PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892918

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892918

Automotive Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

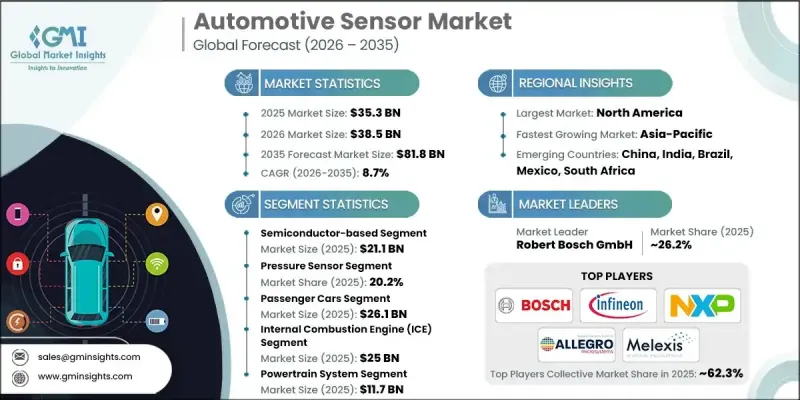

The Global Automotive Sensor Market was valued at USD 35.3 billion in 2025 and is estimated to grow at a CAGR of 8.7% to reach USD 81.8 billion by 2035.

The market's growth is fueled by the rising adoption of advanced driver assistance systems (ADAS), the increasing popularity of connected and autonomous vehicles, and the deployment of smart sensors that enhance safety, efficiency, and overall vehicle performance. Features such as adaptive cruise control, lane departure warning, automatic braking, and blind-spot monitoring are driving the integration of radar, lidar, camera, and ultrasonic sensors, enabling real-time situational awareness. Additionally, the transition to electric vehicles is supporting demand for sensors that manage battery performance, thermal regulation, motor control, and energy efficiency. Government mandates promoting safety, emission reduction, and fuel efficiency further accelerate sensor adoption across all vehicle segments. Rising production of EVs and incentives for cleaner transportation are also contributing to market growth globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $35.3 Billion |

| Forecast Value | $81.8 Billion |

| CAGR | 8.7% |

The semiconductor-based sensors segment reached USD 21.1 billion in 2024. These sensors are highly accurate, reliable, and capable of integrating multiple functions on a single chip. Their compact design, low power requirements, cost-effectiveness, and compatibility with advanced automotive electronics make them indispensable in electric, autonomous, and connected vehicles. They are widely utilized across ADAS, powertrain, battery management, infotainment, and safety systems, sustaining strong demand across global markets.

The pressure sensor segment was valued at USD 7.1 billion in 2025. Their widespread adoption stems from applications in engine management, transmission systems, tire pressure monitoring, braking systems, and electric vehicle battery management. Rising emphasis on vehicle safety, regulatory compliance, emission control, and fuel efficiency continues to drive demand for these sensors across passenger and commercial vehicles worldwide.

North America Automotive Sensor Market held a 37.1% share in 2025. The region's dominance is attributed to its strong automotive manufacturing base, early adoption of advanced vehicle technologies, and increasing demand for safety, fuel efficiency, and emission-compliant vehicles. Growing focus on electrification, connected vehicles, and autonomous driving solutions has driven sensor deployment in ADAS and powertrain systems. Additionally, stringent government regulations and consumer preference for innovative automotive technologies support North America's leadership in the global market.

Key players operating in Global Automotive Sensor Market include Infineon Technologies AG, Denso Corporation, Panasonic Corporation, Melexis NV, Analog Devices Inc., Microchip Technology Inc., TE Connectivity Ltd., NXP Semiconductors, Honeywell International Inc., Allegro MicroSystems LLC, Renesas Electronics Corporation, Robert Bosch GmbH, BorgWarner Inc., ON Semiconductor, Aptiv PLC, Hitachi Astemo Americas Inc., Continental AG, Sensata Technologies Inc., First Sensor AG, Valeo SA, STMicroelectronics NV, and OMNIVISION Technologies Inc. Companies in the Global Automotive Sensor Market are employing diverse strategies to strengthen their presence and expand their market foothold. They are investing heavily in research and development to deliver innovative, high-precision sensors for ADAS, autonomous, and electric vehicles. Strategic partnerships, mergers, and acquisitions are being pursued to expand technological capabilities, geographic reach, and production capacity. Firms are also focusing on product differentiation through miniaturization, multi-function integration, and energy-efficient designs. Additionally, companies are enhancing customer support, providing software-enabled solutions, and targeting emerging markets to capture growth opportunities, strengthen distribution networks, and maintain a competitive edge in the rapidly evolving automotive sensor landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Sensor type trends

