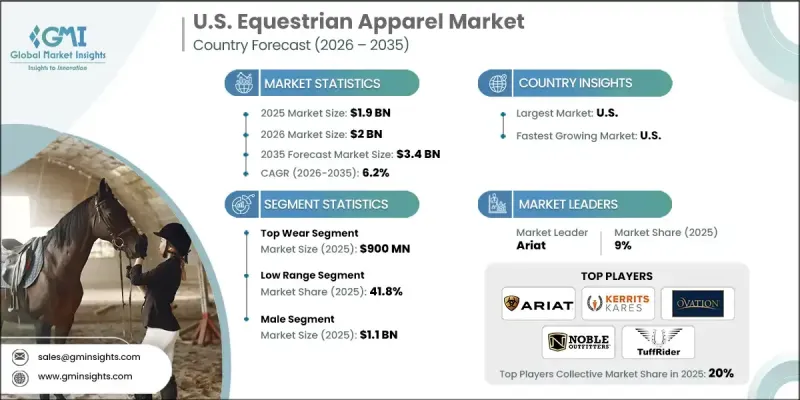

U.S. Equestrian Apparel Market was valued at USD 1.9 billion in 2025 and is estimated to grow at a CAGR of 6.2% to reach USD 3.4 billion by 2035.

The market's expansion is driven by advancements in technical performance fabrics used in equestrian clothing. These fabrics provide riders with enhanced comfort, improved breathability, efficient heat dissipation, and effective moisture management, resulting in a superior riding experience. Manufacturers are focusing on blending functionality with modern aesthetics, ensuring apparel meets both performance needs and consumer preferences. In addition, sustainability is emerging as a critical factor, with consumers increasingly seeking eco-friendly and responsibly manufactured apparel. This shift has prompted brands to adopt environmentally conscious production processes, driving innovation in fabric technology and design while appealing to environmentally aware riders. The combination of performance, style, and sustainability is fueling growth in the U.S. equestrian apparel sector.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 6.2% |

In 2025, the top wear segment generated USD 900 million. These garments, including jackets, shirts, and vests, are essential for riders, offering comfort, protection, and freedom of movement. Features such as moisture-wicking fabrics, UV protection, and stretchable materials make top wear indispensable for a wide range of equestrian activities.

The low-range segment held a 41.8% share in 2025, targeting entry-level riders and casual enthusiasts. These products, including basic shirts, breeches, and helmets, offer functional performance without advanced technologies. This segment's accessibility and affordability have contributed to its dominant position, attracting a broad base of recreational riders.

Major players in the U.S. Equestrian Apparel Market include TuffRider, Kerrits, RJ Classics, Noble Outfitters, FITS Riding, Ovation Riding, Tailored Sportsman, Romfh Equestrian Apparel, Goode Rider, Devon-Aire, Essex Classics, Irideon (Toklat), Equine Couture, Asmar Equestrian, and Ariat International, Inc. Companies in the U.S. Equestrian Apparel Market are strengthening their market position through multiple strategies. They are investing in research and development to enhance technical performance fabrics and introduce innovative, moisture-wicking, and breathable materials. Sustainability initiatives, such as using eco-friendly fibers and minimizing production waste, are being prioritized to appeal to environmentally conscious consumers. Brands are expanding their product lines across price segments to attract both entry-level and premium riders. Direct-to-consumer channels, including e-commerce platforms, are being leveraged to increase reach and engagement.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product

- 2.2.3 Apparel type

- 2.2.4 Category

- 2.2.5 Price range

- 2.2.6 Consumer group

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising participation equestrian sports

- 3.2.1.2 Innovation in performance fabrics

- 3.2.1.3 Increase in disposable income

- 3.2.1.4 Influence of social media

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 High cost of production and materials.

- 3.2.2.2 Seasonal nature of the equestrian sport

- 3.2.3 Opportunities

- 3.2.3.1 Expansion through sustainable and eco-friendly products

- 3.2.3.2 Leveraging digital platforms and customization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Gap Analysis

- 3.9 Risk assessment and mitigation

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behaviour analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Regional variations in consumer behaviour

- 3.12.4 Impact of e-commerce on buying decision

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Top wear

- 5.2.1 Show shirts

- 5.2.2 Polo shirts & tops

- 5.2.3 Show jackets

- 5.2.4 Other (outwear, etc.)

- 5.3 Bottom wear

- 5.3.1 Breeches/riding pants

- 5.3.2 Tights

- 5.3.3 Others (thermal, etc.)

- 5.4 Others (socks, etc.)

Chapter 6 Market Estimates and Forecast, By Apparel Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Sustainable

- 6.3 Unsustainable

Chapter 7 Market Estimates and Forecast, By Category, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Professional rider

- 7.3 Recreational rider

Chapter 8 Market Estimates and Forecast, By Price Range, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates and Forecast, By Consumer Group, 2022- 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Male

- 9.3 Female

- 9.4 Children

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Specialty stores

- 10.3.2 Hypermarkets & supermarkets

- 10.3.3 Others (departmental stores, etc.)

Chapter 11 Company Profiles

- 11.1 Ariat International, Inc.

- 11.2 Asmar Equestrian

- 11.3 Devon-Aire

- 11.4 Equine Couture

- 11.5 Essex Classics

- 11.6 FITS Riding

- 11.7 Goode Rider

- 11.8 Irideon (Toklat)

- 11.9 Kerrits

- 11.10 Noble Outfitters

- 11.11 Ovation Riding

- 11.12 RJ Classics

- 11.13 Romfh Equestrian Apparel

- 11.14 Tailored Sportsman

- 11.15 TuffRider