- 2.2.3 Technology type trends

- 2.2.4 Vehicle type trends

- 2.2.5 Propulsion type trends

- 2.2.6 Application trends

- 2.2.7 Sales channel trends

- 2.2.8 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Million)

- 2.4 CXO Perspectives: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of electric and autonomous vehicles

- 3.2.1.2 Stringent safety and emission regulations

- 3.2.1.3 Consumer demand for enhanced in-vehicle experience

- 3.2.1.4 Technological advancements and cost reduction

- 3.2.1.5 Increasing Demand for Advanced Driver Assistance Systems (ADAS)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and production costs

- 3.2.2.2 Complexity of integration and compatibility issues

- 3.2.3 Market Opportunities

- 3.2.3.1 Expansion of Electric Vehicles (EVs)

- 3.2.3.2 Advanced Driver Assistance Systems (ADAS) and Autonomous Vehicles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction Company market share analysis

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Sensor Type, 2022 - 2035 (USD Million & Units)

- 5.1 Key trends

- 5.2 Pressure Sensors

- 5.2.1 Fuel Rail Pressure Sensors

- 5.2.2 Manifold Absolute Pressure (MAP) Sensors

- 5.2.3 Differential Pressure Sensors (GPF/DPF)

- 5.2.4 Tire Pressure Monitoring Sensors

- 5.2.5 Brake Pressure Sensors

- 5.2.6 Others

- 5.3 Gas Sensors

- 5.3.1 Particulate Matter (PM) Sensors

- 5.3.2 NOx (Nitrogen Oxide) Sensors

- 5.3.3 Oxygen (Lambda) Sensors

- 5.3.4 CO2 Sensors

- 5.3.5 Hydrocarbon (HC) Sensors

- 5.3.6 Others

- 5.4 Temperature Sensors

- 5.4.1 Exhaust Gas Temperature (EGT) Sensors

- 5.4.2 Engine Coolant Temperature Sensors

- 5.4.3 Battery Temperature Sensors (EV)

- 5.4.4 Ambient Temperature Sensors

- 5.4.5 Oil Temperature Sensors

- 5.4.6 Others

- 5.5 Current & Voltage Sensors

- 5.5.1 Battery Current Sensors (EV)

- 5.5.2 Battery Voltage Sensors (EV)

- 5.5.3 High Voltage Interlock Loop (HVIL) Sensors

- 5.5.4 Charging Current Sensors

- 5.5.5 Others

- 5.6 Position & Speed Sensors

- 5.6.1 Camshaft Position Sensors

- 5.6.2 Crankshaft Position Sensors

- 5.6.3 Wheel Speed Sensors

- 5.6.4 Steering Angle Sensors

- 5.6.5 Throttle Position Sensors

- 5.6.6 Others

- 5.7 Optical Sensors

- 5.7.1 Camera/Image Sensors

- 5.7.2 LiDAR Sensors

- 5.7.3 Infrared Sensors

- 5.7.4 Rain/Light Sensors

- 5.7.5 Others

- 5.8 Radar Sensors

- 5.8.1 24 GHz Radar Sensors

- 5.8.2 77 GHz Radar Sensors

- 5.8.3 79 GHz Radar Sensors

- 5.8.4 Others

- 5.9 Ultrasonic Sensors

- 5.9.1 Parking Assistance Sensors

- 5.9.2 Occupancy Detection Sensors

- 5.9.3 Others

- 5.10 Inertial Sensors

- 5.10.1 Accelerometers

- 5.10.2 Gyroscopes

- 5.10.3 Inertial Measurement Units (IMU)

- 5.10.4 Others

- 5.11 Others

Chapter 6 Market estimates & forecast, By Technology, 2022 - 2035 (USD Million & Units)

- 6.1 Key trends

- 6.2 Semiconductor-based Sensors

- 6.2.1 Silicon-based Sensors

- 6.2.2 Ceramic-based Sensors

- 6.3 MEMS (Micro-Electro-Mechanical Systems)

- 6.4 Magnetic Sensors

- 6.4.1 Hall-Effect Sensors

- 6.4.2 Magneto-Resistive Sensors

- 6.5 Optical Sensors

- 6.6 Electrochemical Sensors

Chapter 7 Market estimates & forecast, By Vehicle Type, 2022 - 2035 (USD Million & Units)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 Compact Cars

- 7.2.2 Mid-size Cars

- 7.2.3 Luxury Cars

- 7.2.4 SUVs

- 7.3 Light Commercial Vehicles

- 7.4 Heavy Commercial Vehicles

- 7.4.1 Medium-duty Trucks

- 7.4.2 Heavy-duty Trucks

- 7.4.3 Buses

Chapter 8 Market estimates & forecast, By Propulsion Type, 2022-2035 (USD Million & Units)

- 8.1 Key trends

- 8.2 Internal Combustion Engine (ICE)

- 8.1.1 Gasoline

- 8.1.2 Diesel

- 8.3 Alternative Fuels (CNG, LPG)

- 8.1.3 Electrified Vehicles

- 8.1.4 Hybrid Electric Vehicle (HEV)

- 8.1.5 Plug-in Hybrid Electric Vehicle (PHEV)

- 8.1.6 Battery Electric Vehicle (BEV)

- 8.1.7 Fuel Cell Electric Vehicle (FCEV)

Chapter 9 Market estimates & forecast, By Application, 2022-2035 (USD Million & Units)

- 9.1 Key trends

- 9.2 Powertrain Systems

- 9.2.1 Engine Management Systems

- 9.2.2 Transmission Control Systems

- 9.2.3 Fuel Delivery Systems

- 9.2.4 Emissions After-treatment Systems

- 9.3 Electrification Systems

- 9.3.1 Battery Management Systems

- 9.3.2 Electric Motor Control Systems

- 9.3.3 Charging Systems

- 9.3.4 Thermal Management Systems (EV)

- 9.3.5 High Voltage Safety Systems

- 9.4 Safety & ADAS Systems

- 9.4.1 Collision Avoidance Systems

- 9.4.2 Lane Keeping Assistance Systems

- 9.4.3 Adaptive Cruise Control Systems

- 9.4.4 Parking Assistance Systems

- 9.4.5 Blind Spot Detection Systems

- 9.5 Body & Chassis Systems

- 9.5.1 Steering Systems

- 9.5.2 Suspension Systems

- 9.5.3 Braking Systems

- 9.5.4 Climate Control Systems

- 9.5.5 Lighting Systems

- 9.6 Comfort & Convenience Systems

- 9.6.1 Infotainment Systems

- 9.6.2 Seat Control Systems

- 9.6.3 Access Control Systems

- 9.6.4 Others

Chapter 10 Market estimates & forecast, By Sales channel, 2022-2035 (USD Million & Units)

- 10.1 Key trends

- 10.2 Original Equipment Manufacturer (OEM)

- 10.3 Aftermarket

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million & Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 U.K.

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East & Africa

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profile

- 12.1 Allegro MicroSystems LLC

- 12.2 Analog Devices Inc.

- 12.3 Aptiv PLC

- 12.4 BorgWarner Inc.

- 12.5 Continental AG

- 12.6 Denso Corporation

- 12.7 First Sensor AG

- 12.8 Hitachi Astemo Americas Inc.

- 12.9 Honeywell International Inc.

- 12.10 Infineon Technologies AG

- 12.11 Melexis NV

- 12.12 Microchip Technology Inc.

- 12.13 NXP Semiconductors

- 12.14 OMNIVISION Technologies Inc.

- 12.15 ON Semiconductor

- 12.16 Panasonic Corporation

- 12.17 Renesas Electronics Corporation

- 12.18 Robert Bosch GmbH

- 12.19 Sensata Technologies Inc.

- 12.20 STMicroelectronics NV

- 12.21 TE Connectivity Ltd.

- 12.22 Valeo SA